As of 2:40 PM on July 23, 2025

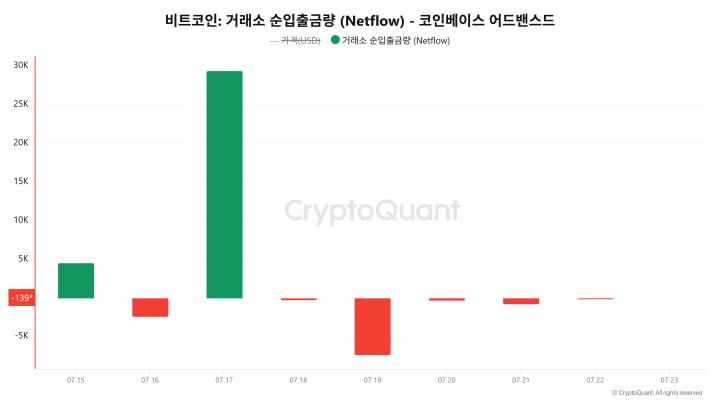

Bitcoin has turned to a downward trend, retreating from a short-term resistance line. However, exchange net outflows have increased by over 13% compared to the previous day, and the number of active wallets has also grown by more than 4%, indicating a trend of strengthening holdings and internal circulation among market participants. With dominance sharply declining, it is possible to interpret this as a full-scale spread into the altcoin market.

📈 Price right now

$118,855.37 (–1.32%) It is experiencing a short-term adjustment, recording a 1.32% decline from the previous day at $118,855.37. This reflects some upward fatigue after failing to break through the psychological resistance line.

Trading volume $7.361 billion (+0.21%) The 24-hour trading volume increased by 0.21% compared to the previous day, with a tendency towards observational demand rather than selling pressure.

Daily volatility –0.96% The volatility over the past 5 days has been –0.09% (19th), –0.55% (20th), +0.2% (21st), +2.17% (22nd), –0.96% (23rd), repeatedly fluctuating within a limited range without significant spikes. After a temporary rebound, the pullback continues, and a strong trend reversal has not yet been confirmed.

Asset comparison – S&P500↑ · Gold↓ The S&P500 index rose 0.06% to 6,309.62, while gold prices fell 0.22% to 3,436.2. With risk and safe assets moving in different directions, the market is still exploring its direction.

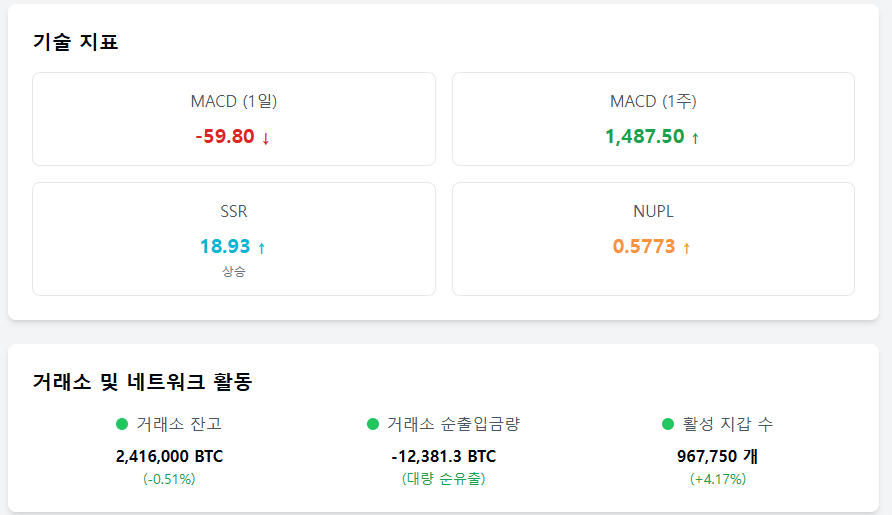

MACD –59.80 The short-term MACD remains in a negative trend at –59.80. In contrast, the 1-week MACD is 1487.50, indicating that medium-term upward momentum is still alive.

❤️ Market sentiment now

Dominance 60.0% (–4.9%p) Bitcoin dominance decreased by 4.9 percentage points to 60.0%, showing funds spreading into altcoins. Some fund outflows and potential internal market circulation are suggested.

Fear & Greed Index 70 (Greed) Rising from 67 (previous day) and 68 (last week) to 70, remaining in the 'Greed' zone. Despite adjustments, positive expectations prevail.

Google Trend score 56 Declining from the previous day (61), search interest is slightly subdued. A continuous downward trend has been observed since the 14th.

🧭 Market now

SSR 18.93 (+1.92%) The Stablecoin Supply Ratio (SSR) increased by 1.92% from the previous day (18.58). Recent slight improvements were seen, but buying capacity appears weakened again.

NUPL 0.5773 (+0.0082) The Unrealized Profit/Loss Ratio (NUPL) slightly increased from the previous day. With more holders in profit, the psychological trend remains closer to holding than taking profits.

Exchange balance 2.416 million BTC (–0.51%) Exchange holdings decreased by 0.51% compared to the previous day. This could indicate long-term holding transfers or exits for OTC trading.

Exchange net inflow/outflow –12,381.3 BTC (+13.05%) The amount of Bitcoin outflowing from exchanges increased by over 13% compared to the previous day. This can be interpreted as short-term selling volume resolution or long-term holder movement.

Active wallets 967,750 (+4.17%) Increasing by over 4% from the previous day (928,971), on-chain activity has become more active. The possibility of short-term participant re-entry is also suggested.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>