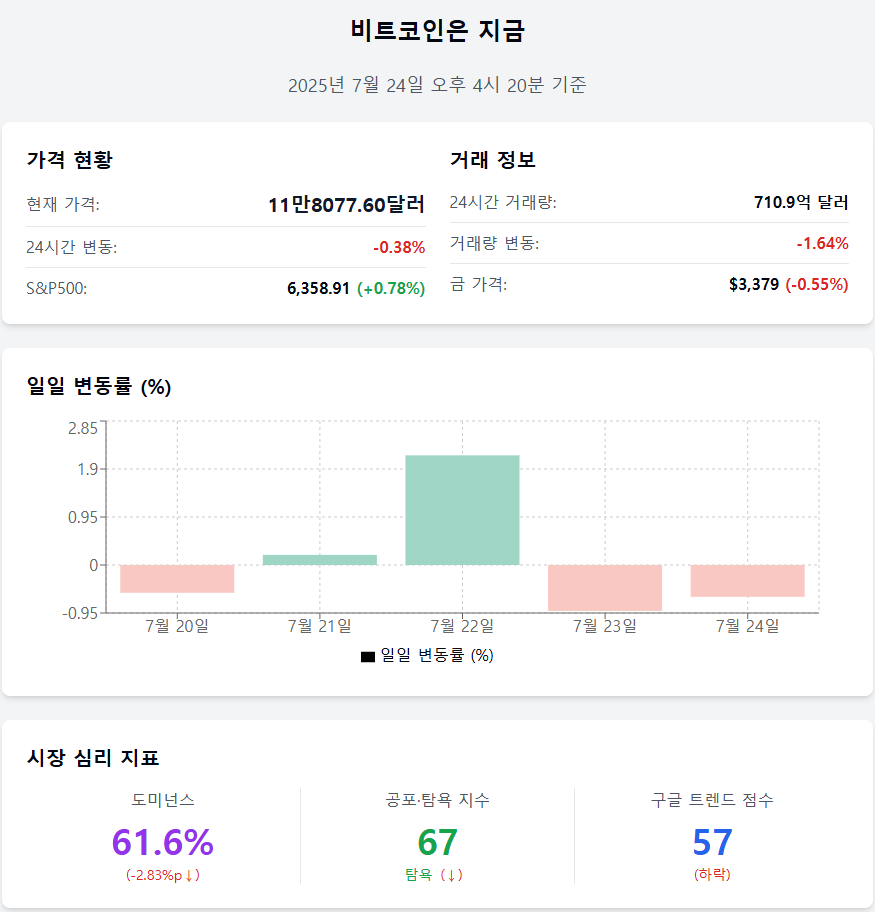

As of July 24, 2025, 4:20 PM

Bitcoin has failed to break through the psychological resistance line and has turned down again. With exchange net outflows and on-chain activities slowing down compared to the previous day, the market appears to be in a consolidation phase after a strong trend. Meanwhile, as dominance declines, funds are gradually spreading to altcoins.

📈 Price now

$118,077.60 (–0.38%) Recorded a 0.38% drop compared to the previous day at $118,077.60, continuing a short-term box range adjustment. Buying pressure is not clearly flowing in, and a tug-of-war continues near the psychological resistance line.

Trading volume $7.109 billion (–1.64%) 24-hour trading volume decreased by 1.64% compared to the previous day. With an expanded wait-and-see attitude, overall market trading activity has somewhat contracted.

Daily volatility –0.63% Recent 5-day volatility is –0.55%(20th), +0.2%(21st), +2.17%(22nd), –0.91%(23rd), –0.63%(24th). The direction is uncertain, and short-term upward fatigue is accumulating.

Asset comparison – S&P500↑ · Gold↓ The S&P500 index rose 0.78% to 6,358.91, while gold price dropped 0.55% to 3,379, showing a slight preference for risk assets.

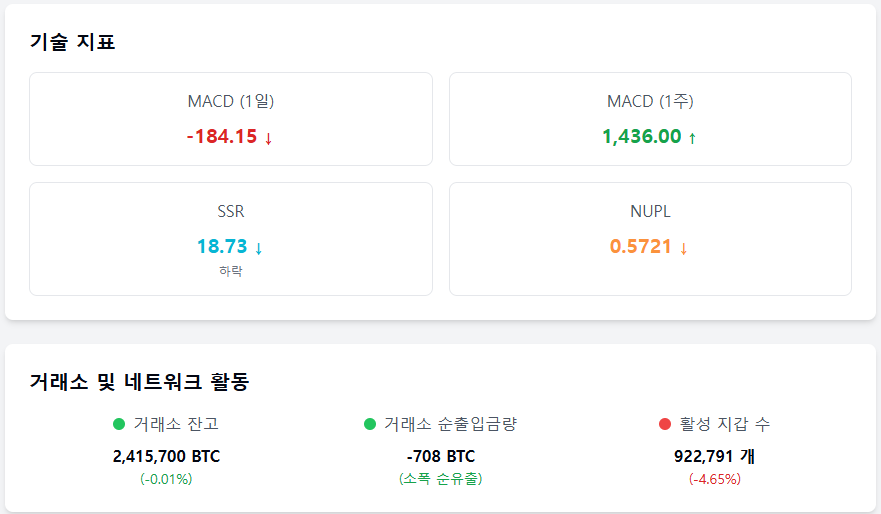

MACD –184.15 Short-term MACD is –184.15, strengthening the downward trend, while the 1-week MACD remains at 1,436.00, maintaining a medium-term upward trend.

❤️ Investor sentiment now

Dominance 61.6% (–2.83%p) Bitcoin dominance recorded 61.6%, a slight decrease of 2.83 percentage points from the previous day. A gradual spread of funds to altcoins is being detected.

Fear & Greed Index 67 (Greed) Slightly decreased from the previous day (70) and last week (70), but still remains in the 'Greed' zone. Despite price adjustments, investment sentiment remains optimistic.

Google Trend score 57 Dropped compared to the previous day (60), with interest continuously weakening. Downward trend has continued since the 14th, indicating somewhat cooled public interest.

🧭 Market now

SSR 18.73 (–1.04%) Stablecoin Supply Ratio (SSR) decreased by 1.04% from the previous day (18.93). Can be interpreted as relatively improved buying capacity.

NUPL 0.5721 (–0.0052) Unrealized Profit/Loss Ratio (NUPL) slightly decreased, reducing the proportion of investors in the profit zone. Holding sentiment is still maintained rather than taking profits.

Exchange balance 2.4157M BTC (–0.01%) Exchange holdings decreased by 0.01% compared to the previous day. Withdrawal flow for long-term holding continues, but the scale is minimal.

Exchange net inflow/outflow –708 BTC (+0.06%) Bitcoin exchange outflow increased by 0.06% compared to the previous day. With no significant change, a mix of selling volume digestion and withdrawal for holding purposes is observed.

Active wallets 922,791 (–4.65%) Decreased by over 4% compared to the previous day (967,750), indicating somewhat contracted on-chain activity. Can be interpreted as short-term participant exit or reduced trading.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>