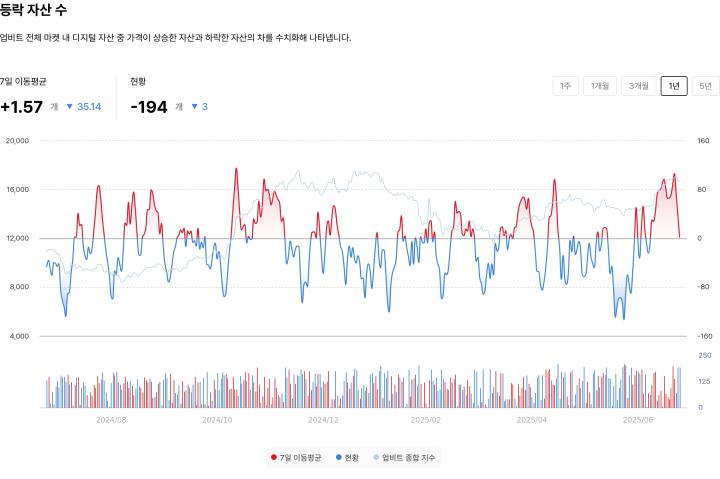

Story's IP token has emerged as today's top-performing asset. This occurred amid a decrease in trading activity today. This altcoin is rising by 3% and continuing the upward trend that began on July 11th.

IP's price has risen by over 20% last week, continuing to show outstanding performance even as the market faces downward pressure.

IP Rising... Starting with $5 Million Spot Inflow

Story's native token IP is currently trading at $5.11 and remains solidly positioned above its key technical support line, supporting its upward trend.

Upon reviewing the IP/USD daily chart, the token has been trading steadily above an ascending trendline since July 11th. This trendline represents an ascending pattern that appears when higher lows are formed over time, indicating strong and persistent buying interest.

This trendline serves as a dynamic support line, continuing to promote IP's price increase despite recent market weakness in several trading sessions.

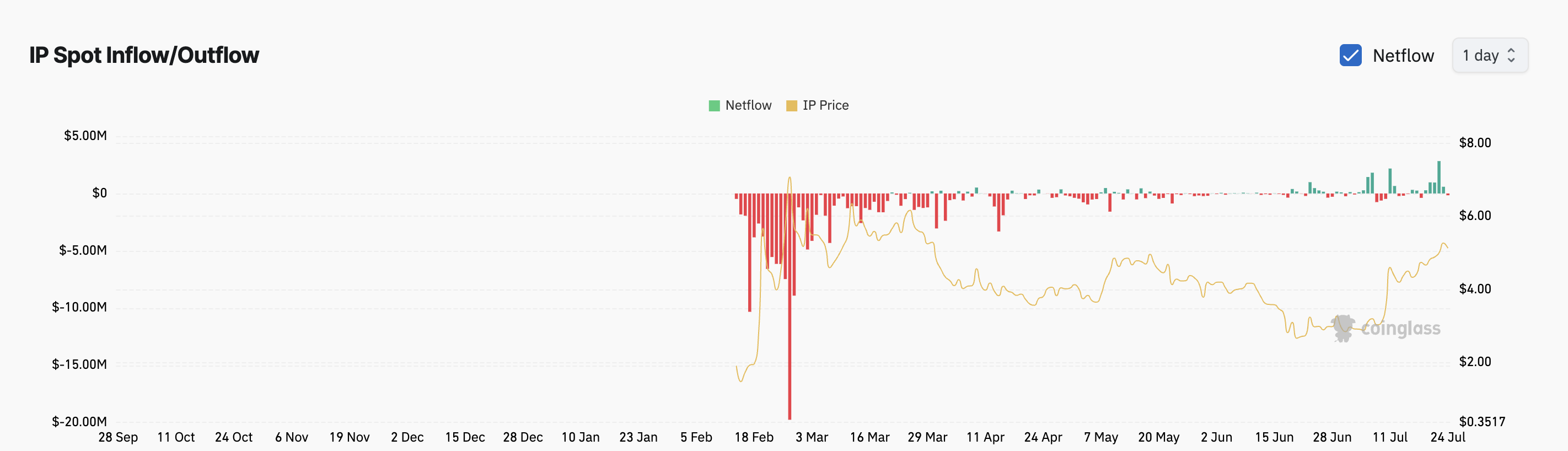

Additionally, spot inflows for IP have remained steady over the past few days, indicating continued investor interest and confidence. According to Coinglass, despite the overall market profit-taking trend, IP has recorded consistent spot net inflows exceeding $5 million over the past four days.

When an asset shows such spot net inflows, it means more capital is entering the asset through spot market purchases. This indicates increasing investor demand and confidence in IP's short-term outlook.

Today saw a net outflow of $157,000 in the IP spot market as some traders took profits, but the overall sentiment towards the token remains positive.

Futures Traders Make Large Bets on IP Rally

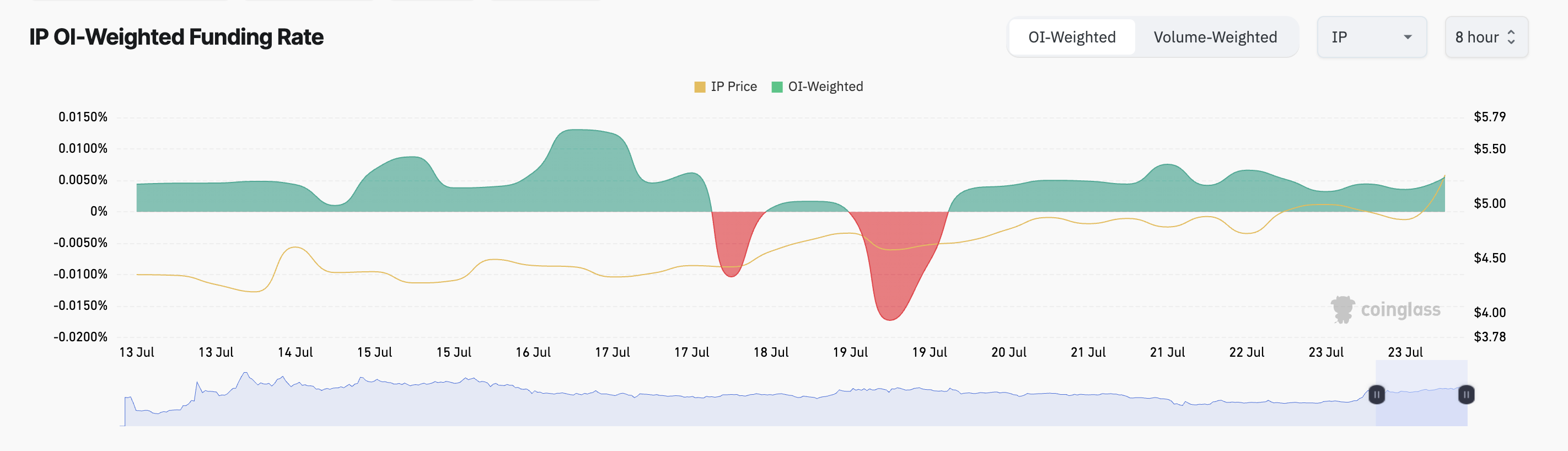

Positive on-chain activity reinforces expectations of short-term further increases, which is also shared among IP futures traders. This is reflected in IP's funding rate, which has remained positive since July 20th.

The current indicator is 0.0055%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures markets. It helps align contract prices with spot prices.

A positive funding rate means traders are paying a premium to maintain long positions, indicating bullish market sentiment.

IP's positive funding rate shows that futures traders are heavily weighted towards long positions, reinforcing the altcoin's upward trend and indicating confidence in price increases.

IP Breaks $4.92 Barrier... Heading Towards March High?

IP's continuous upward trend has broken through the long-term resistance level of $4.92. This price level had been challenging for months. If this level becomes a solid support, the token could rise to $5.59, last seen in March, based on its recent momentum.

However, if demand weakens, IP could fall again. The token may test the $4.92 level, and if it fails to maintain this level, it could open up a deeper correction to $3.83.