In the Upbit market, the daily trading volume in Korean won from midnight to 6:07 PM on July 24th was 5.83 trillion won, with a cumulative 24-hour trading volume of 13.79 trillion won. The 24-hour trading volume surged by 95.04% compared to the previous day.

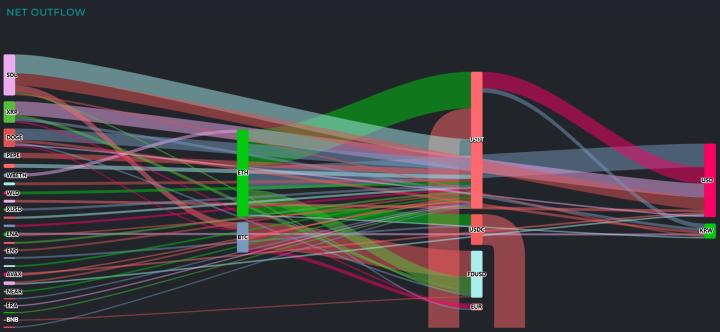

Looking at the trading flow by theme, trading volume was concentrated in the 'infrastructure' and 'smart contract platform' areas.

In the infrastructure theme, ▲NEWT(+48.28%), ▲POKT(+18.32%), ▲HYPER(+15.20%) showed strong upward trends and attracted investor attention. Major assets such as ▲XRP(–3.19%), ▲BTC(–0.52%), ▲XLM(–2.34%) could not avoid a downward trend, but ▲WEMIX(+6.62%) held up well.

In the smart contract platform, large assets like ▲ETH(–0.34%), ▲SOL(–2.24%), and ▲ADA(–1.89%) experienced adjustments. In contrast, ▲SOPH(+13.78%) showed an individual upward trend.

In the DeFi sector, most assets, including ▲STRIKE(–32.36%), showed poor performance. The general stablecoin ▲USDT(–0.47%) was also weak. In the meme theme, ▲DOGE(–2.58%), ▲SHIB(–2.74%), and ▲PENGU(–6.20%) all declined, clearly showing a contraction in investment sentiment.

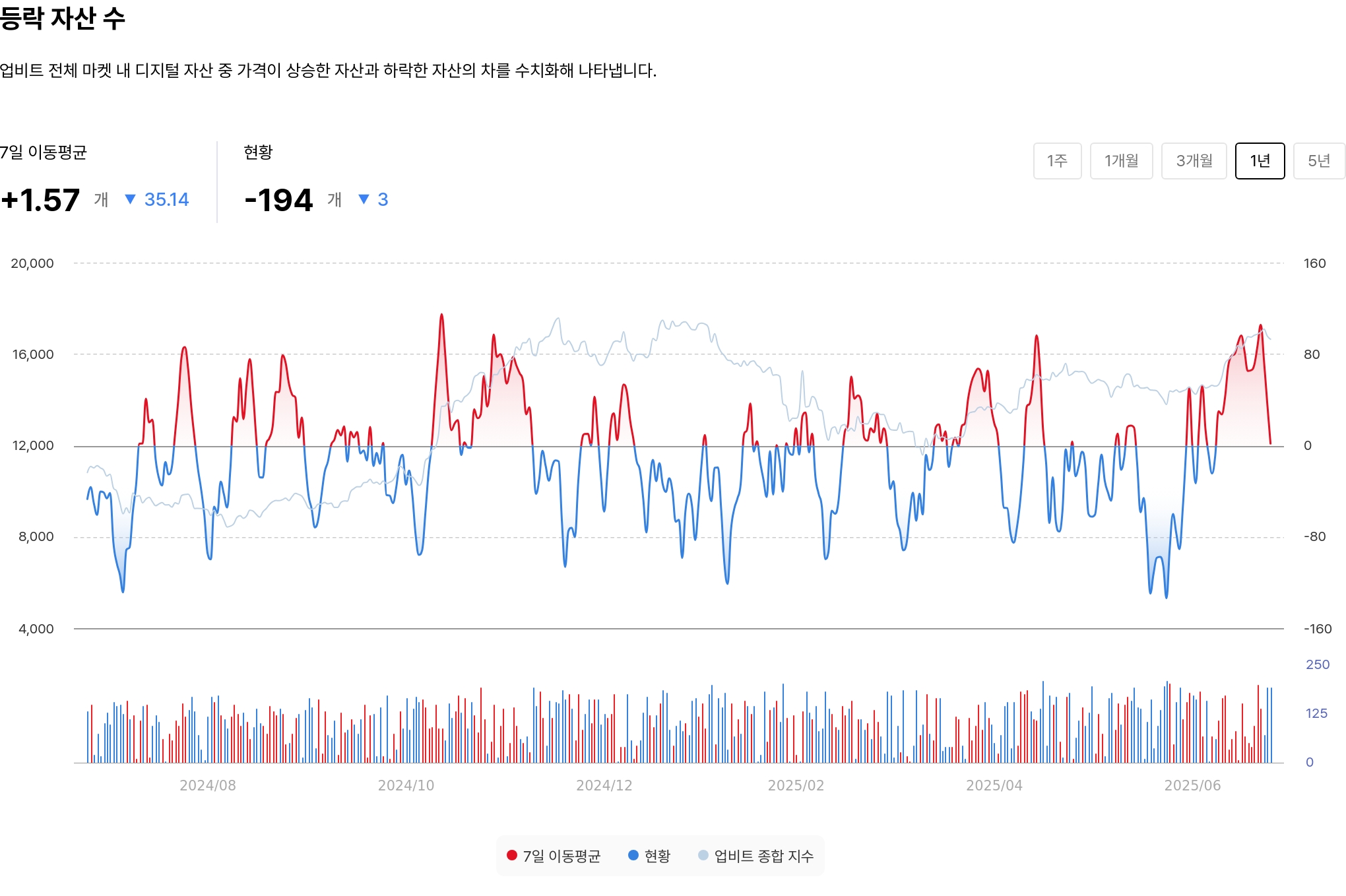

In the Upbit market, the number of declining assets is overwhelming the number of rising assets, continuing a weak trend. The number of rising and falling assets is –194, indicating that there are 194 more declining assets than rising assets.

The 7-day moving average showed +1.57, but with more than three assets declining compared to the previous day, the short-term recovery trend has slowed down. This shows that even in an extreme theme concentration phenomenon, buying sentiment centered on individual assets remains limited.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>