Welcome to the US Cryptocurrency Morning Briefing. We will inform you about today's important cryptocurrency developments.

Prepare your coffee and sit down. The numbers surrounding BTC's future are getting serious. With global liquidity surging and money creation speed accelerating, some investors believe we are entering a new phase of pioneering cryptocurrency.

BTC Reaching $1 Million Inevitable... Global Money Supply Doubles

Recently, in US Cryptocurrency News, Jeremy Davinci urged viewers to purchase BTC using just 1 dollar.

According to Bitcoin maximalists, BTC price can reach $500,000 per coin before 2030. Now, increasingly more analysts believe BTC can surpass $500,000 and ultimately reach $1 million, saying it is inevitable.

Analysts point to a favorable macroeconomic background for BTC, anticipating that surging global liquidity and money supply will double within the next 10 years.

"If $1 trillion flows into BTC, it will reach $1 million. Money supply alone will increase from $100 trillion to $200 trillion by 2035. We have no chance of not getting there." – Fred Krueger, Investor and Bitcoin Maximalist

These sentiments reflect concerns about currency value decline, especially as global central banks maintain loose fiscal policies and governments continue massive deficit spending.

Over the past year, money supply has increased at the fastest rate in recent history, adding credibility to the BTC bullish narrative.

According to River, a BTC-centric platform, those holding BTC since July 2024 have outperformed money debasement by 10x.

We're seeing the fastest money supply growth in years.

— River (@River) July 21, 2025

If you held bitcoin over the past year, you outperformed money debasement by 10x. pic.twitter.com/VEpK0i5yNF

This performance reinforces BTC's position as a hedge against fiat currency dilution, especially in an environment of growing global debt and systematic liquidity injection.

Further supporting the bullish narrative is that BTC has reached a 12-year high relative to global M2 money supply.

"Global liquidity relative to BTC supply has hit a 12-year high, with approximately $5.7 million of global M2 supply per circulating BTC." – DeFi Investor Christiaan

This liquidity-to-scarcity ratio reflects that even relatively small capital can dramatically elevate BTC.

Only 21 million BTC coins exist, with actual circulation being much lower. BTC's fixed supply becomes increasingly sensitive to institutional or sovereign capital inflows.

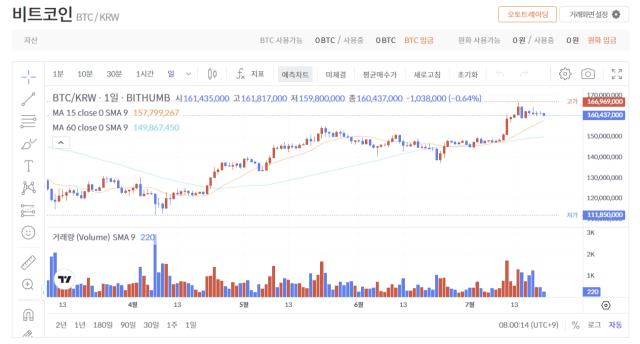

Today's Chart

Byte Size Alpha

Today's US Cryptocurrency News summary:

- PI Coin rises 14% after launching direct purchase feature on Pi Network.

- Capital inflow into Non-Fungible Token threatens PENGU's upward trend.

- Elon Musk's SpaceX moves $153 million in BTC before Tesla earnings report.

- Western Union joins stablecoin competition, transforming traditional payment methods.

- JP Morgan focuses on cryptocurrency-backed loans following US regulatory relaxation.

- Between Rolex, Banner, Buffett: What is the cryptocurrency market trying to tell us?

- Ark Invest reduces Coinbase holdings, investing $175 million in Bitmain.

- Dogecoin (DOGE) sees $7 billion on exchanges—Are sell-offs leading?

- More listed companies switching to BTC this week, increasing corporate adoption.

Cryptocurrency Stock Pre-Market Overview

| Company | Closed on July 21 | Pre-Market Overview |

| Strategy (MSTR) | $426.28 | $429.03 (+0.65%) |

| Coinbase Global (COIN) | $413.63 | $415.20 (+0.38%) |

| Galaxy Digital Holdings (GLXY) | $27.45 | $27.85 (+1.46%) |

| Marathon Holdings (MARA) | $18.83 | $18.98 (+0.80%) |

| Riot Platforms (RIOT) | $14.02 | $14.26 (+1.71%) |

| Core Scientific (CORZ) | $13.27 | $13.35 (+0.60%) |