As Bitcoin (BTC) takes a breather, Michael Saylor, co-founder of Strategy, hinted at additional BTC purchases. Strategy currently holds a total of 601,550 BTC.

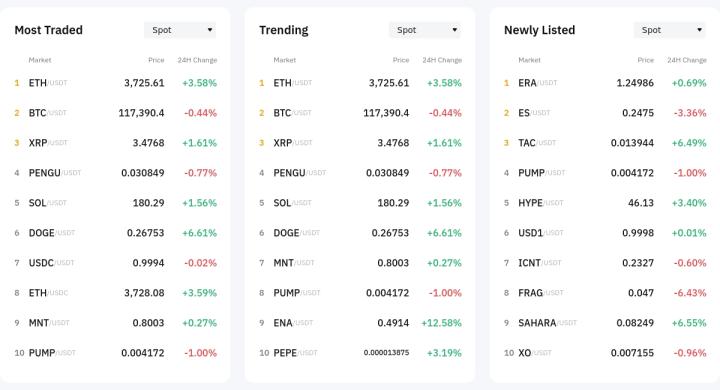

According to CoinMarketCap, a global virtual asset market tracking site, as of 8 AM on the 21st, BTC was down 0.21% from the previous day at $117,602.59. At the same time, the altcoin leader Ethereum was trading at $3,751.90, up 4.79%, XRP was up 0.92% at $3.459, and Solana (SOL) was up 2.40% at $180.80.

Related Articles

- Genius Act Passes US Congress and Senate... XRP Approaches All-Time High [Decenter Market Conditions]

- Revived US Crypto Week Expectations... Virtual Assets Rise Simultaneously [Decenter Market Conditions]

- US House Rejects Virtual Asset Law Procedural Vote... Bitcoin at $117,000 Range [Decenter Market Conditions]

- Bitcoin Touches $123,000 and Takes a Breather... Fluctuating Around $120,000 [Decenter Market Conditions]

The domestic market showed weakness. At the same time, based on Bithumb, BTC recorded 160,437,000 won, down 0.65% from the previous day. ETH was down 0.43% at 5,108,000 won, XRP fell 2.32% to 4,709 won, and SOL declined 0.16% to 246,200 won.

Cointelegraph reported that Michael Saylor, co-founder of Strategy, hinted at additional BTC purchases on the 21st (local time). Currently, Strategy's BTC holdings have exceeded $71.4 billion (approximately 99.4 trillion won). The most recent purchase was made on the 14th of this month. At that time, Strategy invested $472.5 million to purchase 4,225 BTC.

According to the Saylor Tracker, Strategy has recorded approximately 66.5% returns on BTC investments as of that day. The valuation gain is about $28.5 billion (approximately 39.7 trillion won). Cointelegraph analyzed that "BTC-holding listed companies, including Strategy, are a major demand axis for this rally along with ETFs, institutional investors, and centralized exchanges".

Recently, there has been a spread among institutional investors of indirectly exposing themselves to virtual assets by investing in stocks or corporate bonds of companies holding BTC, like Strategy. Vanguard is a prime example. While Vanguard has previously opposed directly holding or offering BTC to customers, it currently holds about 20 million shares of Strategy, which is approximately 8% of total circulating shares. Such indirect investment through BTC-holding companies is seen as a symbolic case showing the trend of BTC's integration into the traditional financial system.

The Fear and Greed Index from virtual asset data analysis company Alternative.me dropped 2 points from the previous day to 72 points, indicating a 'greed' state. This index means that the closer to 0, the more contracted the investment sentiment, and the closer to 100, the more overheated the market.

- Reporter Do Ye-ri

< Copyright ⓒ Decenter, Unauthorized Reproduction and Redistribution Prohibited >