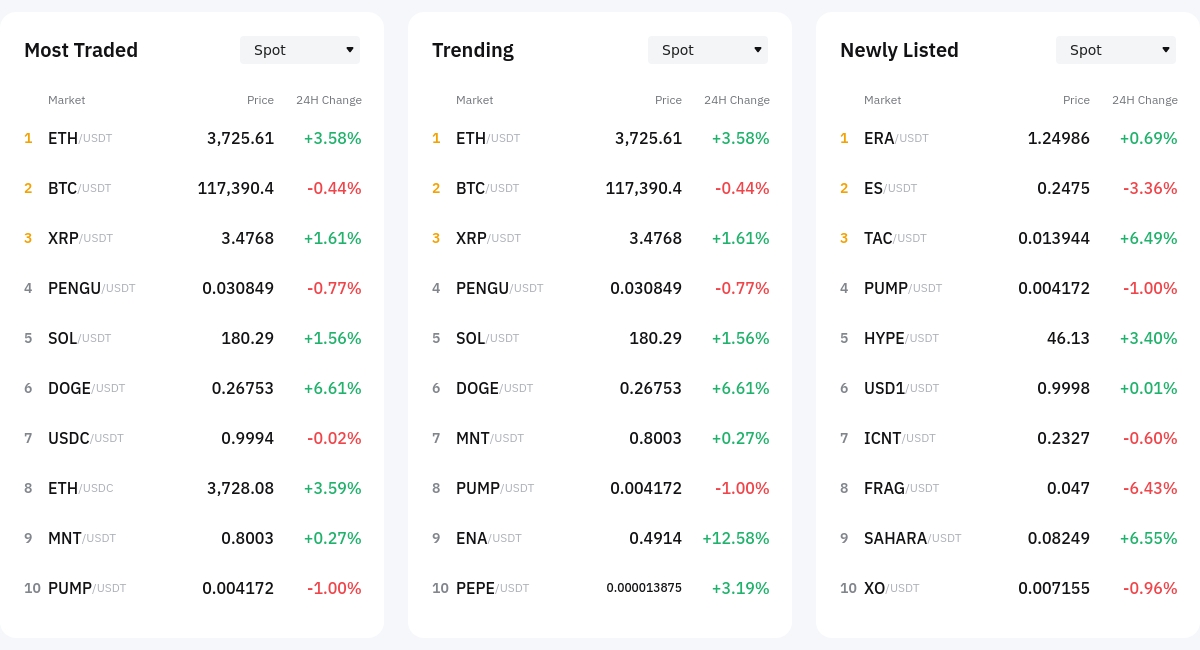

Spot Trading Most Traded Assets Analysis: Doge Surges 6.61%... Ethereum Maintains Strength, PUMP Declines

According to Bybit, Doge stood out with the most notable rise in the 24-hour spot market. Doge traded at $0.26753, up 6.61% from the previous day, recording a remarkable rally among top market cap assets. Ethereum (ETH) rose 3.58% to $3,725.61, with the ETH/USDC pair also climbing 3.59%. Bitcoin (BTC) slightly declined, closing at $117,300, down 0.44%.

XRP also increased by 1.61%, reaching $3.4768, and Solana (SOL) rose 1.56% to $180.29, participating in the overall altcoin uptrend. However, among top trading assets, the meme coin PENGU dropped 0.77%, and PUMP, a recently listed token, declined 1.00%, suggesting profit-taking.

Notably, ENA (ENA/USDT) showed significant price movement, surging 12.58% in a single day, indicating rapid investor demand. The meme coin Pepe rose 3.19%, emerging as a trending asset, while new tokens like TAC (+6.49%) and SAHARA (+6.55%) also showed strong performance.

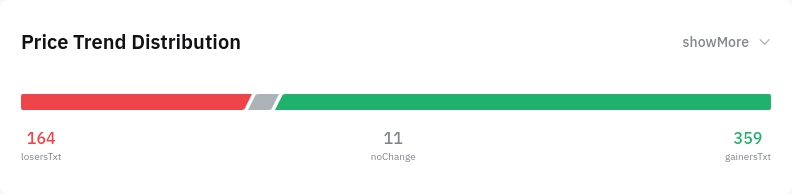

Price Trend Distribution Analysis: 359 out of 534 Assets Rising... 67% in Profit Zone

Analysis of 534 digital assets showed 359 assets in an uptrend, representing approximately 67.2% of the total, indicating most market participants are in a profit zone. In contrast, 164 assets declined, accounting for 30.7%, with only 11 assets showing no price change.

This distribution suggests short-term buy-side demand remains valid and reflects a bull market with widespread price increases. The fact that profitable assets are distributed across various small-cap tokens, not just major altcoins, indicates positive momentum across the market.

The spot market shows a stable expected return zone rather than an extreme overheated condition, with balanced upward trends suggesting positive potential for trend continuation.

Trending Sector Analysis: Storage and Zero-Knowledge Sectors Strong, AI and Non-Fungible Token Also Prominent

The Storage sector showed the highest average rise, increasing 5.75%, with AR (Arweave) leading a 15.55% surge. The sector benefits from increasing decentralized data storage demand.

The Zero Knowledge sector followed, averaging 5.74% growth, with CELO rising 7.72%. The a16z Portfolio sector also rose 5.38%, with AR contributing significantly.

The AI sector rose 4.87%, with INJ increasing 5.70%. The HK Concept sector rose 4.34%, with RSS3 surging 10.68%.

Non-Fungible Token and Rollups sectors rose 4.15% and 4.14% respectively, with SLP and MINA increasing 6.14% and 6.20%. The Polychain Portfolio sector also rose 4.14%.

Overall, infrastructure-related storage and Layer2 technology sectors led the rise, with AI and Non-Fungible Token sectors also performing well, suggesting capital movement towards sectors with structural growth potential.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction Prohibited>