GMX was busy dealing with thefts, and Hyperlqiuid was busy with business development.

This time, Hyperliquid has taken a big step into the Solana ecosystem. Different from a simple multi-chain deployment, this time it provides liquidity support through the Phantom wallet. It is also surprising that Phantom chose Hyperliquid instead of Drift and Jupiter.

Compared to simply supporting Solana chain and Phantom wallet login, Hyperliquid's idea is different from its predecessors such as dYdX and GMX. It is more like an on-chain version of Binance, that is, it will become the ultimate source and destination of liquidity for all protocols and dApps, and use super liquidity to become a true on-chain cornerstone.

The Third Way

To understand Hyperliquid, you can't just talk about Hyperliquid itself.

It must be said that in comparison with spot DEXs such as Uniswap, contract products from a spot perspective are a gamble of borrowing money to speculate in cryptocurrencies, and liquidity is extremely difficult to maintain. Please note that the difficulty of spot DEX is liquidity creation, so AMM and Bonding Curve are extremely important.

Uniswap can promote more assets to participate in transactions through multi-chain deployment, and can promote the growth of the protocol TVL even if it is only on this chain. However, contract DEX, whether it is dYdX, GMX or Hyperliquid, must "attract" liquidity to gather in one place, which is also the natural advantage of CEX such as Binance.

Centralization naturally facilitates the concentration of liquidity.

It must be said that in comparison with peers such as dYdX and GMX, Perp DEX from the perspective of GMX is a combination of off-chain matching, on-chain trading and liquidity tokenization of dYdX's order book. This is also the essence of GMX's crazy revenue in 2022, maintaining liquidity through the "induction" of LP Token —> GMX Token.

The same is true for Hyperliquid, but its operations are more sophisticated. The closed HyperCore is responsible for spot and contract transactions, which is the main basis for believing that Hyperliquid is centralized. HyperEVM is responsible for the "blockchain" part. The vague operational concepts have kept Hyperliquid in a state of superposition of decentralization and centralization for a long time, and its super liquidity and matching efficiency are also hidden in it.

For the overall architecture of Hyperliquid, please refer to: Hyperliquid: 9% Binance, 78% Centralization

Decentralization is naturally conducive to brand effect.

It is necessary to grow in the dynamic game and companionship with Binance. To become the strongest liquidity, it is necessary to have centralized efficiency and decentralized experience, dYdX's order book matching mechanism improvement, GMX's liquidity token "bribery" mechanism, and BNB connects BNB Chain, the role of the main site-$HYPE connects HyperCore and HyperEVM.

In the end, Hyperliquid completed multiple contradictions that were difficult to couple in the past. System engineering once again exerted its magic. The existing technical elements were stacked to create the best PMF in the current market, and even improved on Binance's ideas.

• Multi-chain deployment/centralized liquidity

• Bridge/Chain Abstraction/Aggregator/Intent

• Decentralized UI/Centralized UX

To become the infrastructure of the market, it is necessary to capture as many entrances as possible. Phantom is very suitable as a diverter for the Solana ecosystem, but subsidies cannot be used in exchange for the market. Profit sharing is a wiser approach than token subsidies.

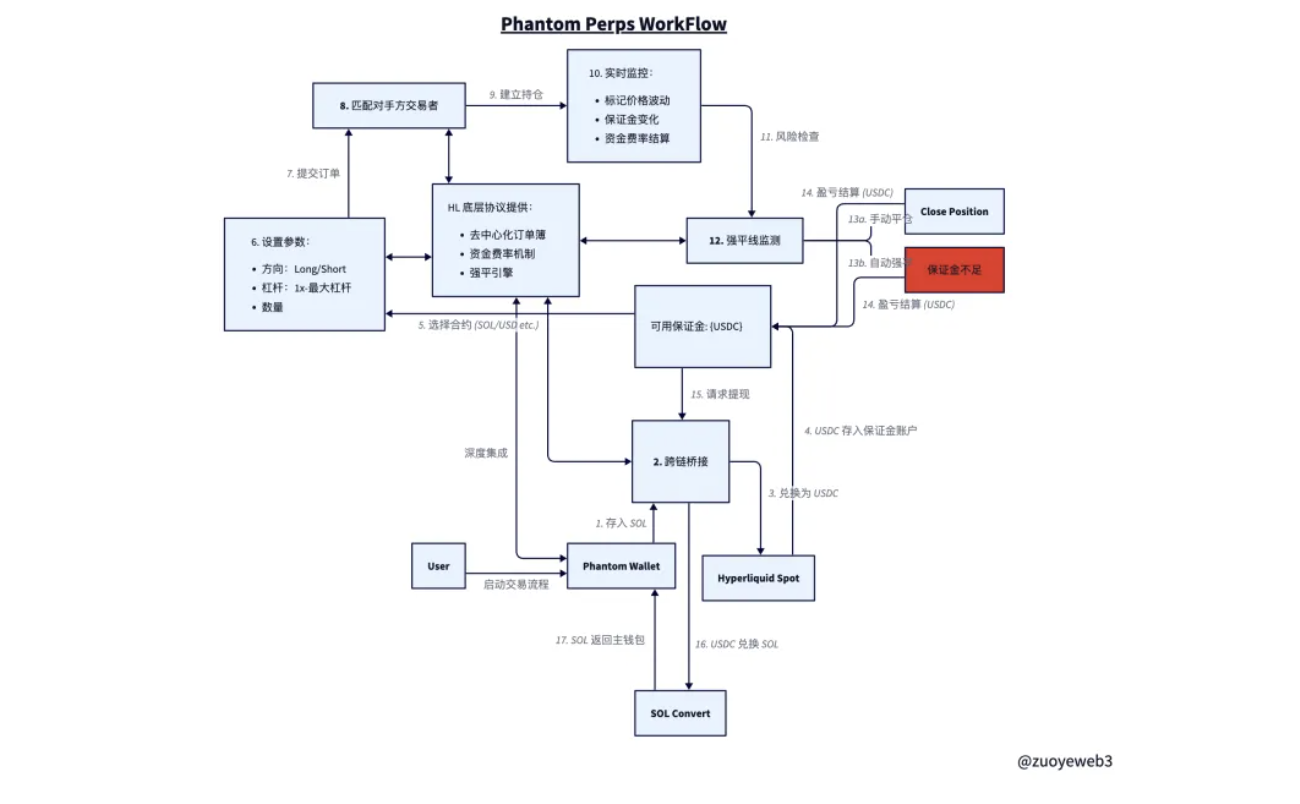

In the design concept of Phantom Perps, unlike the previous login to dYdX or Drift, Hyperliquid is embedded in its own interface. The premise is that the SOL on Solana enters the Hyperliquid spot account through bridging and is exchanged for USDC, and then transferred to the Hyperliquid contract account as margin.

Bridging may be supported by Hyperunit provided by Unit protocol, but it is not completely certain. You are welcome to add relevant information. Security assessment is also very important.

In the subsequent transaction process and settlement stages, Phantom and Hyperliquid exchange roles. The Phantom interface only displays relevant information, and the actual operations are completely controlled by Hyperliquid. This is also the biggest difference from dYdX and Drift. User funds will actually enter the Hyperliquid system.

After deciding to close a position, the user's profit or loss will be denominated in USDC, but will be gradually unwrapped into SOL. Specifically, USDC needs to first enter the spot from the Hyperliquid contract account, then be converted into SOL in the spot, and then bridged back to the Solana chain, and finally displayed in the Phantom in the form of SOL.

The advantage of doing this is greater financial freedom.

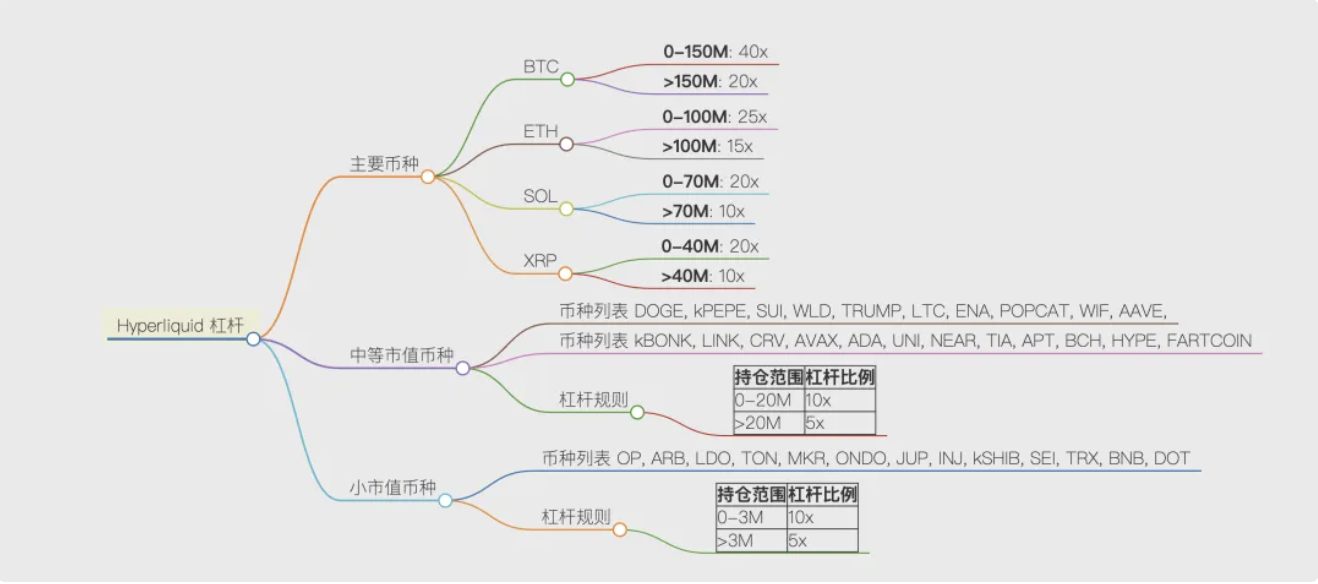

After the user's SOL enters Hyperliquid, they can trade any currency supported by Hyperliquid and choose a leverage of up to 40x based on the amount of funds. Of course, after frequent attacks, Hyperliquid's style is that the more niche the currency and the larger the position, the lower the leverage multiple.

The downside of doing this is that system security will be reduced.

The entry and exit of bridge assets will be tested when market conditions are extremely volatile.

During the transaction process, users need to trust Hyperliquid, which essentially requires the same level of trust as CEXs such as Binance, that is, the exchange will not embezzle user assets and will complete matching according to user instructions.

Hyperliquid is not simply cooperating with Phantom, but hopes to use it as an ally to infiltrate and control Solana. This is undoubtedly an active attack on Solana's native DEX. CEX represented by Binance and local DEX of each chain will have to consider how to deal with Hyperliquid next.

BNB’s performance far exceeds that of any exchange token, representing Binance’s mastery of liquidity. The same is true for Hyperliquid. From spot to Perps, from Ethereum to Solana, this is a charge where success or failure is the only way to win.

Emerging profit points

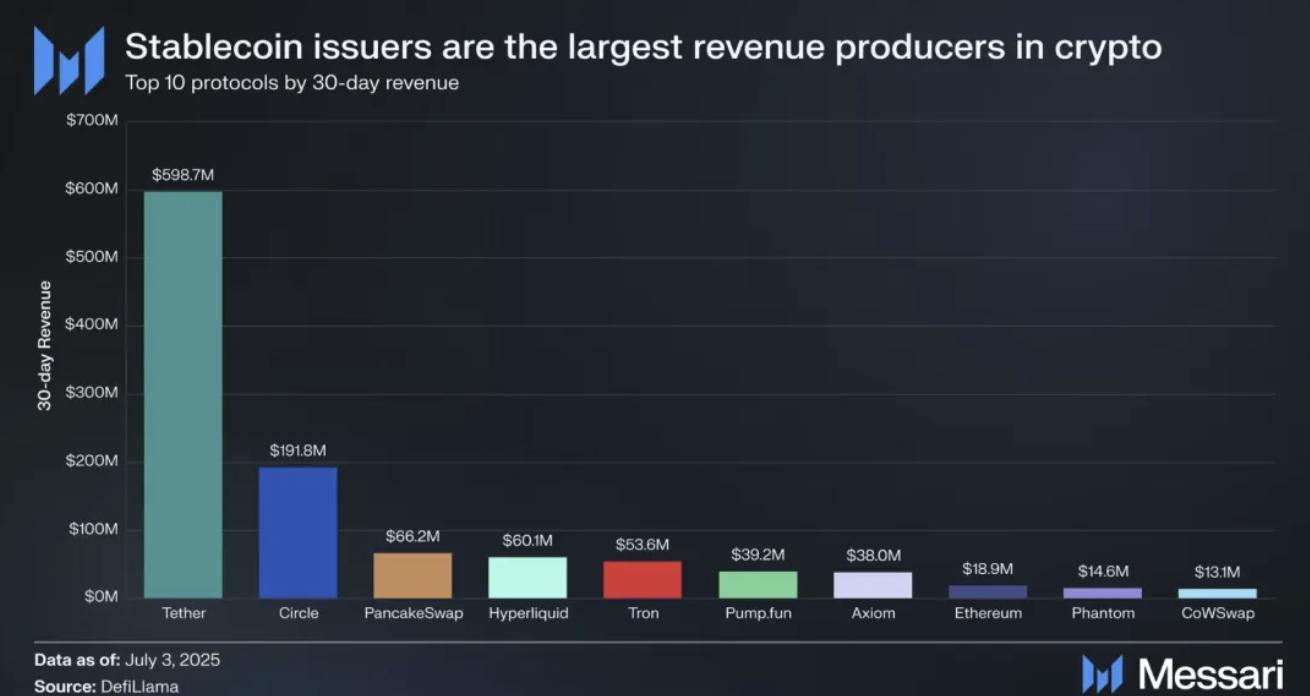

Hyperliquid is not cheap, in other words, it is highly profitable.

Compared with dYdX and Binance, Hyperliquid has never won by being cheap. Coincidentally, Phantom is also a profit expert. From SOL staking to trading, from single chain to multi-chain, its business diversification capabilities are extremely strong.

MetaMask is already a distant myth in the wallet world, and Phantom is the reality.

But it is not enough to be called the future. Backpack also wants to fight against its own team on Solana, and OKX Wallet is an even stronger enemy. Since the integration of CEX and DEX is the main axis of this cycle, Binance + Pancakeswap, OKX main site + OKX Wallet, Backpack Wallet + Backpack Exchange all have their own opportunities and strategies.

Stablecoins will continue to exist, but it is unknown how long Meme and on-chain issuance and trading tools can last. Public chains and DEX need to find their own growth points again. Hyperliquid itself is the storage place for public chains, DEX, stablecoins and Meme, but it lacks wallet tools, or in other words, it lacks the ability to reach more retail and mass markets.

This is indeed counterintuitive, but whale are the main players in Hyperliquid. Although the amount of funds is large enough, without a sufficient number of retail investors, it is difficult to run stablecoins, Memes, or even higher-frequency, daily-use products such as RWA.

The significance of retail investors is to carry out marginal innovation and popularize it. Only a sufficient amount of data can "emerge" intelligence, and randomness can trigger the myriad possibilities of evolution.

It just so happens that Phantom has enough retail investors, at least first among Solana.

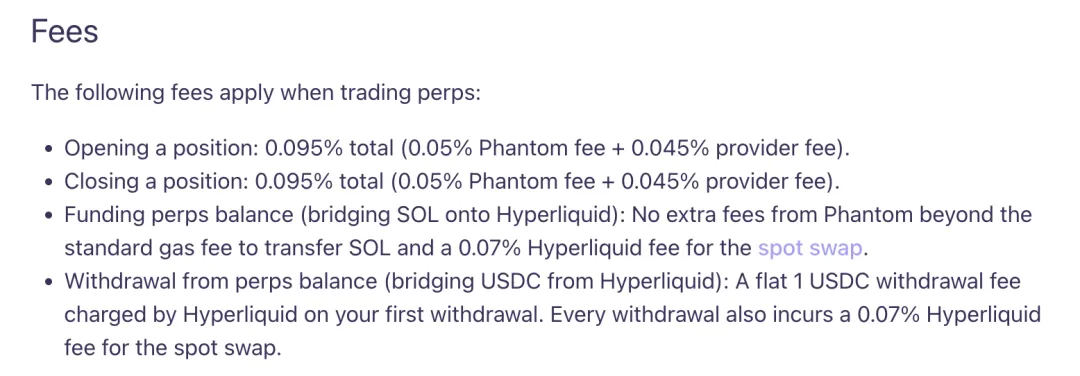

In addition, the cooperation between the two parties is also profitable. Charging anchor points are thoughtfully set up at various angles and entrances and exits. Phantom and Hyperliquid gates will charge fees. I wonder if competitors have any good ideas to increase speed and reduce fees. Will HL+Phantom also become a dragon?

Conclusion

HL decided to attract more new users through the wallet, and Phantom hopes to break away from the stereotype of the Solana wallet and move towards a more mainstream market.

CEX competes with cryptocurrency stocks, while DEX actively acquires customers. It can be seen that Crypto traffic has reached a bottleneck period, and simple product types can no longer support their own businesses. Mutual competition, acquisitions, and attacks will become more and more frequent.

Every cycle will be an arena for exchanges and public chains. This time, will it be Hyperliquid versus Binance, and Solana versus Ethereum?