On July 9th, the long-standing on-chain perpetual contract exchange GMX suffered a major blow.

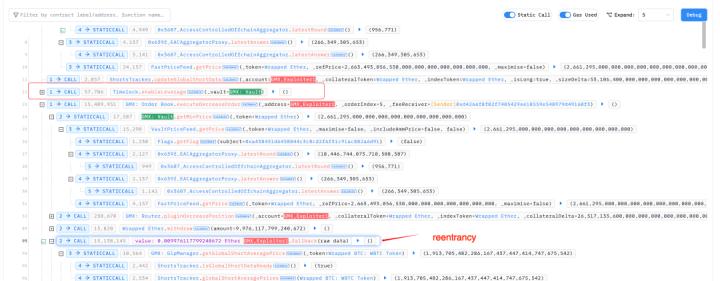

Hackers exploited a re-entrancy vulnerability in the GMX V1 smart contract, stealing approximately $42 million in crypto assets from its GLP liquidity pool, including USDC, FRAX, WBTC, and WETH.

On-chain data shows that about $9.6 million in assets have been transferred through cross-chain bridges. The GMX team has proposed conditions to the attacker: if 90% of the funds are returned within 48 hours, they will receive a 10% "white hat bounty" and avoid prosecution.

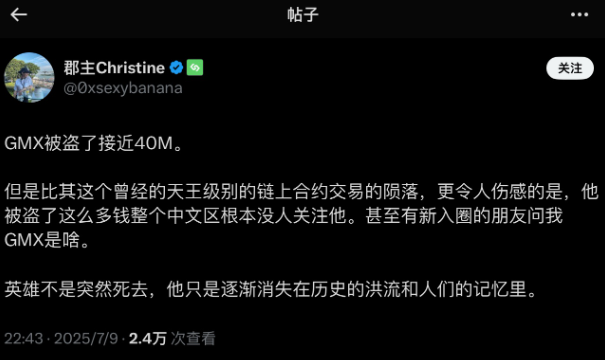

However, despite the significant amount, this incident has not sparked widespread discussion.

One cutting comment was:

"Who still keeps money in GMX?"

While everyone is discussing Bitcoin reaching a new high, Pumpfun's upcoming token launch, and ETH standing tall again... the market may have already stopped caring about GMX.

The former "on-chain Perp DEX king" has been marginalized.

In a crypto market with short memory and scarce attention, being ignored is the greatest punishment. This theft stole not just $42 million, but also GMX's former glory.

Remembering Past Glory

Players who entered this market cycle might not even have heard of GMX.

Looking back at GMX's peak, this decentralized perpetual contract exchange (Perp DEX) was once a shining star in on-chain trading, and calling it "the Hyperliquid of the previous cycle" would not be an exaggeration.

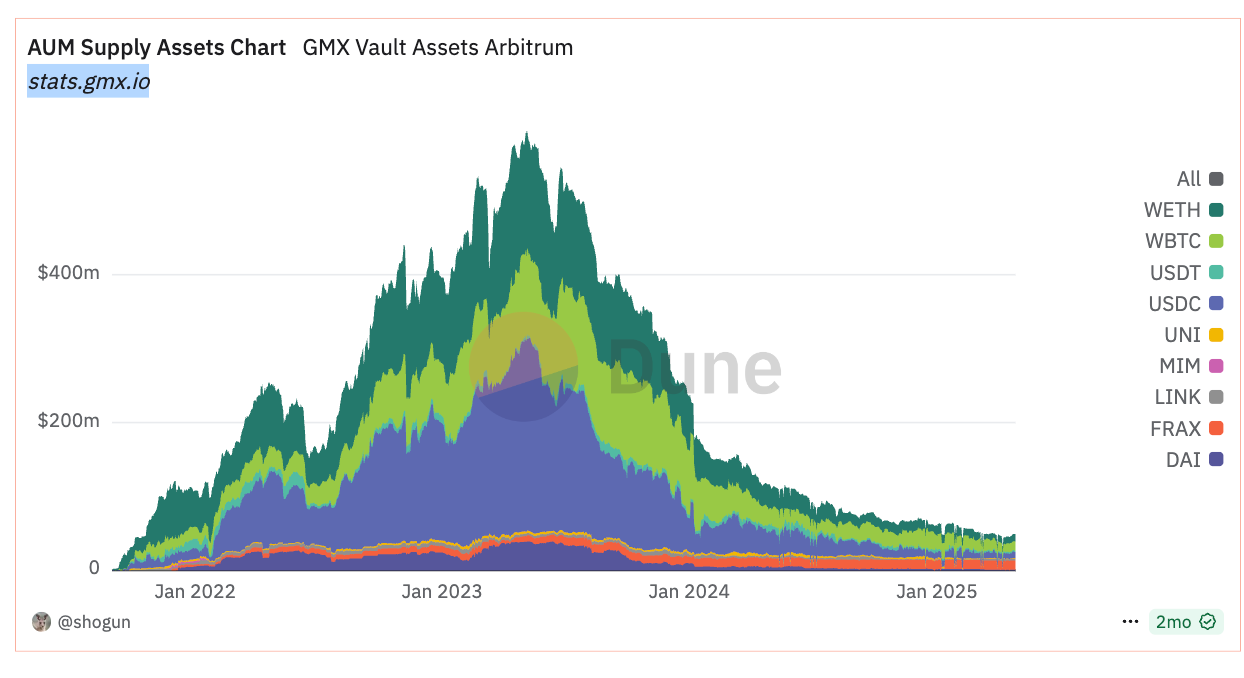

In September 2021, GMX launched on the Arbitrum network and quickly emerged with its innovative multi-asset liquidity pool GLP. The GLP pool integrated assets like USDC, DAI, WBTC, WETH, supporting up to 100x leverage trading, attracting massive users and funds.

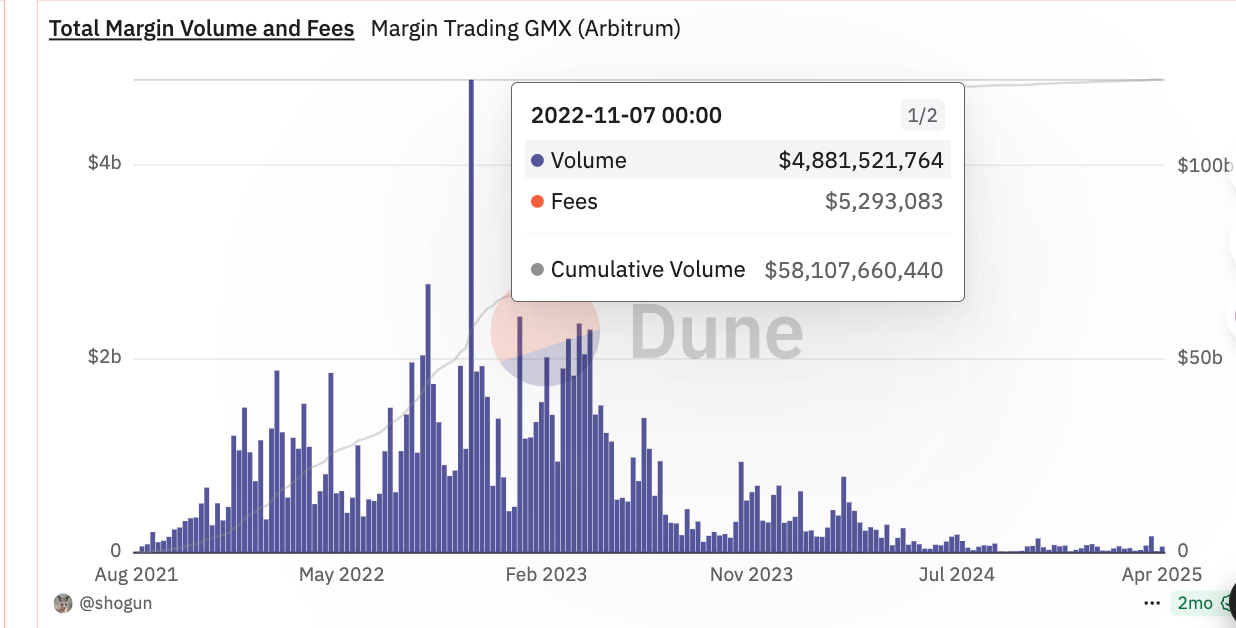

Between 2022 and 2023, GMX's cumulative trading volume soared to $27.7 billion, with an average daily trading volume of $923 million. Defillama data shows its TVL peaked at nearly $700 million in May 2023, once occupying about 15% of Arbitrum's total locked value, firmly holding the top spot in on-chain Perp DEX.

At the time, GMX performed well in technical breakthroughs and economic incentives.

Its vAMM mechanism eliminated the complexity of traditional order books and expanded cross-chain to Avalanche (early 2022) and Solana (March 2025), accumulating over 700,000 users.

GMX token stakers could then receive 30% protocol fees (paid in ETH or AVAX), with additional esGMX and Multiplier Points (MP) rewards, with APR reaching up to 100% at its peak. In 2022, staked GMX tokens accounted for over 30% of circulation, effectively mitigating selling pressure.

Unlike today's on-chain meme products with broad participation, GMX primarily attracted professional DeFi players and those distrustful of centralized exchanges, making its popularity no small feat.

Subsequently, many DEXs that emerged on-chain would reference GMX in their whitepapers and promotional materials, describing their optimizations and superiority in experience or returns, reminiscent of competitor comparisons at product launch events.

New King Hyperliquid, Changing of the Guard

The following graph clearly shows that GMX's asset management scale on Arbitrum began rapidly declining from the end of 2023, with data around $30-40 million in April, far from its peak.

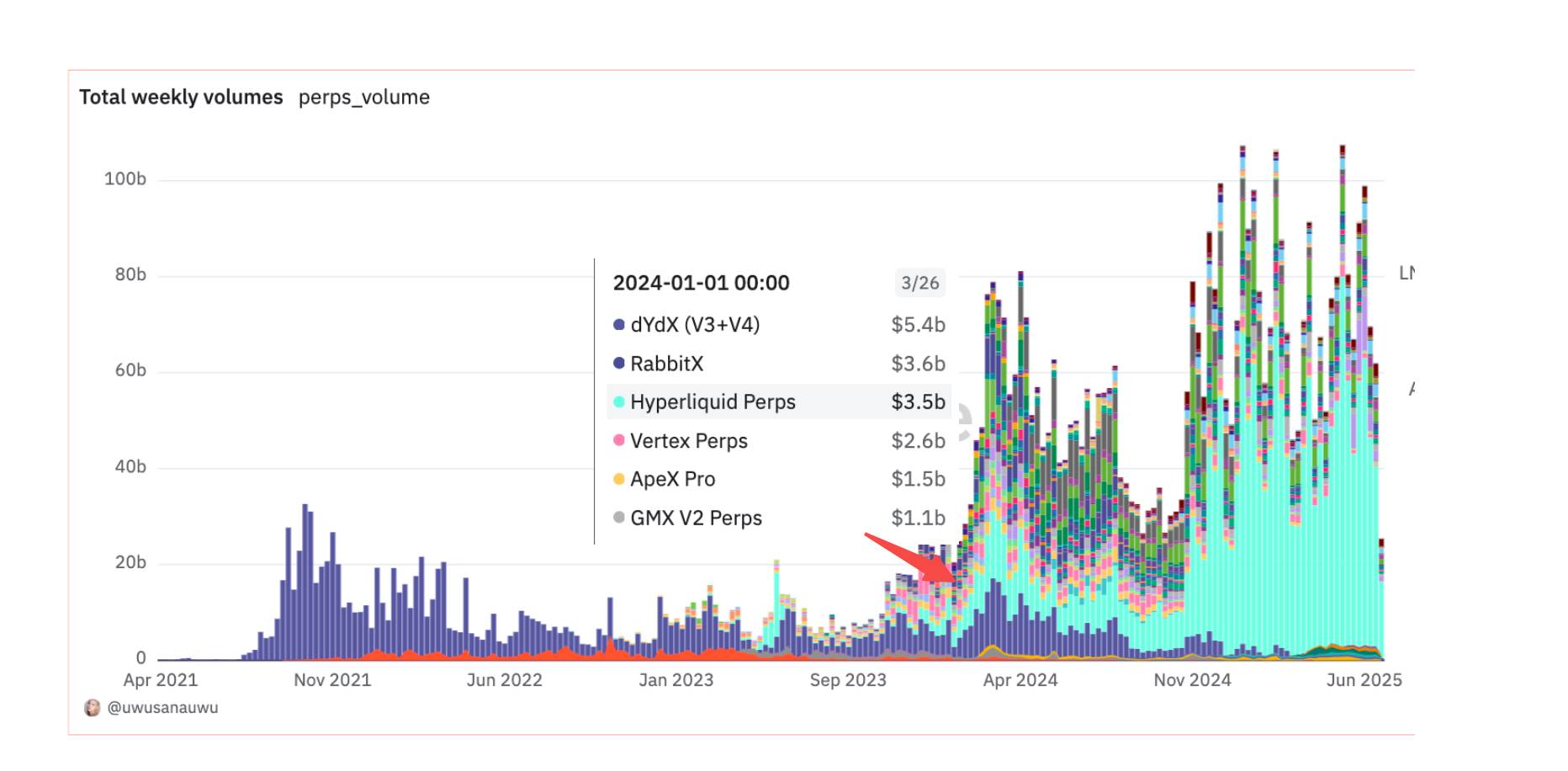

This decline coincides precisely with Hyperliquid's rise.

Hyperliquid represents the new king. The platform uses an order book mechanism, replacing traditional vAMM, significantly reducing slippage and price manipulation risks. On-chain Degens, most sensitive to experience and returns, gradually vote with their feet for even slight improvements.

For instance, in the last week of 2023, in a comparison of DEX trading volumes, Hyperliquid's volume silently reached $3.5 billion, while GMX was only $1.1 billion.

Not just GMX, but all similar DEXs were impacted by Hyperliquid. The data graph clearly proves this: after late 2024, Hyperliquid almost completely dominated the on-chain Perp DEX market.

Broadly speaking, the DeFi boom of 2021-2022 drove GMX's rapid growth, but during the same period, many VCs began investing in on-chain infrastructure, with lower-fee, higher-performance products emerging, intensifying on-chain DEX competition.

Moreover, with multiple chains competing, each chain had representative DEXs, like Jupiter on Solana. While GMX could operate cross-chain, it also meant competing with native DEXs across different chains, naturally fragmenting its market share.

As new kings rise and guards change, GMX's decline was perhaps already trending, with this recent hack merely bringing it back into the spotlight.

No Eternal Reign

GMX's decline is not an isolated case, but another annotation of rapid project replacement in the crypto market.

In the last cycle, blockchain games like STEPN that were once incredibly popular - where are they now? If this example might hint at project teams actively selling out, many projects without token launches or product refinement sometimes get abandoned by the times without doing much wrong.

For example, two years ago, there were still on-chain wallets focusing on MPC and full-chain experiences and characteristics, but when OKX Wallet and Binance Alpha bound their own portals, these similar competitors had long since disappeared.

Uniswap was once the benchmark for DEX, but at that time, with the rise of SushiSwap and Curve, its market dominance was also shaking; Aave and Compound, while gradually iterating, were also facing challenges from emerging lending protocols.

In the crypto industry, product experience is not the only moat, speculation drives liquidity and can overturn the moat at any time.

After a narrative brings a track to life, you can see projects rising like feudal lords, all vying for the supreme position on the throne; but the cycle of rise and fall is repeated, and looking back, the only constant is BTC.

The kingdom of the crypto market is not eternal, attention is power, and GMX's silence may be the best proof.

Data sources used in the article: