Author: YettaS, Investment Partner at Primitive Ventures; Translation: Jinse Finance xiaozou

True native innovation is a product that has never existed before and can only be born under an emerging technological paradigm. In the Web3 domain, we are always asking: What kind of innovation truly qualifies as native to the crypto technology stack?

Fred Wilson proposed an enduring framework in his 2009 article "The Mobile Challenge":

By "native", we mean opportunities that did not previously exist and cannot exist without mobile devices. For example, we would not consider pushing breaking news to mobile devices a native opportunity, as almost no startup is better positioned to become a "mobile version of CNN" than CNN itself.

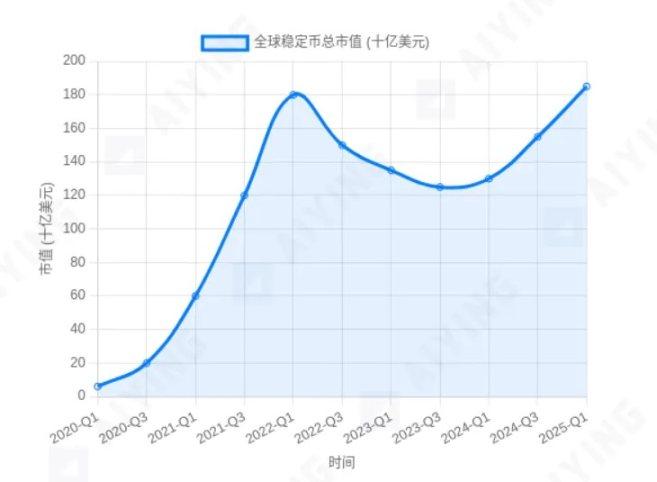

This insight is extremely sharp: True nativeness only emerges when a new interface completely reshapes our interaction with the system. Applying this principle to Web3, I believe stablecoins are one of the most native innovations in the crypto field, especially from a payment and banking perspective.

1. Interface Transformation Generates Aggregation Opportunities

Every revolution in finance begins with a new user interface. These interfaces initially create friction but also open up aggregation opportunities by redefining how value is initiated, verified, and settled.

Card Era: Credit cards became the new interface for cash.

Digital Era: Digital wallets became the new interface for e-commerce.

Web3 Era: Stablecoins are becoming the new interface for banking.

Card Era: Visa and the Birth of Global Payment Networks

Post-World War II America experienced income growth and consumer prosperity. As consumer demand for seamless payments rose, credit cards emerged. Diners Club pioneered in 1950, followed by American Express and Mastercard.

However, early systems were fragmented. A card issued by one bank might not be usable at a merchant in another payment network, and true interoperability had not yet been achieved.

In 1958, Bank of America launched BankAmericard—a scalable system that connected banks and merchants through an authorization licensing mechanism. By 1976, it transformed into Visa, a global network that aggregated a fragmented market into a unified layer.

Digital Era: PayPal and E-commerce Interface

In the late 1990s, with eBay's rise and cross-border P2P trade explosion, business models were redefined. However, payment systems severely lagged behind. Buyers needed a transaction method that didn't require sharing card information and could avoid forex and remittance friction.

PayPal quickly became the dominant online payment platform. By offering email-based transfers and instant account creation, it significantly reduced friction and deeply embedded itself in the internet's native economic ecosystem.

Web3 Era: Stablecoins as a Value Transfer Interface

So, what truly constitutes native innovation in Web3? In this paradigm, data is currency, and currency is data.

Traditional systems separate information from value. SWIFT sends payment instructions, while settlement requires a complex network of correspondent banks and clearing houses—a process that is slow, expensive, and opaque.

Blockchain merges information and value into a single layer. Now, value can flow as efficiently as information. This opens design space for programmable, composable finance:

• Trustless: Every transaction can be verified on-chain.

• Permissionless: Anyone can build and use financial services.

• Interoperable: Assets can move across protocols and chains.

Stablecoins are the core of this system. They have become the native interface in the crypto economy for deposits, yield generation, lending, and consumption, essentially functioning as a new type of banking interface.

[The translation continues in the same manner for the rest of the text, maintaining the original structure and meaning while translating to English.]Crypto Whales/Speculators: Still the fastest liquidity source for crypto native models, driven by whales, speculators, and margin traders in CEX and DeFi.

Protocol Vaults: Large in scale and high in stickiness. BuidlFi.io holds $2.8 billion TVL with just 69 wallets, with the top two vaults from Ethena Labs and Sky. Stablecoins are becoming reserve assets for crypto native institutions.

Corporate Capital: From RWA projects to regional fintech companies, everyone is chasing enterprise vaults and remittance networks to issue or integrate stablecoins. USDX has made early progress in this area.

Cross-border Payment Float: Stablecoins have now become the second-largest payment channel globally. Idle liquidity in crypto interoperability settlement layers naturally becomes a float source. I'm optimistic about Codex's development in this field.

Banking Track: After the GENIUS Act passes, banks can directly interact with stablecoin infrastructure. Frax Finance is one of the first projects to enter this track.

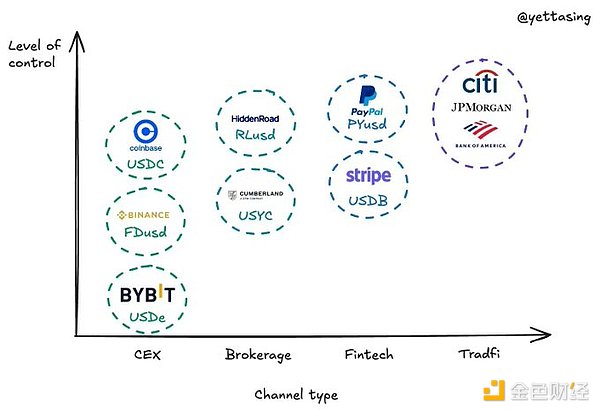

(2) Channel Control: Distribution Determines Fate

Distribution channels are the moat. Whether controlling end-user experience, wallets, CEX, brokers, or merchant networks, whoever controls these channels can lock in users and build defensive barriers.

Two dominant strategies are currently forming:

Distributors Transforming into Issuers

• PayPal launches PYUSD, natively monetizing its payment ecosystem.

• Stripe launches a stablecoin financial account supporting USDB issued by Bridge.

• Hashnote, a Cumberland affiliate, launches USYC—an interest-bearing stablecoin backed by US Treasuries.

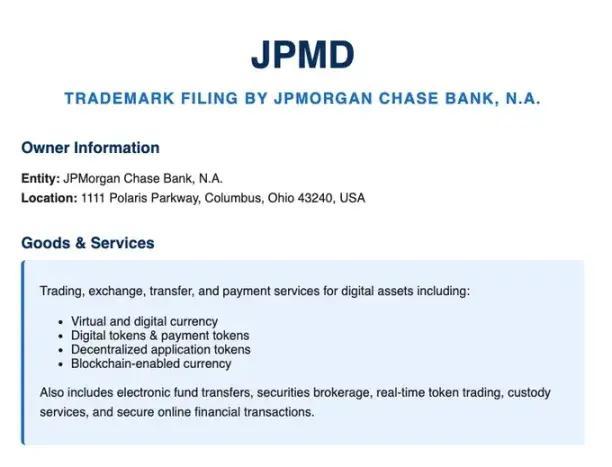

• JPMorgan, Bank of America, Citigroup, and Wells Fargo are exploring joint stablecoin issuance.

Controlling CeFi Distribution Channels

• Coinbase is a key distribution engine for Circle's USDC.

• Binance promotes FDUSD to replace BUSD, now its internal settlement token.

• Ethena Labs drives USDe adoption through direct access to Bybit.

• Ripple acquires Hidden Road to deeply layout institutional brokerage infrastructure.

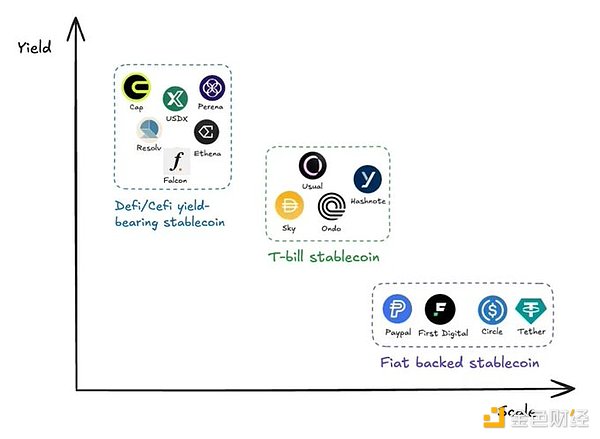

(3) Yield Strategies: Designing Stablecoin Yield Curves

Beyond trust and liquidity, stablecoin competition also manifests in the monetization capability of float. However, yield design faces classic trade-offs: high returns will limit scalability.

The current landscape can be divided into three strategic areas:

DeFi/CeFi Interest-Bearing Stablecoins:

These protocols attract funds through high yields, typically using innovative financial engineering. However, their expansion capabilities are constrained by two core challenges: risk management and regulatory complexity.

• Ethena initially used a delta-neutral strategy to generate yield for its synthetic dollar USDe, now expanded to asset management and payment solutions, offering a comprehensive DeFi platform.

• Perena is a Solana-based stable bank that collaborates with external vault managers to diversify user yield sources.

• CAP incorporates re-staking to secure the ecosystem while introducing Franklin Templeton as a key asset manager to create yields for stablecoin holders.

• Resolv expanded from an initial delta-neutral strategy to leveraging broad crypto yield opportunities, ensuring stability and institutional adoption through a risk isolation mechanism (RLP tokens).

• Falcon, supported by DWF Labs, is a synthetic dollar protocol using a unique reverse delta-neutral strategy.

• StableLabs' USDX is a synthetic dollar stablecoin using a multi-currency arbitrage strategy, maintaining an approximately delta-neutral dollar position through balanced trading of multiple digital assets.

Treasury Stablecoins:

Medium yields, institutional-grade structure. Players like Ondo and Hashnote tokenize US Treasury money market funds, balancing compliance and composability.

Fiat-Collateralized Stablecoins:

Zero yield, maximum scale. USDC, USDT, FDUSD, and PYUSD achieve distribution dominance through CEX and payment channels, primarily monetizing offshore float, with extremely low user incentives.

Just as Visa abstracts merchant bank relationships into a universal settlement layer, stablecoins are now abstracting the bank deposit layer—transforming money into an open API.

This changes the interface of the banking industry itself.

And in this interface migration lies a significant opportunity: rebuilding the monetary technology stack from scratch with stablecoins as the core operating system.