Author: Tiger Research

Translated by: AididiaoJP, Foresight News

Executive Summary

JPMorgan Chase begins issuing deposit tokens on public chains, overlaying blockchain technology onto existing financial order

Circle applies for a trust bank license, attempting to build a completely new financial order on technological foundations

Two types of institutions are attacking traditional finance from different directions, forming a "bidirectional convergence" trend

Ambiguous value positioning may weaken their respective competitive advantages, requiring clarification of core strengths and finding a balance point

A New Competitive Landscape of Blockchain Financial Infrastructure

Blockchain technology is reshaping the basic architecture of global financial infrastructure. According to the latest report from the Bank for International Settlements (BIS), by the second quarter of 2025, the global on-chain financial asset scale has exceeded $4.8 trillion, maintaining an annual growth rate of over 65%. In this wave of transformation, traditional financial institutions and crypto-native enterprises have demonstrated entirely different development paths:

Traditional Financial Institution Representative: JPMorgan Chase

Adopting a progressive "blockchain +" reform strategy, embedding distributed ledger technology into the existing financial system. Its blockchain division Onyx has served over 280 institutional clients, with an annual transaction processing volume of $600 billion. The recently launched JPM Coin has a daily settlement volume exceeding $12 billion.

Crypto-Native Enterprise Representative: Circle

Constructed a completely blockchain-based financial network through USDC stablecoin. Currently, USDC circulation reaches $54 billion, supporting 16 mainstream public chains, with an average daily transaction count of over 3 million.

Compared to the financial technology revolution of the 2010s, the current competition presents three significant differences:

Competition focus shifts from user experience to infrastructure reconstruction

Technical depth descends from the application layer to the protocol layer

Participants transition from complementary relationships to direct competition

JPMorgan Chase: Technological Innovation within Traditional Financial System Framework

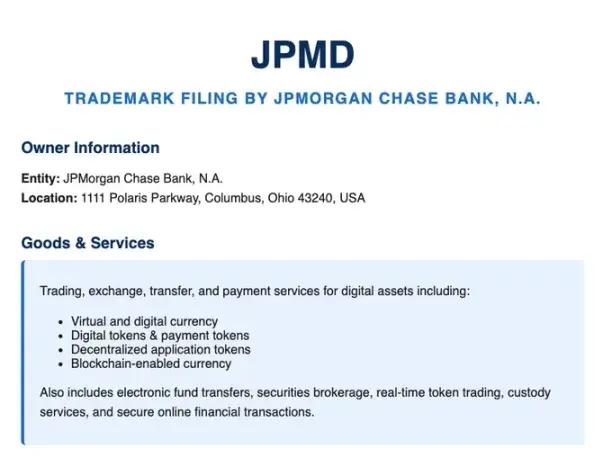

JPMorgan Chase has applied for a trademark for its deposit token "JPMD"

In June 2025, JPMorgan Chase's blockchain division Kinexys began trial operation of deposit token JPMD on the public chain Base. Previously, JPMorgan Chase primarily applied blockchain technology through private chains, but this time directly issuing assets on an open network and supporting circulation marks traditional financial institutions beginning to directly operate financial services on public chains.

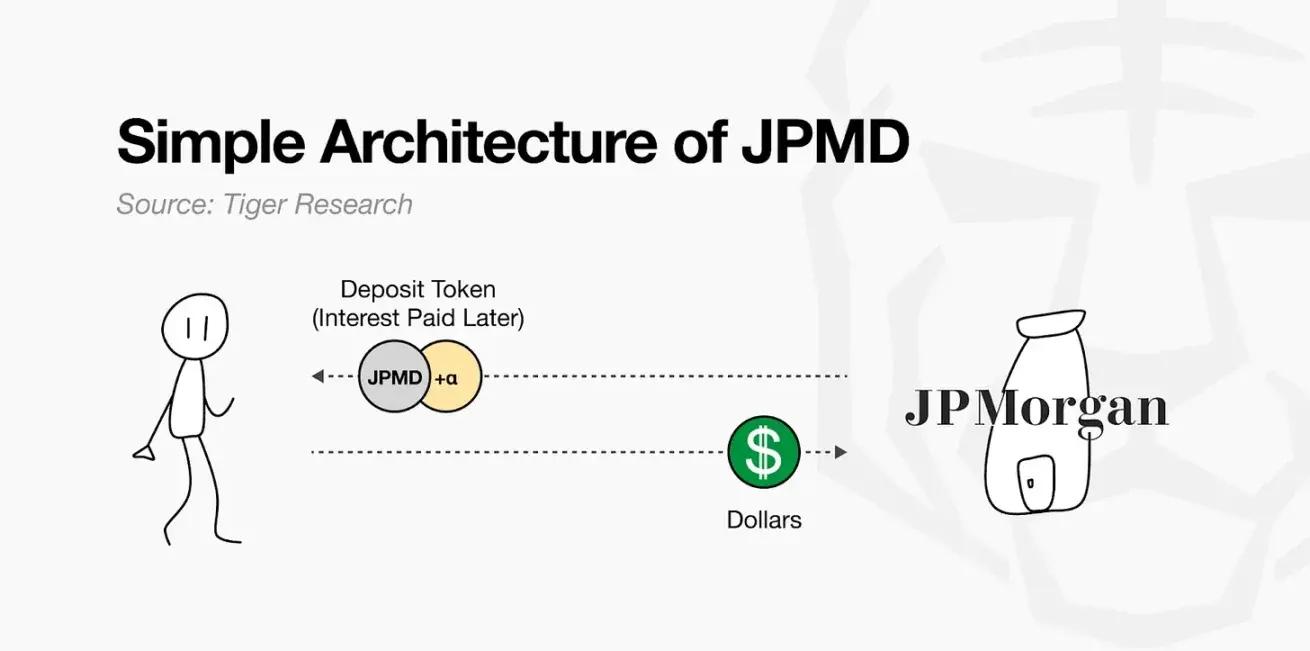

JPMD combines digital asset characteristics and traditional deposit functions. When customers deposit US dollars, the bank records deposits on its balance sheet while simultaneously issuing equivalent JPMD on the public chain. This token can circulate freely while retaining legal claim rights to bank deposits, with holders able to exchange 1:1 for US dollars and potentially enjoy deposit insurance and interest earnings. Current stablecoin profits are concentrated with issuers, whereas JPMD differentiates by granting users substantive financial rights.

These features provide very attractive practical value for asset management institutions and investors, potentially even overlooking some legal risks. For instance, on-chain assets like BlackRock's BUIDL fund using JPMD as a redemption payment tool can achieve 24-hour redemption. Compared to existing stablecoins requiring separate fiat currency exchange, JPMD supports instant cash conversion while providing deposit guarantees and interest earning opportunities, showing significant potential in the on-chain asset management ecosystem.

JPMorgan Chase's launch of deposit tokens is to respond to the new capital flows and income structures formed by stablecoins. Tether's annual revenue is approximately $13 billion, while Circle generates considerable income by managing government bonds and other safe assets. Although these models differ from traditional lending interest margins, their mechanisms of generating revenue from customer funds are similar to some bank functions.

JPMD also has limitations: strictly designed to follow existing financial regulatory frameworks, difficult to achieve complete blockchain decentralization and openness, currently only targeting institutional clients. However, JPMD represents traditional financial institutions' pragmatic strategy of entering public chain financial services while maintaining existing stability and compliance requirements, viewed as a representative case connecting traditional finance with on-chain ecosystem expansion.

Circle: Blockchain-Native Financial Reconstruction

Circle established a key position in on-chain finance through its stablecoin USDC. USDC is 1:1 pegged to the US dollar, with reserves in cash and short-term US Treasury bonds. Leveraging low fees and instant settlement technological advantages, it has become a practical alternative for enterprise payment settlement and cross-border remittances. USDC supports 24-hour real-time transfers, avoiding SWIFT network's complex procedures, helping enterprises break through traditional financial infrastructure limitations.

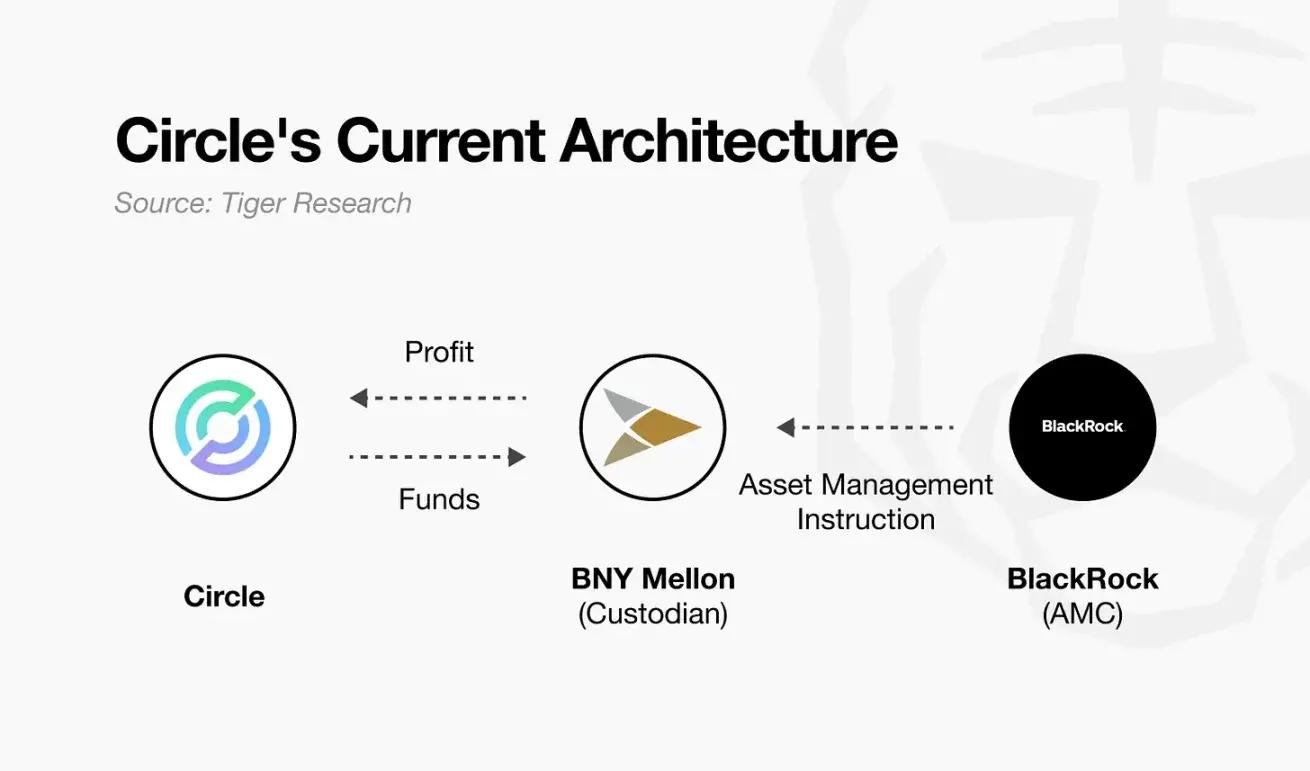

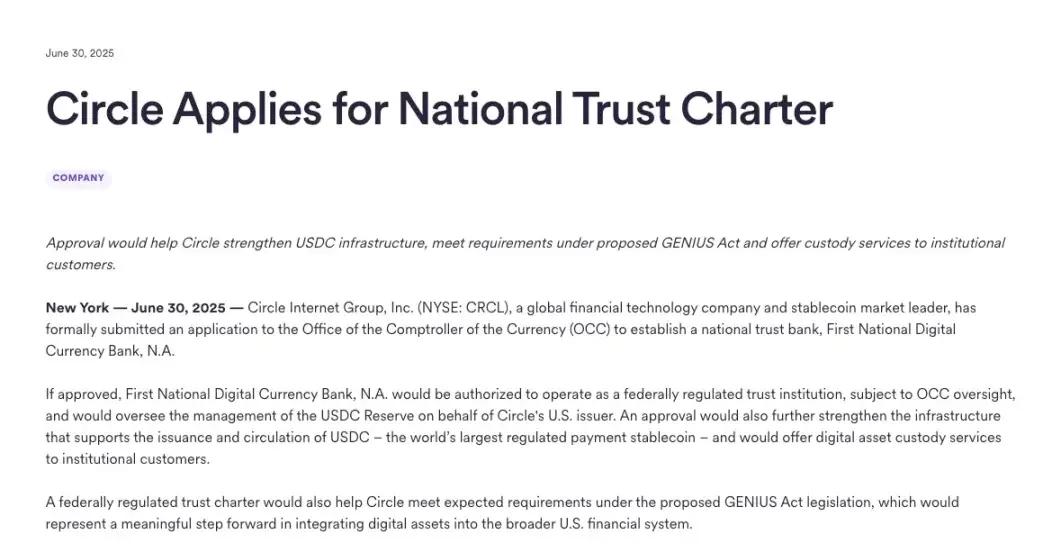

However, Circle's existing business structure faces multiple constraints: BNY Mellon custody of USDC reserves, BlackRock managing asset operations. This architecture delegates core functions to external institutions. While Circle earns interest income, its actual asset control is limited, and current profit models are highly dependent on high-interest environments. Circle needs more independent infrastructure and operational permissions, which are necessary conditions for long-term sustainability and revenue diversification.

Source: Circle

In June 2025, Circle applied to the Office of the Comptroller of the Currency (OCC) for a national trust bank license. This strategic decision goes beyond mere compliance requirements. The industry interprets it as Circle's transformation from stablecoin issuer to institutional financial entity. The trust bank identity will enable Circle to directly manage reserve fund custody and operations, strengthening internal control of financial infrastructure while creating conditions for business expansion, laying the foundation for institutional digital asset custody services.

As a crypto-native enterprise, Circle is adjusting its strategy, establishing a sustainable operating system within the institutional framework. This transformation requires accepting existing financial system rules and roles, trading decreased flexibility and increased regulatory burden. Future specific permissions will depend on policy changes and regulatory interpretations, but this attempt has become an important milestone in measuring on-chain financial structure's establishment within existing institutional frameworks.

Who Will Dominate On-Chain Finance?

From traditional financial institutions like JPMorgan Chase to crypto-native enterprises like Circle, participants from different backgrounds are actively deploying the on-chain financial ecosystem. This recalls the competitive landscape of past financial technology industries: tech companies entering finance by internally implementing core financial functions like payments and remittances, while financial institutions expanded users and improved operational efficiency through digital transformation.

The key is that this competition breaks down boundaries between both sides. Similar phenomena are emerging in the current on-chain financial field: Circle directly performs core functions like reserve fund management by applying for a trust bank license, while JPMorgan Chase issues deposit tokens on public chains and expands on-chain asset management business. Both sides gradually absorb each other's strategies and domains from different starting points, seeking new balance points.

This trend brings new opportunities and inherent risks. Traditional financial institutions forcibly imitating tech companies' flexibility might conflict with existing risk control systems. When Deutsche Bank implemented a "digital-first" strategy, it suffered billions in losses due to conflicts with legacy systems. Conversely, crypto-native enterprises expanding institutional acceptance might lose the flexibility supporting their competitiveness.

The success of on-chain financial competition ultimately depends on a clear understanding of one's own foundations and advantages. Enterprises must organically integrate technology and systems based on their "unfair advantages", and this balancing capability will determine the ultimate winner.