Written by: AiYing Research

In the wave of digital assets, stablecoins are undoubtedly one of the most eye-catching innovations in recent years. By promising to be pegged to fiat currencies like the US dollar, they have built a value "safe haven" in the volatile crypto world and have increasingly become an important infrastructure in DeFi and global payment fields. Their market capitalization leap from zero to hundreds of billions of dollars seems to herald the rise of a new monetary form.

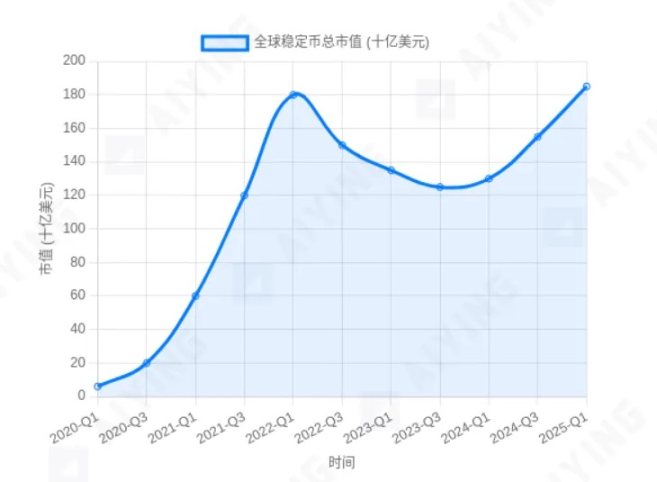

Chart 1: Global Stablecoin Market Capitalization Growth Trend (Schematic). Its explosive growth stands in sharp contrast to regulators' cautious attitude

However, just as the market is celebrating, the Bank for International Settlements (BIS), known as the "central bank of central banks," issued a stern warning in its May 2025 economic report. BIS clearly stated that stablecoins are not true currencies, and behind their seemingly prosperous ecosystem, there are potential systemic risks that could shake the entire financial system. This assertion is like a bucket of cold water, forcing us to re-examine the nature of stablecoins.

[The rest of the translation follows the same professional and accurate approach, maintaining the original meaning and tone while translating into clear English.]Let's imagine a specific scenario: a stablecoin worth millions of dollars transferred through a public chain from one anonymous address to another, potentially taking only a few minutes with low transaction fees. Although the transaction record is publicly verifiable on the blockchain, it is extremely difficult to correlate these addresses composed of random characters with real-world individuals or entities. This opens convenient channels for illegal cross-border fund flows, rendering core regulatory requirements like "Know Your Customer" (KYC) and "Anti-Money Laundering" (AML) virtually ineffective.

In contrast, traditional international bank transfers (such as through the SWIFT system) may seem inefficient and costly, but their advantage lies in each transaction being within a tight regulatory network. Sending banks, receiving banks, and intermediary banks must all comply with their respective national laws and regulations, verify the identities of transaction parties, and report suspicious transactions to regulatory authorities. While cumbersome, this system provides fundamental guarantees for the "integrity" of the global financial system.

The technical characteristics of stablecoins fundamentally challenge this intermediary-based regulatory model. This is the root cause why global regulatory agencies remain highly vigilant and continuously call for comprehensive regulatory frameworks. A monetary system that cannot effectively prevent financial crimes, no matter how technologically advanced, cannot ultimately gain social and governmental trust.

Aiying's perspective: Attributing the "integrity" issue entirely to technology might be overly pessimistic. With the increasing maturity of on-chain data analysis tools (such as Chainalysis, Elliptic) and the gradual implementation of global regulatory frameworks (like the EU's Markets in Crypto-Assets Regulation, MiCA), the ability to track stablecoin transactions and conduct compliance reviews is rapidly improving. In the future, "regulatory-friendly" stablecoins that are fully compliant, have transparent reserves, and undergo regular audits are likely to become mainstream. At that point, the "integrity" issue will be largely mitigated through the combination of technology and regulation, and should not be viewed as an insurmountable obstacle.

The Aiying research team believes this is essentially a "co-optation" strategy. It aims to absorb the programmability and atomic settlement advantages brought by tokenization technology, while firmly placing it on the trust foundation led by central banks. In this system, innovation is guided within a regulated framework, allowing enjoyment of technological dividends while ensuring financial stability. Stablecoins can only play a "strictly limited, auxiliary role".

Market Selection and Evolution

Although BIS has drawn a clear blueprint, the market's evolution path is often more complex and diverse. The future of stablecoins is likely to present a differentiated landscape:

Compliance Path:

Some stablecoin issuers will actively embrace regulation, achieve complete transparency of reserve assets, undergo regular third-party audits, and integrate advanced AML/KYC tools. Such "compliant stablecoins" are expected to be integrated into the existing financial system, becoming regulated digital payment tools or settlement media for tokenized assets.

Offshore / Niche Market Path:

Another group of stablecoins may choose to operate in regions with relatively loose regulation, continuing to serve specific niche markets such as decentralized finance (DeFi) and high-risk cross-border transactions. However, their scale and influence will be strictly limited, making it difficult to become mainstream.

The "triple gate" dilemma of stablecoins profoundly reveals their structural defects and reflects the shortcomings of the existing global financial system in terms of efficiency, cost, and inclusiveness. The BIS report sounds an alarm, reminding us not to pursue blind technological innovation at the expense of financial stability. However, the market's real needs also suggest that the answer on the path to the next-generation financial system may not be black and white. True progress may lie precisely in carefully integrating top-down institutional design with bottom-up market innovation, finding a middle path towards a more efficient, safer, and more inclusive financial future between "encirclement" and "co-optation".