Some large institutional investors are taking advantage of the recent Ethereum price drop to expand their investment portfolios, indicating a focus on long-term investment rather than short-term profits.

This activity shows that organizations are positioning themselves for long-term investment instead of short-term gains.

Ethereum Market Sentiment Surpasses Bitcoin as Accumulation Increases

Blockchain analysis from Lookonchain reveals that an unnamed institution created three new wallets last week. The company also withdrew 92,899 ETH, valued at approximately $412 million, from Kraken.

Market analysts typically view such withdrawals as positive signals, indicating investors are moving coins to self-management with a long-term holding strategy.

Meanwhile, Donald Trump's DeFi project, World Liberty, also participated in this purchasing round.

On-chain data shows the company spent 8.6 million USDC to buy 1,911 ETH at around $4,500 each. Simultaneously, the company allocated an additional $10 million to purchase 84.5 Wrapped Bitcoin (WBTC) at $118,343 per coin.

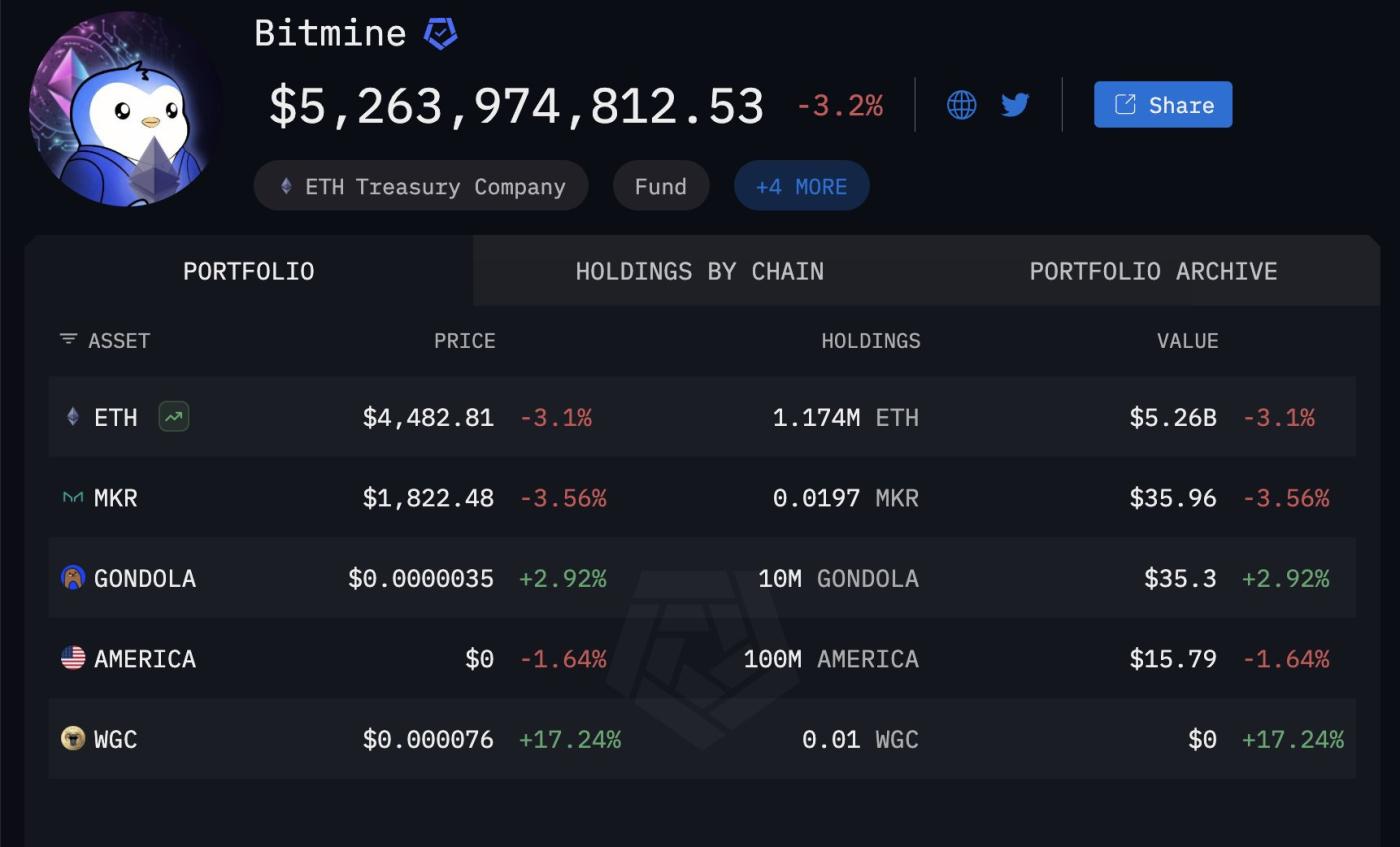

Additionally, Ethereum-focused company BitMine made the largest move during this period. Lookonchain reports that the company added 106,485 ETH to its balance sheet at a cost of $470 million.

This brings BitMine's Ethereum treasury to 1.17 million ETH, currently valued at approximately $5.3 billion. The Tom Lee-led company is the largest Ethereum treasury holder.

BitMine Ethereum Holdings. Source: Arkham Intelligence

BitMine Ethereum Holdings. Source: Arkham IntelligenceThese institutional moves occurred after Ethereum's recent correction following several weeks of strong growth nearly reaching ETH's ATH.

Market analysts note that the timing and scale of these institutional purchases indicate a calculated accumulation strategy rather than speculative trading.

Notably, institutional interest is driven by the increase in ETFs and the development of treasury companies. Together, these entities have accumulated over 10 million ETH, equivalent to approximately $40 billion in digital assets.

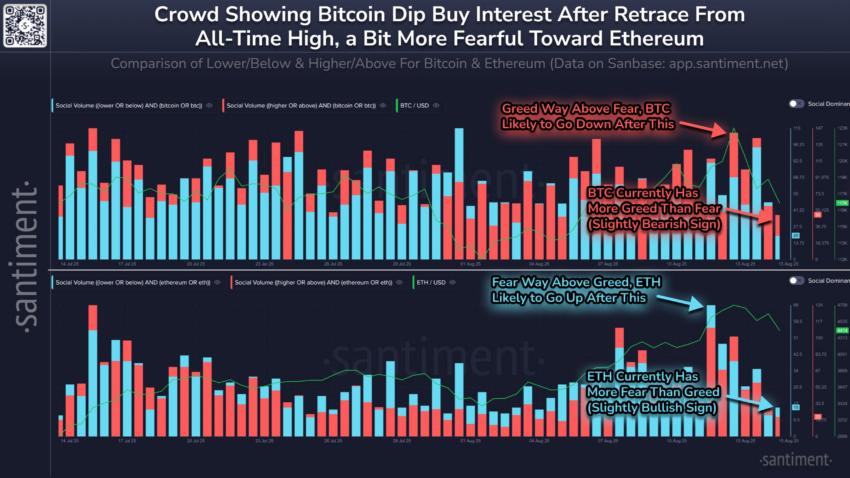

In this context, blockchain analysis platform Santiment suggests that Ethereum currently maintains a modest short-term advantage over Bitcoin in market sentiment.

Bitcoin and Ethereum Market Sentiments. Source: Santiment

Bitcoin and Ethereum Market Sentiments. Source: SantimentSantiment's analysis shows that Bitcoin price increases often generate social media attention. In contrast, Ethereum's stable performance over the past three months has attracted calculated and patient accumulation from large investors rather than public enthusiasm.

According to the company, this disciplined approach indicates that institutions are positioning for sustainable growth. It also reinforces Ethereum's role as a top macro investment choice in the digital asset market over the next decade.