Source: M31 Ventures; Translated by: Jinse Finance

M31 Ventures recently published a 95-page research report on Chainlink. The report believes that the LINK token represents one of the best risk/reward investment opportunities they have seen.

Here are the main contents of the report:

LINK token represents one of the best risk/reward investment opportunities we have seen:

1. Main beneficiary of a $30 trillion long-term trend; 2. Holding a complete monopoly in the on-chain financial middleware field; 3. An undervalued asset with its narrative severely misunderstood; 4. Recent catalysts to change market narrative; 5. Actual reasonable 20-30 times upside potential; Trading premium of (objectively inferior) similar tokens reaching 15 times.

1. Main Beneficiary of a $30 Trillion Long-Term Trend

The global financial system is undergoing a structural transformation towards tokenization: digitizing real-world assets, payments, and market infrastructure onto the blockchain. Industry predictions show that by the end of 2030, tens of trillions of dollars in assets will be tokenized, covering government bonds, real estate, funds, commodities, and currencies. This transformation requires a secure, standardized, and compliant infrastructure layer to connect traditional finance (TradFi) with the emerging on-chain economy.

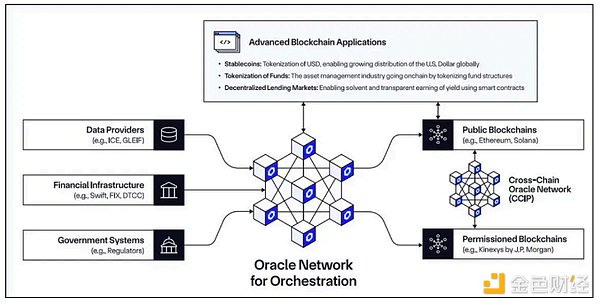

Chainlink has established its position as this infrastructure layer. As the de facto standard for on-chain data delivery and cross-chain interoperability, Chainlink secures billions of dollars in decentralized finance (DeFi) value daily, providing critical mission systems for SWIFT, DTCC, JPMorgan, Euroclear, Mastercard, and sovereign national projects, and is recognized at the highest policy level, including the White House Digital Assets Report (excerpt below). Its enterprise-level products, such as Price Feeds, Proof of Reserve (PoR), and Cross-Chain Interoperability Protocol (CCIP), are deeply embedded in regulated pilot projects connecting traditional systems and tokenized assets.

These integrations are more than just technical proof of concepts; they represent strategic footholds in regulated tokenization workflows. As the first infrastructure provider to solve compliance-grade interoperability and asset verification issues, Chainlink has positioned itself as the default choice for institutions that cannot afford operational or reputational risks.

These integrations are more than just technical proof of concepts; they represent strategic footholds in regulated tokenization workflows. As the first infrastructure provider to solve compliance-grade interoperability and asset verification issues, Chainlink has positioned itself as the default choice for institutions that cannot afford operational or reputational risks.

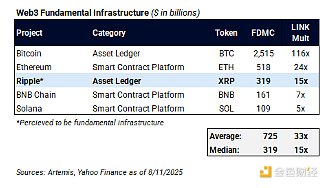

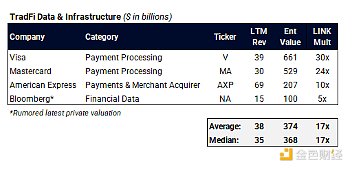

Moreover, the most similar liquidity token to LINK is XRP; not because Ripple can actually be compared with Chainlink, but because LINK possesses all the qualities that XRP holders believe XRP has. In fact, XRP has no utility, has no formal connection with Ripple, and essentially lacks any institutional traction, yet its trading price is 15 times higher than LINK, providing investors with possibly the most asymmetric risk/reward opportunity in today's market. In the long term, we believe traditional financial companies like Visa and Mastercard would be more appropriate comparisons, which means LINK has a 20-30 times upside potential.

This revaluation could be sudden, intense, and sustained, as institutional capital recognizes the scale of this opportunity. Now is the time to invest.

This revaluation could be sudden, intense, and sustained, as institutional capital recognizes the scale of this opportunity. Now is the time to invest.

Full research report address: https://docsend.com/view/d9zgwzxxfbdjg7ck