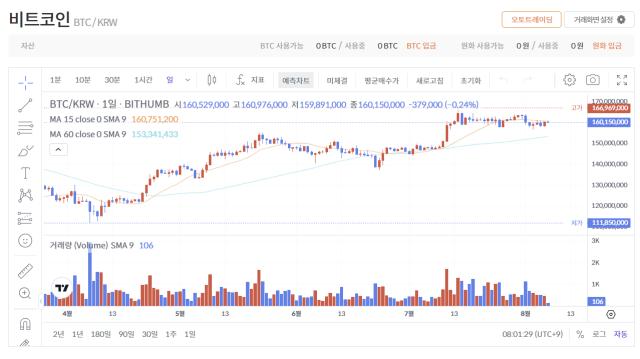

After reaching a peak of over $123,000 in mid-July, Bitcoin (BTC) has fallen into an indecisive state. It is currently trading in what Glassnode's on-chain analysts call a "low liquidity gap".

Analysts at QCP Capital mentioned that investors are readjusting their expectations for global growth and liquidity.

Between Two Peaks, 'Bitcoin Air Gap'... Market Anxiety Signal

After the all-time high adjustment, the BTC price fell below the support level of $116,000. On one side, short-term holders are wavering, and on the other, potential buyers have not recovered the cost basis of recent high-price buyers.

On July 31, Bitcoin fell below a critical support cluster between $116,000 and $123,000, entering a thin liquidity zone extending to $110,000.

This "gap" is an area where coins were previously rarely traded. Such zones typically require new demand or sell-offs.

According to Glassnode data, approximately 120,000 BTC were purchased from July 31 to August 4, after rebounding from the local low of $112,000. This indicates interest in buying the dip, but it was not sufficient.

Bitcoin's price remains below the key resistance of $116,900, which is near the cost basis of short-term holders who bought at the local high.

"The rebound lacks sufficient strength to recover resistance. If demand does not quickly rebound, new investors' confidence may weaken." – Glassnode mentioned.

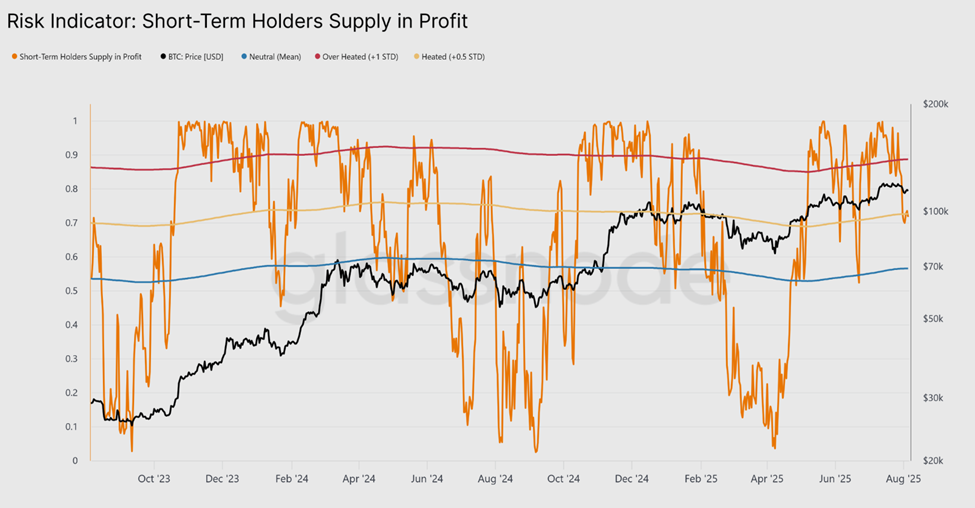

Short-term holder (STH) profitability is often used as a measure of confidence. This indicator has already dropped from 100% to 70%, aligning with the midline of historical bull markets.

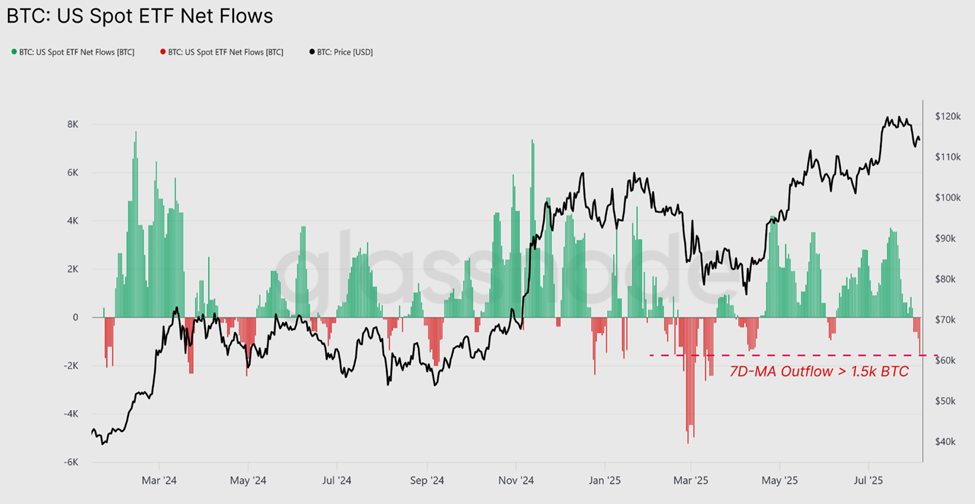

While not yet at a warning level, a deeper correction could rapidly change sentiment. Meanwhile, ETF inflows did not help. The outflow of 1,500 BTC on August 5 was the largest since April, adding to short-term bearish pressure.

BTC, Decreasing Leverage and Accumulation... New Demand Needed

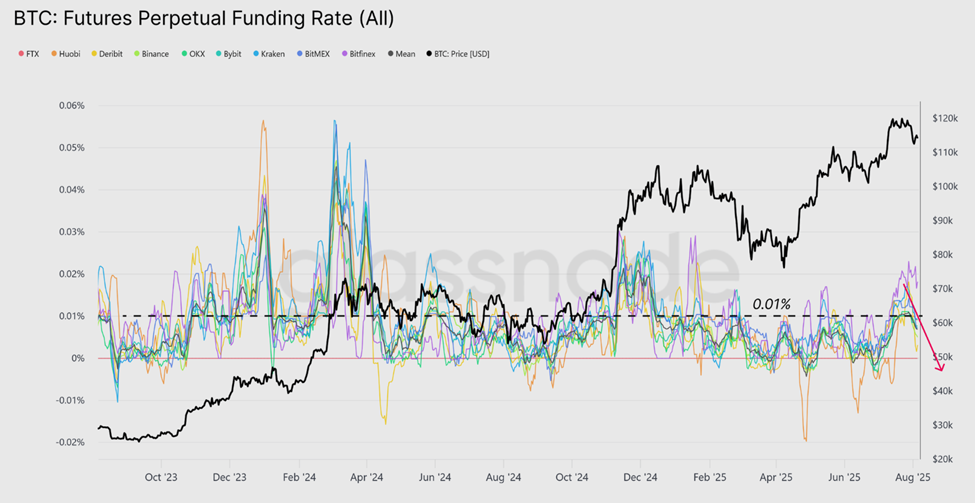

Meanwhile, the perpetual futures funding rate has dropped below 0.1%. This premium decline indicates diminishing enthusiasm for leveraged longs, reflecting the current market hesitation.

Despite the weakness, the broader macro structure remains intact. Bitcoin's monthly close in July was historically the highest.

Analysts at QCP Capital say this decline is more of a correction than a sell-off, occurring at a time when macro and structural tailwinds continue to support it.

Historical data suggests such fluctuations often precede a new accumulation phase when excessive leverage is removed.

Glassnode's heatmap confirms accumulation behavior with all wallet categories blinking green. However, recovery depends on demand. A sustained move above $116,900 would be a strong signal that buyers are regaining control.

Until then, BTC appears trapped between the $110,000 floor and $116,000 ceiling. ETF inflows, volatility compression, and options market behavior could provide early recovery signals.

Bitcoin remains in a state of post-all-time-high amnesia, caught between fading momentum and unstable confidence, waiting for its next move.