Table of Contents

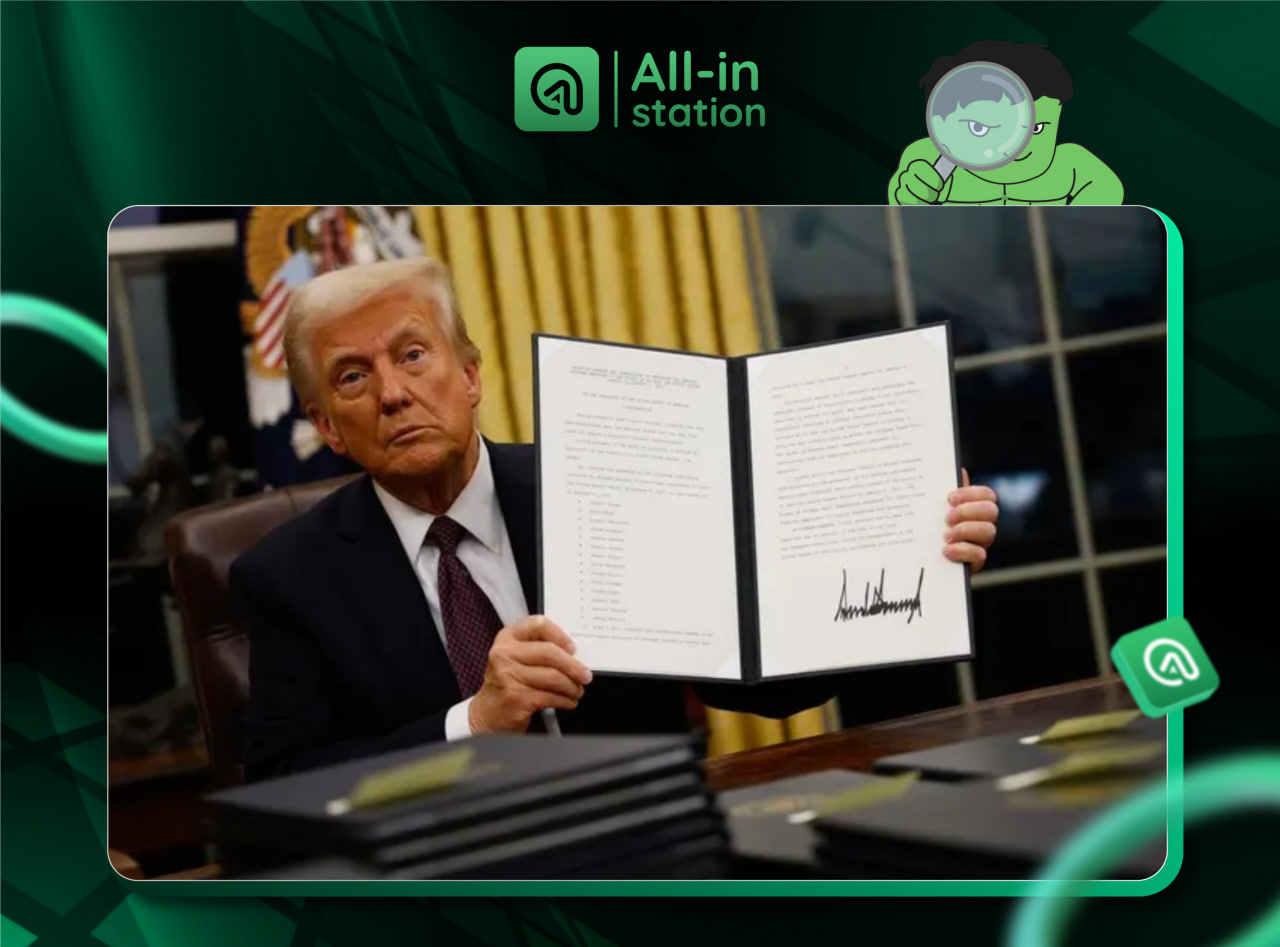

TogglePresident Trump is about to sign an executive order allowing 401(k) retirement funds to invest in cryptocurrency, real estate, and private equity.

On August 7th, according to Bloomberg sources, US President Donald Trump is expected to sign an executive order on Thursday to pave the way for 401(k) retirement funds to be allowed to invest in alternative assets, including real estate, private equity, and cryptocurrency.

This move is considered a major breakthrough for industries eager to access the US retirement fund market worth approximately $12.500 trillion. It is also a clear signal that the Trump administration is pursuing a policy to promote investment in non-traditional assets, aiming to expand long-term profit opportunities for workers.

The US Department of Labor will have to review all guidelines

According to close but anonymous sources, this executive order will require the US Department of Labor to reassess guidelines for alternative asset investments within the framework of the Employee Retirement Income Security Act of 1974 (ERISA). The department will also need to clarify the federal government's legal perspective on fiduciary responsibility when retirement funds allocate capital to assets like cryptocurrency or real estate.

President Trump will also task Labor Secretary Lori Chavez-DeRemer to coordinate with federal agencies such as the Department of the Treasury and the US Securities and Exchange Commission (SEC) to review whether regulations need to be adjusted to promote program implementation. Additionally, the SEC will be asked to facilitate the inclusion of alternative asset investments in workers' self-directed retirement accounts.

Policy has been carefully prepared over many months

This policy has been incubated by high-level leaders in Washington for months, with the goal of removing long-standing legal barriers that have prevented alternative assets from accessing defined contribution retirement funds. Currently, the investment portfolios of most 401(k) retirement funds in the US still focus primarily on stocks and bonds, partly because fund managers are wary of the risks and low liquidity of complex products like crypto or real estate.

If implemented, this would be a turning point policy in Trump's second term, continuing the legacy from his first term. In 2020, the Trump administration had issued guidelines confirming that allocating a small portion to private equity does not violate the fiduciary obligations of retirement fund managers. However, this policy was revoked by the Biden administration shortly after taking office in 2021.

New context: the race for market share in the retirement fund market

Currently, both traditional asset management companies and non-traditional investment funds are fiercely competing to access the retirement fund market – a segment with strong growth potential as traditional fundraising channels are stagnating. Particularly, many large US retirement funds are approaching internal investment limits in private equity, forcing them to seek new directions for portfolio diversification.

Supporters of this policy argue that opening 401(k) to alternative assets will provide workers with more investment choices and create better long-term profit opportunities. However, some experts warn that the high costs and risks associated with these assets could expose fund managers to litigation risks if the market experiences significant volatility.

Related story: BlackRock and Fidelity previously proposed similar things

Notably, opening retirement funds to cryptocurrency and alternative assets is not a new idea. Since 2022, large asset management corporations like BlackRock and Fidelity had proposed including Bitcoin and crypto investment products in 401(k) portfolios. However, this proposal was met with opposition from the Biden administration, which was concerned about market risks and the lack of a clear legal framework.

President Trump's decision to "revive" this idea in his second term not only demonstrates strong support for digital assets but is also part of a strategy to promote growth in US household assets through investment liberalization.