On the morning of August 7, 2025, as Asian traders just opened their screens, a chill pierced through the summer's stuffiness. A cryptocurrency token named Test (TST), within a short hour, saw its K-line chart collapse like a cliff, plummeting vertically from a still-warm $0.0496 to a cold $0.01547, a decline of nearly 70%. Panic spread like a plague across the market, with the TST/USDT trading pair on Binance contributing an astonishing $15.95 million in trading volume during the crash.

However, the protagonist of this bloodbath was not some star public chain or DeFi giant. Its name—"Test"—was like a black comedy, revealing the absurd nature behind this storm. This was not an accident, but a textbook "contract squeeze" orchestrated by human greed, algorithmic coldness, and market structural defects.

An Accidentally Viral Solo Performance: The Absurd Origin of TST

TST was not born from a grand technological vision or a rigorous whitepaper. Its life began in a teaching video by the BNB Chain team. To demonstrate how their Meme token issuance platform "four.meme" works, the team created this example token named "Test". An unintentional act, yet due to the contract address accidentally leaked in the video, this specimen meant to lie in the laboratory was pushed onto the noisy stage by speculators.

"Related to Binance/BNB Chain" - this vague but highly tempting label became the fuel for TST's price takeoff. In the crypto world, narrative often matters more than reality. The community and sensitive KOLs quickly seized this story, packaging it as a "community-driven" Meme miracle. Suddenly, discussions about TST spread virally on social media. Many investors didn't even know its origin, only that it was a "value pit" related to a giant.

This is a classic portrayal of the Meme token's "attention economy". Its value does not stem from technology or application, but from the sum of community sentiment and social media heat. As a gate.io analysis pointed out, such tokens' price curves follow a predictable lifecycle: "Hype-Surge-Consolidation-Crash". TST, which saw a 1100% price surge after listing in early February 2025, was a perfect enactment of this cycle. However, when attention recedes, a castle built on quicksand can only collapse. Former Binance CEO CZ personally clarified that TST had no direct connection with the official team, but this faint voice of reason was long drowned out by the market's frenzied noise.

Launching the "Meat Grinder": Reviewing That Breathtaking Hour

The flash crash on the morning of August 7 was not merely market panic, but more like a precise surgical operation. The core of this operation was the linkage mechanism of "spot market dumping and contract liquidation".

Step One: Whale Probing and Algorithmic Resonance.

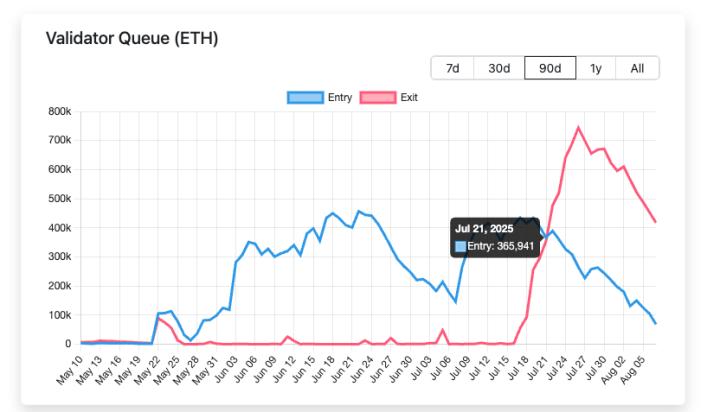

The storm began with a tiny disturbance. On-chain data showed that TST's chips were highly concentrated, with a few "whale" addresses holding enough tokens to shake the market. On the eve of the crash, it was likely one or more whales decided to end the game. They began continuous selling in the spot market, exploiting TST's fragile liquidity on decentralized exchanges like PancakeSwap - its liquidity pool was previously only around $3.3 million - creating the first wave of price decline.

This first selling pressure was like a stone thrown into a calm lake, triggering violent ripples. Numerous latent high-frequency trading (HFT) algorithms were instantly activated. When the price broke through a key technical support level, these pre-set programs automatically executed stop-loss and liquidation orders. Platform X user @bitfoxdotai analyzed afterward: "Cascading long liquidations led to liquidity exhaustion." This precisely described the scene: machine coldness replaced human hesitation, with selling pressure geometrically amplified, forming a merciless algorithmic echo chamber.

Step Two: The Ultimate Harvest in the Contract Market.

If spot market selling was the ignition, the real explosive was the high-leverage derivatives market. Within 24 hours of the flash crash, the total trading volume of TST/USDT contract pairs across networks reached a staggering $266 million, an increase of 1173%. The contract trading volume on Binance increased by an even more jaw-dropping 1855%. Behind these cold data were the lamentations of countless leveraged long positions.

This was a typical "Longing Squeeze". Manipulators created price drops in the spot market, with their true target being the long positions in the contract market. When spot prices touched these positions' "forced liquidation line", the exchange's risk engine would automatically sell their positions at market price to recover margin. These new, massive sell orders passively hammered the market, causing further price drops and triggering more liquidations at lower price points.

This was a self-reinforcing death spiral. The total contract open interest dropped by 28.86% in those 24 hours, meaning nearly one-third of leveraged positions were wiped out in agony. X platform trading analysis app @AlvaApp commented: "MACD indicators confirmed risk-averse sentiment, leverage was cleared." The TST contract market became an efficient "meat grinder" that morning.

Reflections on the Ruins: Systemic Cracks from TST

[The rest of the text continues in the same translated manner...]

More profoundly, we can see the echoes of history. Although the mechanism is more complex, the epic collapse of LUNA/UST in 2022 similarly had a core system with internal mechanism flaws that fell into an inescapable death spiral under external pressure. Whether it's the de-pegging of algorithmic stablecoins or the contract killing of meme coins, they all point to a common tragedy: when an asset's value completely depends on fragile consensus rather than solid value support, its collapse is inevitable, only a matter of time and method.

Conclusion: The Absurd Drama Ends, Warning Bell Resonates

The story of TST, starting from a teaching accident and ending with a market massacre, is full of absurd drama. It provided the most brutal public lesson about risk for all market participants.

The core of this lesson is: when a meme concept with no intrinsic value meets a highly leveraged derivatives market that can infinitely amplify risk, they create an extremely unstable financial "explosive". For ordinary investors, trying to build wealth on this quicksand is tantamount to seeking skin from a tiger.

In the end, what this farce leaves us, besides the shocking scar on the K-line chart, is the slightly sarcastic response from former CEO CZ - he denied any direct connection to the project. The creator has long since left the stage, but the monster born from the market has already devoured countless people's real money. The bell of TST has rung, warning latecomers that while chasing the next hundred-fold coin myth, they must look clearly beneath their feet to see whether it's solid ground or a bottomless abyss.