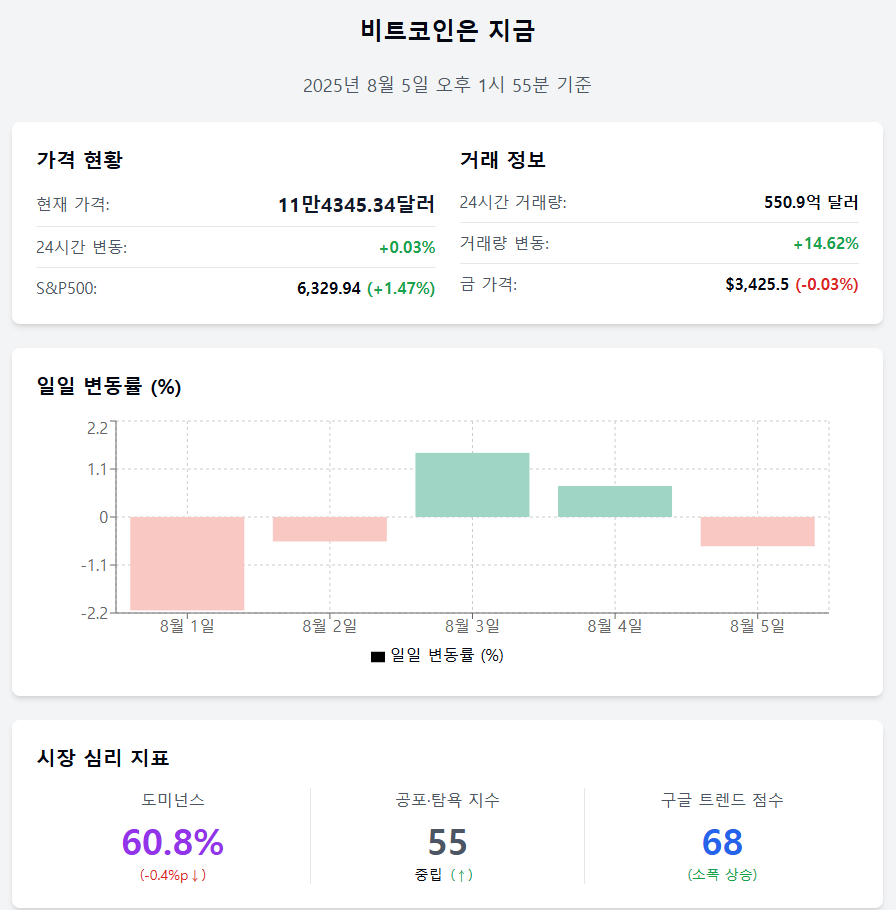

As of August 5, 2025, 1:55 PM

Bitcoin is showing signs of market participation revival with increasing trading volume and active wallets while maintaining a stable price trend. On-chain indicators are capturing investment sentiment recovery and bottom-buying movements, generating expectations for a short-term rebound.

📈 Price right now

Price $114,345.34 (+0.03%) Bitcoin is trading at $114,345.34, up 0.03% from the previous day.

Trading volume $5.509 billion (+14.62%) The 24-hour trading volume increased by 14.62% to $5.509 billion. With trading volume rebounding, investor activity is regaining vitality.

Daily fluctuation rate –0.67% The daily fluctuation rate over the past 5 days was recorded as –2.14% (August 1), –0.56% (August 2), +1.47% (August 3), +0.71% (August 4), –0.67% (August 5). In the short term, it appears to have entered a directional exploration phase.

Asset comparison S&P500↑ · Gold↓ The S&P500 index rose 1.47% to 6,329.94, while gold price dropped 0.03% to $3,425.5. The divergent flow between risk and safe assets suggests potential fund reallocation.

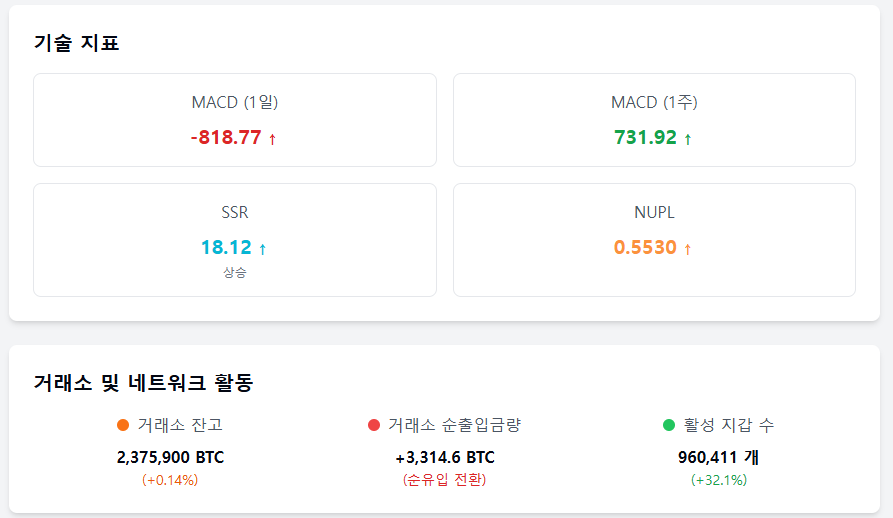

MACD –818.77 The short-term MACD is –818.77, still showing a weak trend, but the 1-week MACD is 731.92, maintaining a medium-term upward trend.

❤️ Investor sentiment now

Dominance 60.8% (–0.4%p) Bitcoin dominance dropped 0.4 percentage points, indicating some funds are dispersing into altcoins.

Fear & Greed Index 55 (Neutral) The Fear & Greed Index slightly increased from the previous day's 52, maintaining a 'Neutral' level. Compared to last week's 63 greed zone, sentiment is stabilizing.

Google Trend score 68 Bitcoin-related search scores rose slightly from 67 on the 4th to 68 on the 5th. Public interest remains steady.

🧭 Market now

SSR 18.1177 (+0.61%) The Stablecoin Supply Ratio (SSR) increased to 18.12, indicating a slight decrease in stablecoin buying capacity in the market.

NUPL 0.5530 (+0.0029) The Net Unrealized Profit/Loss (NUPL) slightly increased, with the proportion of investors in the profit zone continuing to expand.

Exchange balance 2,375,900 BTC (+0.14%) The Bitcoin balance on exchanges increased 0.14% to 2,375,900 BTC, showing a slight strengthening of deposit trends.

Exchange net inflow +3,314.6 BTC (–3.31%) The 24-hour net inflow of 3,314.6 BTC decreased by 3.31% from the previous day, but the inflow-dominant trend continues.

Active wallets 960,411 (+32.1%) Active wallet numbers increased 32.1% from 727,093 the previous day, indicating a resurgence of on-chain activity and increased transaction participation.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>