Tokyo-based listed company Metaplanet (TSE: 3350) has significantly expanded its Bitcoin (BTC) holdings by purchasing an additional 463 BTC, amounting to approximately $55 million.

This strategic investment was executed at an average price of around $119,500 per BTC. This highlights the company's commitment to strengthening shareholder value through cryptocurrency accumulation.

Strengthening Finances with Bitcoin

After this recent acquisition, Metaplanet now holds 17,595 BTC, with an average purchase price of approximately $102,800 per coin. The company's total Bitcoin investment reaches around $1.8 billion, establishing Metaplanet as one of the largest Bitcoin holders in Japan and seventh largest globally.

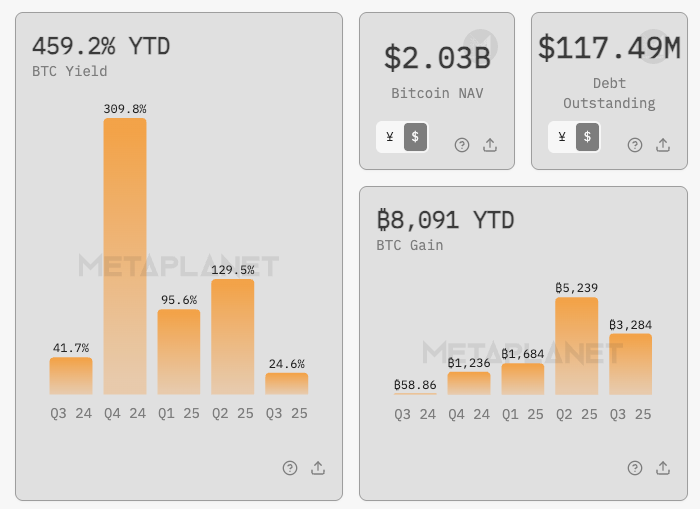

Metaplanet uses Bitcoin yield (BTC Yield) as a key performance indicator (KPI) to measure asset strategy success. BTC Yield measures the variation of Bitcoin holdings relative to fully diluted shares during a specific reporting period. From July 1 to August 4, 2025, Metaplanet reported a 24.6% BTC Yield, reflecting continued aggressive accumulation.

The company also tracks BTC Profit and BTC Dollar Profit indicators. BTC Profit quantifies the absolute growth of the company's Bitcoin holdings, excluding the dilutive effect of new stock issuance. BTC Dollar Profit converts BTC Profit's market value to dollars. This provides investors with clear insights into Metaplanet's asset management performance.

During the second quarter of 2025 (April 1 to June 30), Metaplanet reported a 129.4% BTC Yield, accumulating 5,237 BTC in BTC Profit, amounting to approximately $604 million. These figures underscore Metaplanet's robust financial strategy of leveraging cryptocurrency investments to strengthen corporate assets.

Exploring Inflation and Currency Risks

Metaplanet's aggressive Bitcoin acquisition comes amid growing concerns about inflation and continuous Japanese yen value decline. Industry analysts suggest the company's cryptocurrency strategy serves as a protection against monetary inflation.

"Japanese companies are facing persistent yen value depreciation, and Bitcoin is becoming an attractive hard asset hedge," a cryptocurrency market analyst previously told BeInCrypto. "BTC provides superior long-term risk-adjusted returns, especially in markets where real returns remain negative."

Metaplanet's Bitcoin-centric asset management occurs against the backdrop of rising global inflation in major economies like the United States and Japan. As the yen continues to depreciate, Japanese companies increasingly view Bitcoin as a long-term safeguard against purchasing power erosion.

The company's extensive BTC holdings significantly contribute to corporate value, surpassing traditional businesses like hotels and media, which currently represent only a limited revenue base.

The hotel sector remains stable, but its profit contribution is minimal compared to the scale of cryptocurrency investments. In the first quarter of 2025, Metaplanet reported approximately $6 million in revenue, a 943.9% increase from the previous year, primarily due to profits from Bitcoin sales and related activities.

Metaplanet's stock demonstrates volatility exceeding Bitcoin's, indicating increased exposure and sensitivity to cryptocurrency market changes. This volatility is triggered by debt financing, new stock issuances, and market premiums for anticipated future holdings.

Redefining Corporate Value through Bitcoin-Centric Strategy

The company argues that its KPI methodology accurately reflects asset performance without exaggerating stock dilution. Management emphasizes that BTC Yield, BTC Profit, and BTC Dollar Profit are valuable asset performance indicators, helping to evaluate effectiveness independently of traditional revenue or profitability metrics.

Metaplanet's continuous Bitcoin accumulation demonstrates confidence in BTC's long-term potential, viewing it as a tool for robust inflation protection and attractive returns. Investors are carefully monitoring Metaplanet's breakeven point at a BTC price of $101,000, considered a financial "risk zone" where potential losses could occur.