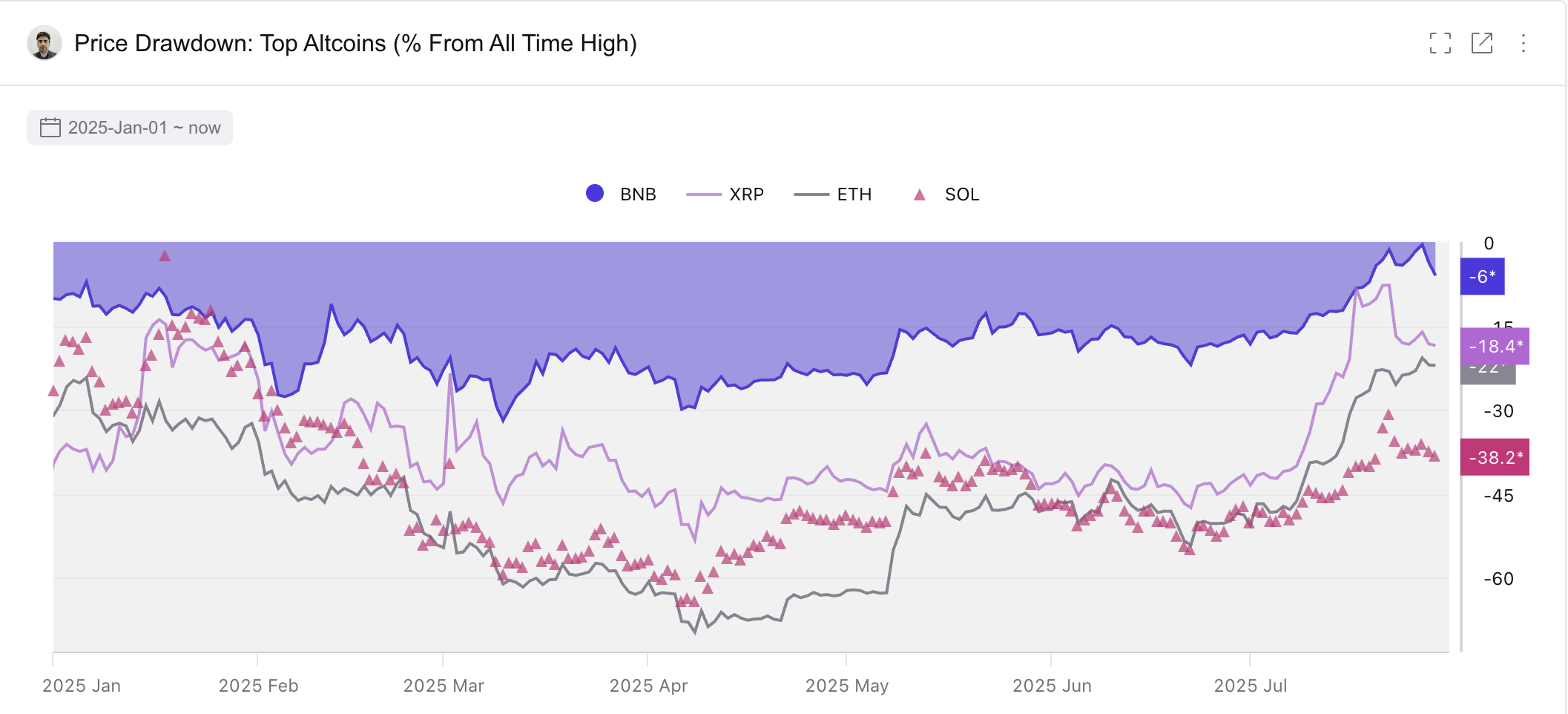

The start of August was not very kind to the cryptocurrency market. After a relatively strong performance in July, the total market capitalization was hit, and most altcoins entered a downward trend. Ethereum dropped by 9.5% compared to the previous month. XRP fell by 9.1%, and DOGE declined by 19.1%, recording the largest drop among the top 10 losing coins. Traders are also anxious about whether another decline is coming.

However, not all altcoins are showing weakness. Despite an uneasy start, some coins are showing strong resilience, approaching or moving towards their all-time highs. Driven by on-chain strength and narrative momentum, here are three coins that could reach new all-time highs in August.

BNB (BNB)

Among top market cap altcoins, BNB is currently showing the most robust technical position. It is currently positioned 12.3% below its all-time high.

What differentiates BNB is its minimal downward trend over 2025. According to year-to-date decline data, it has never fallen more than 30% from its all-time high. This is a rare consistent resilience in a highly volatile market.

Investor confidence has been reinforced by the tangible utility across the Binance ecosystem, with DeFi activity on the BNB chain recently increasing by 11%, strengthening on-chain momentum.

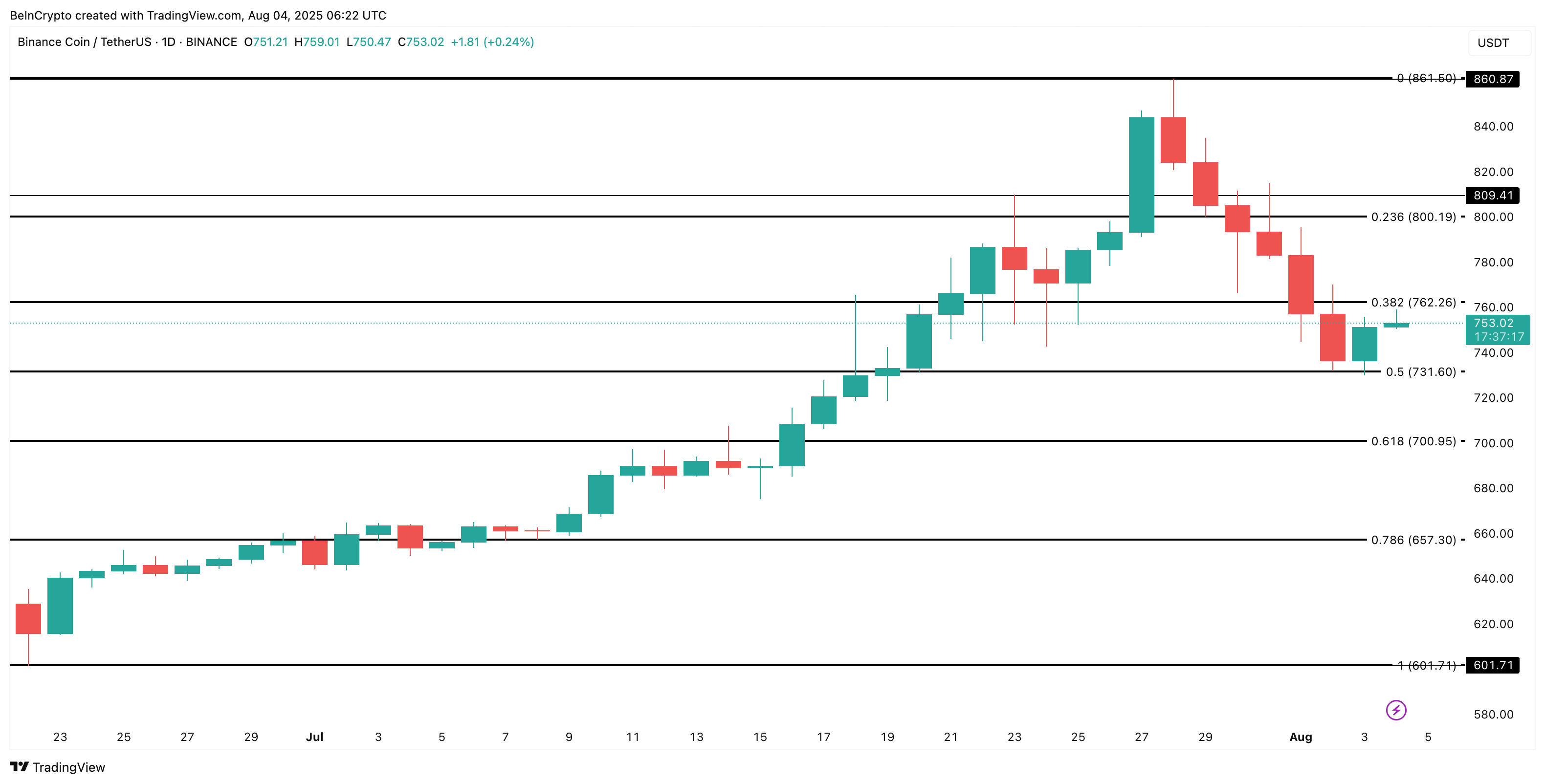

BNB is currently trading at around $753, maintaining levels above $731. This is a key support zone derived from the Fibonacci retracement between the June low of $601 and the recent high near $809.

- If $731 is maintained, the next major resistance is $762. This is where BNB showed a correction before its last breakout.

- If it breaks above $762, an opportunity opens to retest the $800–$809 zone.

Note: There are no strong technical resistance levels between $800 and $861, so if $800 is broken again, the possibility of a new BNB all-time high is strengthened.

Due to strong structural support, limited historical decline, and steadily increasing DeFi usage, BNB is one of the major altcoins that could reach a new all-time high this month, provided market stability continues.

Token Technical Analysis and Market Updates: Want more such token insights? Subscribe to the daily crypto newsletter by editor Harsh Notariya here.

HYPE (Hyperliquid)

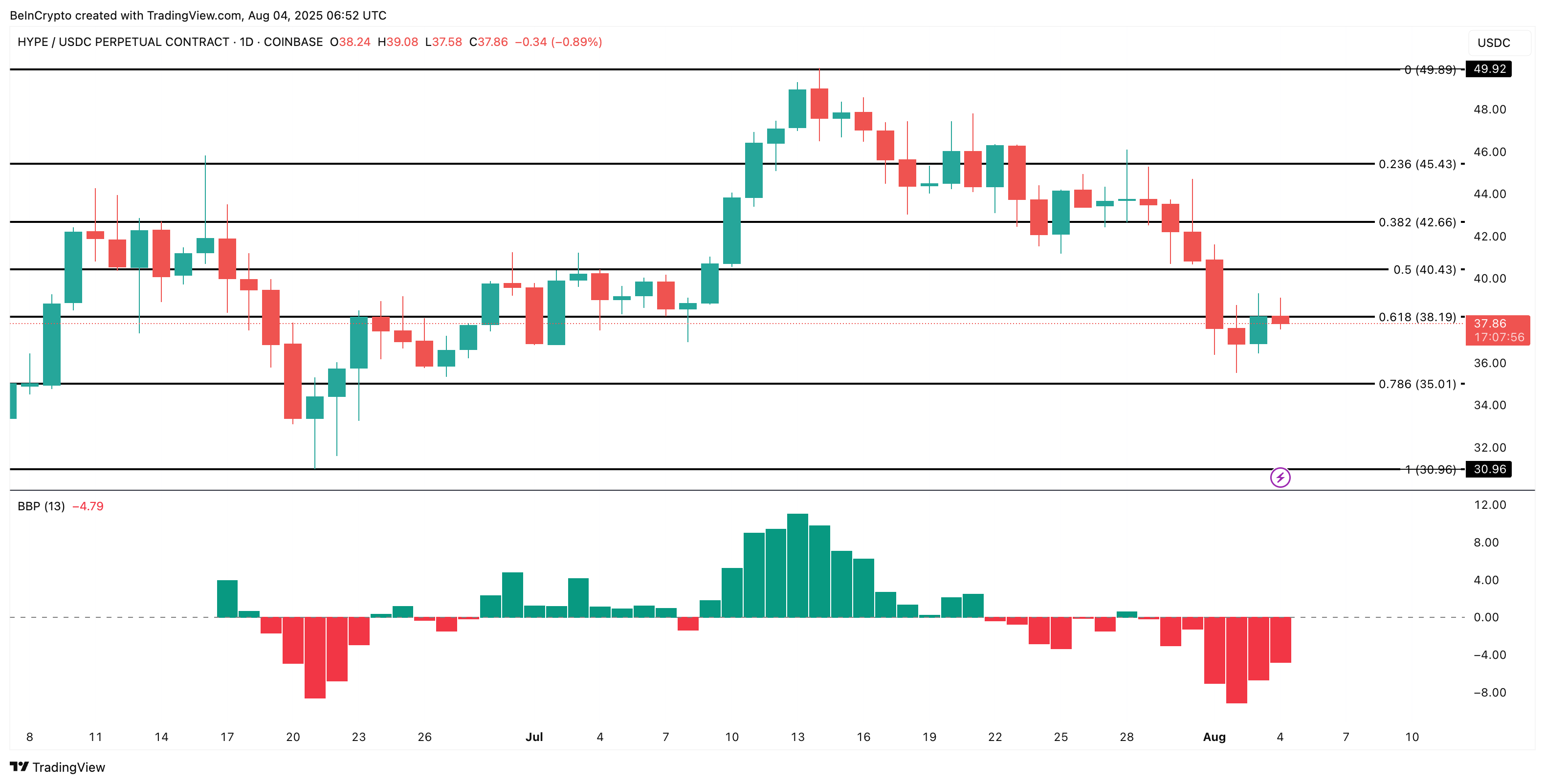

Hyperliquid is rapidly emerging as a strong contender in the DeFi derivatives space. With a Total Value Locked (TVL) of over $2.06 billion, it is ahead of major platforms like dYdX, which holds about $263 million. This protocol has entered the top 10 DeFi ecosystems by TVL.

In terms of recent performance, HYPE has dropped more than 24% from its all-time high of $49.92 a few weeks ago. However, the three-month rise is still 86.8%, and despite a 15.3% decline over the past seven days, the larger uptrend is maintained.

One of the key technical validations towards a new all-time high comes from the Bull Bear Power (BBP) indicator. At the time of writing, BBP shows a pattern similar to before the price rose over 60% from around $30 to nearly $50. The current pattern is mimicking that behavior, with BBP showing a similar bearish exhaustion. If that setup repeats, a strong reversal could be possible.

At the price level, HYPE is entering a correction just below the 0.618 Fibonacci retracement level of $38. This zone is being closely watched, and breaking this resistance could open the path to $42 and potentially return to the high. Particularly, the $35 area acts as a strong psychological and structural support, which was the base of the last breakout.

TRX (TRON)

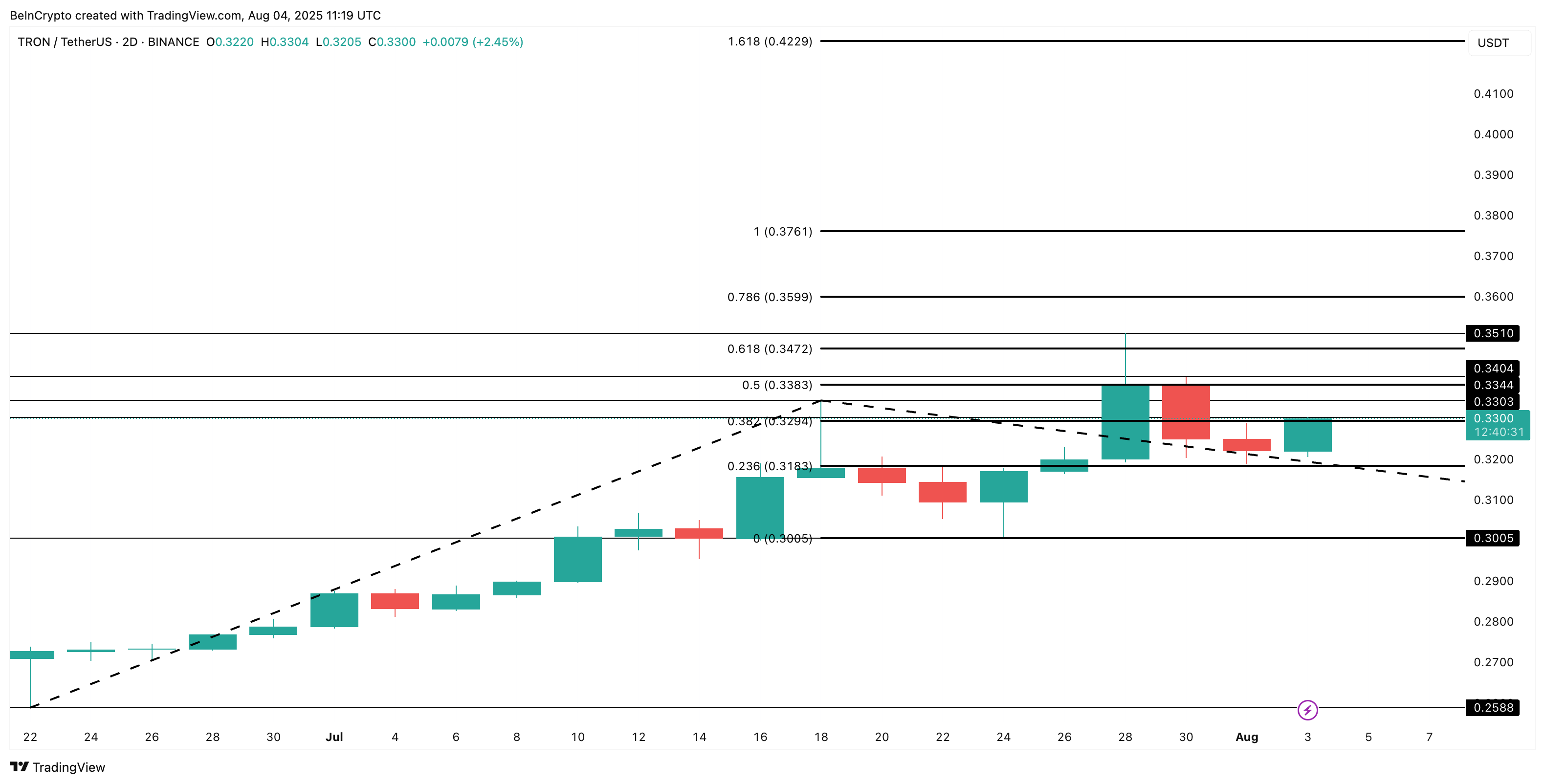

TRON is one of the few altcoins that has shown resilience amid recent market volatility. While most large-cap stocks were falling, it recorded a steady 2.4% increase last week. In a broader trend, it rose more than 17% last month. It is currently positioned 23.82% below its all-time high of $0.43 recorded eight months ago.

Strengthening TRX's upward logic is a remarkable fractal from late 2024. This is very similar to what was formed before the previous major rally. The price recorded higher highs. At the peak of the 2024 fractal, the price doubled, surpassing $0.40. Today, a similar fractal is forming again.

In the recent rise, there was a healthy correction to $0.30 after a rally from $0.25 to $0.33. Using trend-based Fibonacci expansion on the 2-day chart shows this correction is textbook, with the current structure setting $0.34 as a key resistance level.

Clearly breaking this threshold could set the stage for a rally to $0.42 (1.618 expansion), with the possibility of testing or even breaking the previous all-time high.

If Fractal is fully realized, 100% movement is possible, and TRX can be positioned near $0.70. Reinforcing this is the hidden bullish divergence on the daily chart. The price is creating higher lows, but the RSI is showing a downward trend. This is a signal supporting the continuation of the upward trend.

Lastly, the sentiment around TRON gained significant attention when Justin Sun completed commercial space flight through Blue Origin's NS-34 mission earlier this month.