US Spot Cryptocurrency ETFs Started August with Nearly $1 Billion in Outflows, Closing July's Strong Performance

According to SoSoValue data, investors withdrew $812 million from 12 US-listed Bitcoin ETFs on August 1st. This was the largest single-day withdrawal in five months and the second-worst record this year.

Cryptocurrency ETF Outflow Shock... July's Historic Rise and Regulatory Developments

Recently gaining momentum ETH ETF also experienced significant redemptions that day.

A total of $153 million flowed out of nine Ethereum products, marking the third-largest single-day outflow since its launch. This ended a 20-day inflow streak. During the inflow period, ETH ETFs attracted over $5 billion in new capital.

This reversal occurred after a successful month in July. The cryptocurrency industry recorded significant gains.

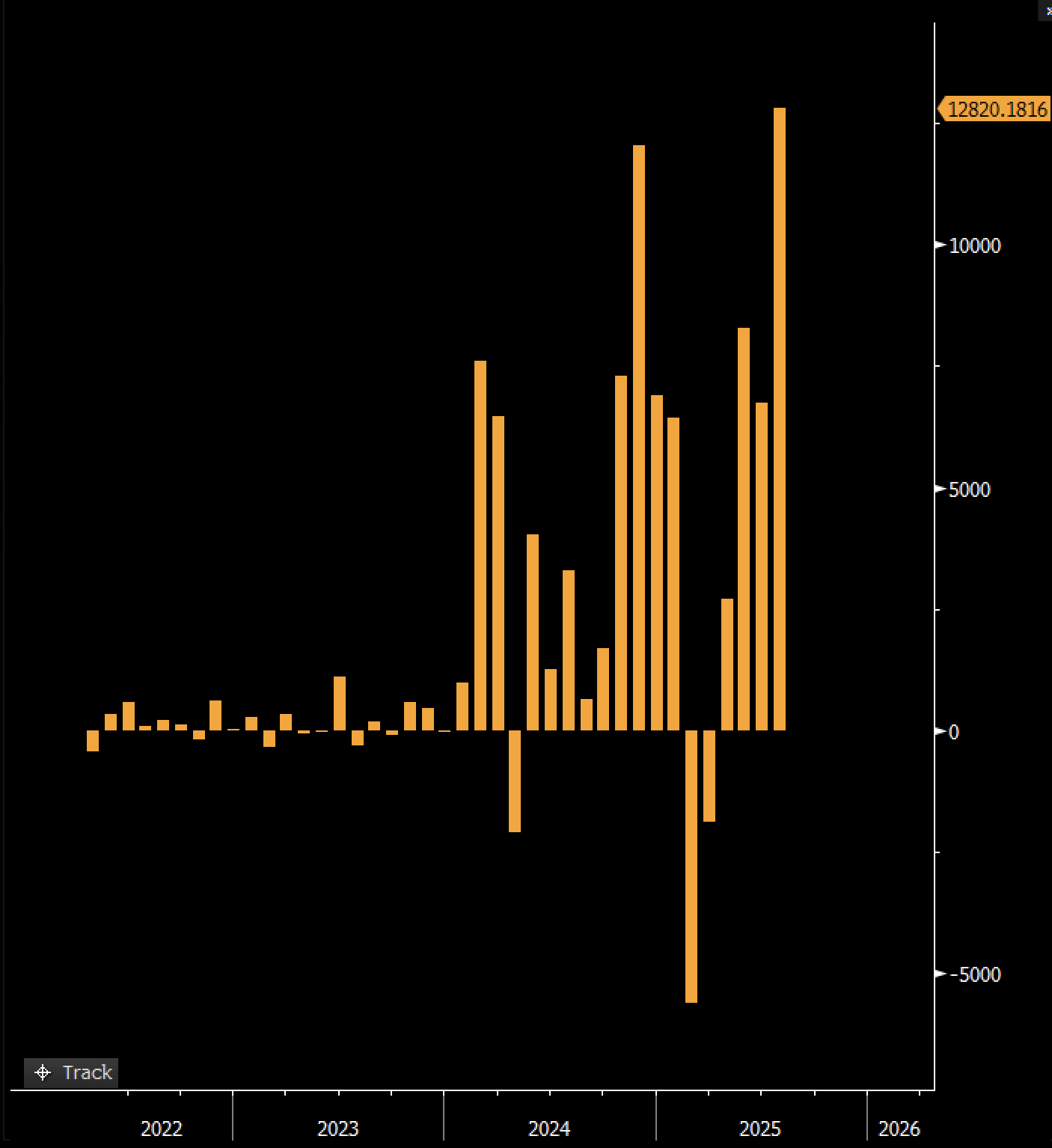

During this period, Bloomberg's senior ETF analyst Eric Balchunas emphasized that US cryptocurrency funds raised $12.8 billion in new capital, representing an average daily inflow of $600 million.

Notably, the inflows were widely distributed, with both Bitcoin and Ethereum products contributing significantly.

Balchunas mentioned that this pace exceeded the performance of top traditional ETF Vanguard S&P 500 ETF (VOO).

Therefore, the point of decline raised questions across the industry, especially as regulatory developments seemed to support continued growth in the cryptocurrency market.

In July, SEC Chairman Paul Atkins announced "Project Crypto", a new regulatory initiative. This project aims to modernize US securities laws to better fit blockchain-based financial systems.

"The SEC will not sit idly by while our capital markets stagnate as innovation develops overseas. To realize President Trump's vision of making the US the cryptocurrency capital, the SEC must comprehensively consider the potential benefits and risks of moving markets from off-chain to on-chain environments." – Paul Atkins, SEC Chairman

As part of this broad initiative, the SEC approved spot redemptions for cryptocurrency ETFs and accelerated review of exchange-sponsored product applications.

Considering these developments, Nate Geraci, chairman of NovaDius Wealth, expressed surprise at the ETF outflows.

According to him, this was in stark contrast to the momentum across the cryptocurrency market. He also described the sudden retreat as a surprisingly quiet conclusion to one of the most important weeks in the digital asset space.