Bitcoin (BTC) and Ethereum (ETH) Options Mass Expiration On August 1st, 2025, Forecasting Volatility in the Cryptocurrency Market.

Similar to monthly options expiration, weekly options expiration can influence price direction, or prices may be fixed near key strike prices as traders hedge or settle their positions.

Bitcoin, Ethereum Options Expiration Approaching... $7 Billion at Risk

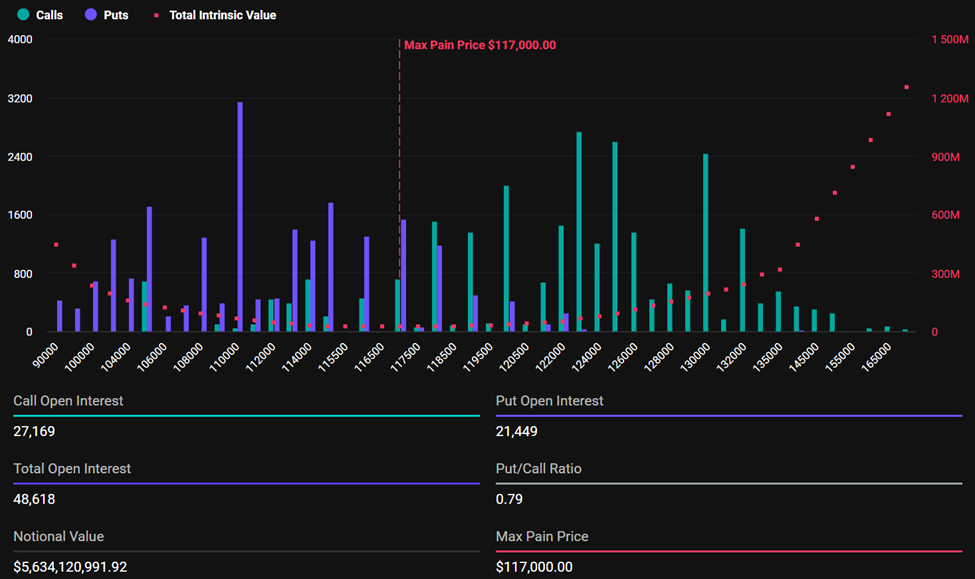

According to Deribit cryptocurrency derivatives exchange data, the maximum pain level or strike price for Bitcoin options expiring today is $117,000, which is higher than the current price of $116,003.

Meanwhile, the total open interest, which is the sum of Put and Call options, is 46,618. The nominal value of Bitcoin options expiring today is $5.6 billion.

Based on the current price, crypto options traders are holding Bitcoin options for approximately 48,568.75 BTC tokens.

With a Put-to-Call ratio (PCR) of 0.79, Deribit data shows the prevalence of call options, suggesting a generally bullish trend.

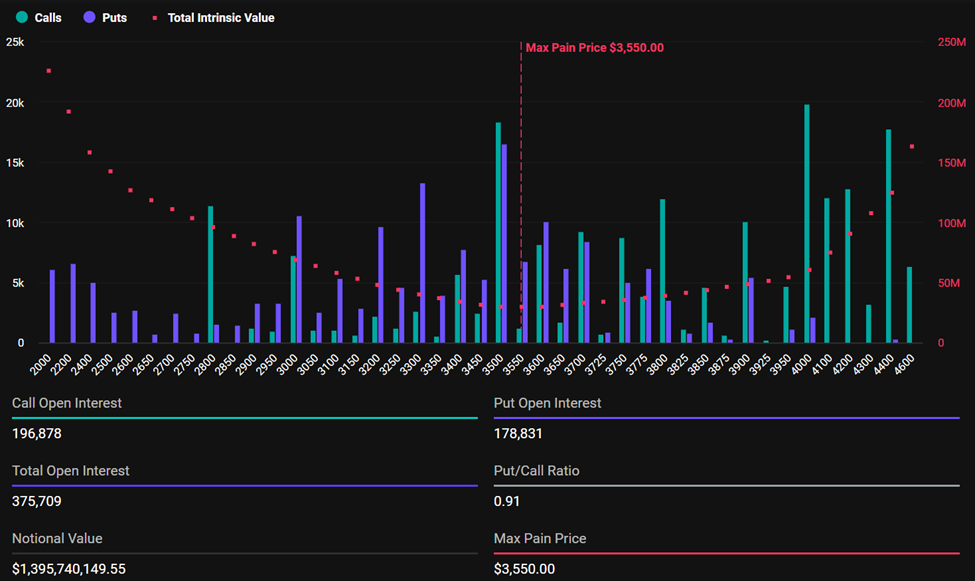

On the other hand, Ethereum's options expiration PCR is 0.91, indicating that call orders exceed put orders, suggesting a cautiously optimistic market outlook.

Most traders will experience the greatest financial pain at the $3,550 maximum pain level for Ethereum options expiring today. Unlike Bitcoin, Ethereum's price is significantly higher than the strike price.

Meanwhile, the total open interest for expiring ETH options is 375,709, indicating more capital is being invested in ETH option contracts compared to BTC options. This may also suggest that traders are showing greater interest in Ethereum's short-term volatility.

Another reason for more ETH open interest than Bitcoin is Ethereum's growing dominance in the derivatives market and its rich narrative. According to Deribit data, the nominal value of ETH options expiring today is $1.39 billion.

As options approach expiration, prices tend to be drawn to their respective maximum pain levels, suggesting a slight correction for ETH and a minor recovery for BTC. This is due to smart money's actions of selling options to retail traders.

Their actions tend to fix prices near the maximum pain level, minimizing payouts for both calls and puts.

Notably, such manipulation is not always intentional. Sometimes, simple hedging actions can cause a natural gravitational pull towards the maximum pain level.

However, when liquidity is thin and positioning is skewed, prices may appear to be manipulated towards that point.

"BTC positions are wide, but the price is just above maximum pain. ETH is also fixed just above 3.5K. Will expiration act like a magnet, or will it be a launching pad?" Deribit analysts questioned.

Corporate Purchases, Unstable Support

On the other hand, Greeks.live analysts emphasize $116,000 as a critical support level for Bitcoin, pointing out a divided market sentiment. On the upside, the pioneering cryptocurrency faces potential resistance near $118,000.

"...opinions are divided on whether the recent decline is a buying opportunity or the start of a deeper correction," Greeks.live wrote.

Particularly, Bitcoin price and the broader cryptocurrency market have retreated. This is likely due to a correction following the recent FOMC's decision to hold interest rates.

Despite market selling pressure, Michael Saylor's strategy protects the Bitcoin market from a long-term decline.

"Strategy Corp closed a $2.52 billion IPO and immediately purchased 21,021 Bitcoins at $117,256, providing significant institutional buying pressure," Greeks.live analysts added.

Meanwhile, analysts point out that a supply shock could be converted into buying pressure, potentially driving BTC price higher.

On the other hand, some view Strategy's recent purchase as temporary support located near $114,000.

"Traders note that this purchase was likely a major buying support at the 114 level, explaining why open interest remained flat during the rebound. The community emphasized that without this institutional flow, the price could have easily fallen below 115, expressing concerns that the market currently depends on corporate financial flows," Greeks.live mentioned.

As options approach expiration today, traders should prepare for volatility that could impact price action through the weekend.

However, the market may stabilize soon after options expire at 8:00 UTC on Deribit, and traders will adapt to the new market conditions.