The U.S. Bureau of Labor Statistics (BLS) has released the latest U.S. employment report, and the data paints a gloomy picture of the U.S. labor market. While this indicates broader economic weakness, it could potentially benefit the cryptocurrency sector in important ways.

Token prices slightly declined after the announcement, but market participants are carefully observing how macroeconomic conditions are changing, especially regarding interest rates and the strength of the U.S. dollar.

U.S. Employment Market Rapidly Weakening

Nonfarm payrolls increased by just 73,000 in July, falling short of expectations. Private sector employment increased slightly to 83,000, while public sector employment decreased.

These are some of the weakest figures reported since the pandemic recovery.

BREAKING: US job cut announcements jumped +140% YoY in July, to 62,075, well above the 4-year average.

— The Kobeissi Letter (@KobeissiLetter) August 1, 2025

This is more than double the average July job cut number of 23,584 between 2021 and 2024.

Year-to-date, US-based employers have announced 806,383 job cuts, the highest total… pic.twitter.com/M4x0Evqr6P

More concerning are the downward revisions for previous months. The BLS reduced job growth in May from 144,000 to just 19,000. June was also revised from 147,000 to 14,000.

In total, over 258,000 jobs were reduced compared to initial reports. Job cuts also surged, reaching 292,294, which is the highest since 2020 and the second-highest since the 2008 financial crisis.

Larger Issues Beneath the Surface

Some impact has not yet been fully reflected in the data. Over 160,000 federal employees are currently on administrative leave, affected by the recent D.O.G.E. budget cuts.

They are expected to appear in official job cut statistics after September 30, further clouding the employment situation.

These structural weaknesses suggest that the labor market is in worse condition than headline figures indicate. The market is already reflecting this in prices.

Trump Pressures Powell for Rate Cut

In response to the gloomy data, President Trump immediately criticized Federal Reserve Chair Jerome Powell and again demanded a rate cut.

Trump has long criticized the Federal Reserve for maintaining rates too high and sees the weak employment market as a lever for more aggressive monetary easing.

Too Little, Too Late. Jerome "Too Late" Powell is a disaster. DROP THE RATE! The good news is that Tariffs are bringing Billions of Dollars into the USA!

— Trump Truth Social Posts On X (@TrumpTruthOnX) August 1, 2025

The cryptocurrency market could benefit from such changes. Rate cuts generally lower the opportunity cost of capital and encourage speculative investments, boosting risky assets like cryptocurrencies.

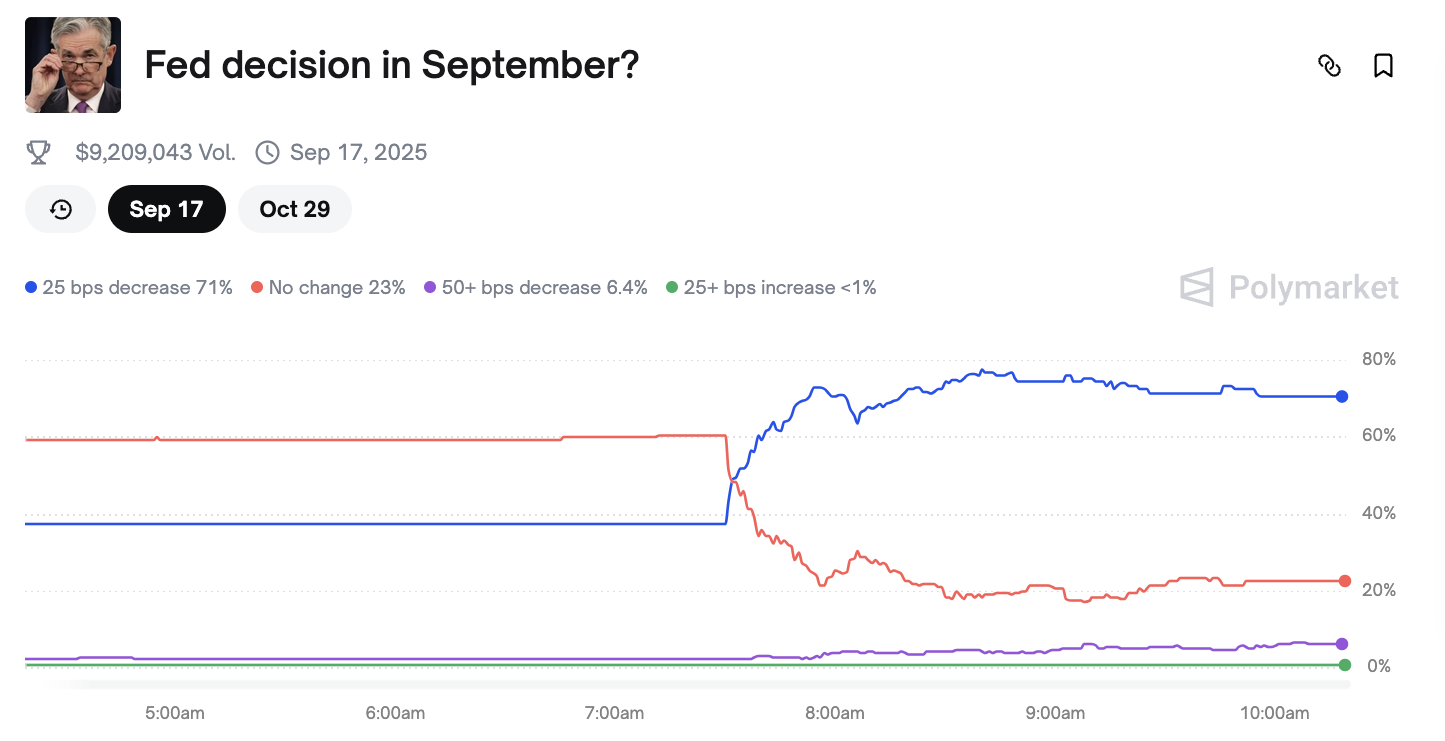

Prediction markets are already reflecting these changes. On platforms like Polymarket, the probability of a September rate cut has surged, indicating increased investor confidence in a Fed pivot.

Weak Dollar Supports Cryptocurrency Inflow

The deteriorating job market threatens the stability of the U.S. dollar, which could accelerate capital flows into cryptocurrencies.

For individual investors, a weak dollar can make Bitcoin and other tokens appear cheaper compared to local currencies, especially when most assets are priced in dollars or purchased through dollar-based stablecoins.

For institutional investors, cryptocurrencies might look more attractive as a hedge against economic slowdown or long-term monetary easing.

Short-Term Impact Limited

Despite long-term bullish signals, the immediate cryptocurrency market reaction was minimal. Most major tokens slightly declined following the employment report.

Bitcoin and Ethereum saw slight drops, reflecting uncertainty rather than panic.

This caution is likely to persist in the short term. Traders are digesting the data and waiting for clearer signals from the Federal Reserve.

Until then, cryptocurrency's upside potential is limited by short-term volatility and global macroeconomic uncertainty.

Outlook: Bad News Could Be Positive for Cryptocurrencies

The U.S. labor market is rapidly weakening. While this is bad news for the economy, it could ultimately create favorable conditions for cryptocurrencies through lower rates and a weak dollar.

However, traders should temper expectations. These tailwinds may take time. The current cryptocurrency market remains reactive, carefully watching the Federal Reserve and macroeconomic data.

If additional cracks appear in the U.S. economy, cryptocurrencies could be among the primary beneficiaries.