The altcoin market has recorded its largest monthly recovery this year. While most 'altcoin season' predictions focus on cryptocurrency indicators, the correlation with US small-cap stocks is an overlooked factor.

So what does this correlation suggest? Here are some in-depth insights.

Altcoin Season, Rising with US Small Caps

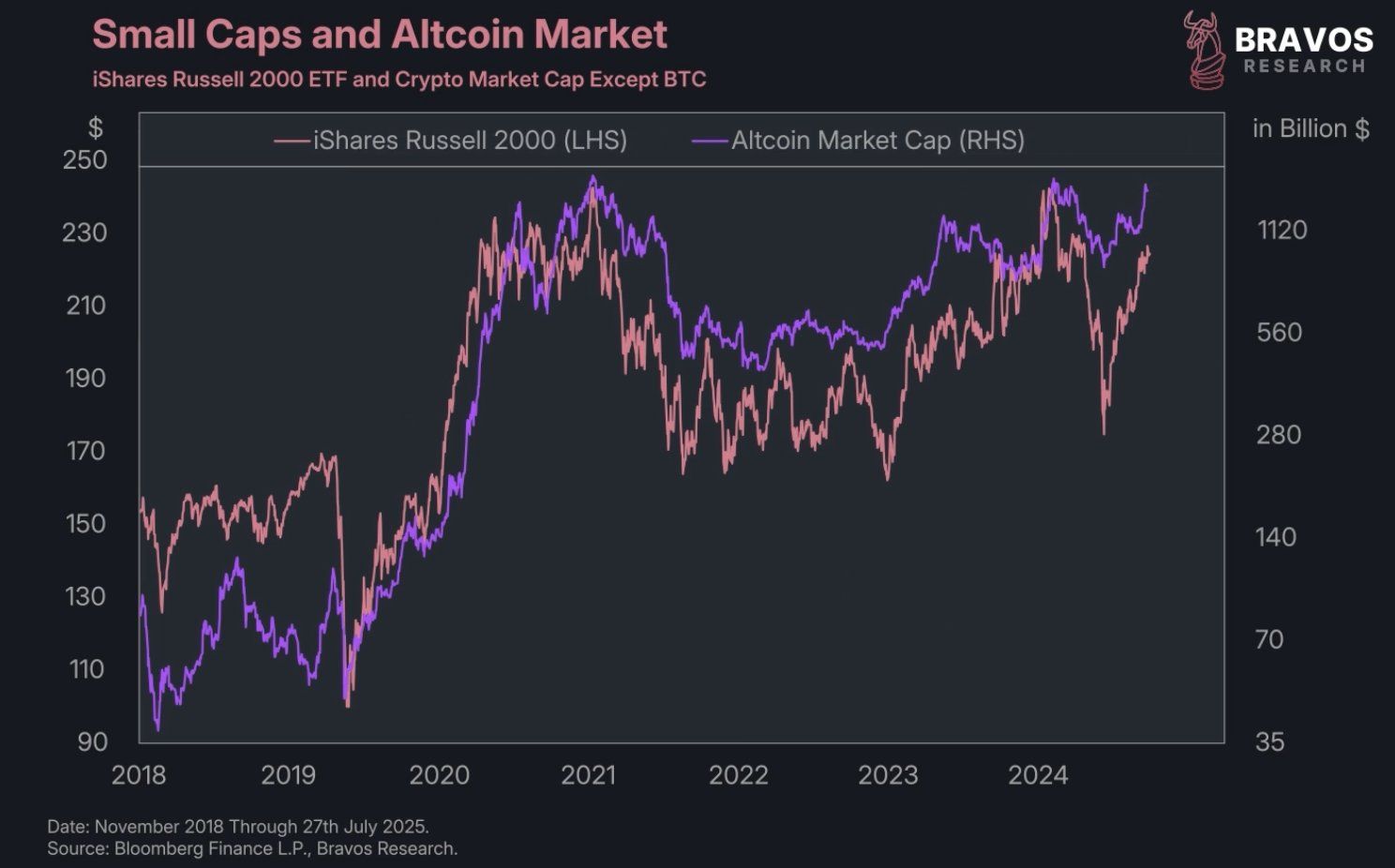

According to Bravos Research, the altcoin market shows a strong correlation with US small-cap stocks represented by the Russell 2000 index.

iShares Russell 2000 is an ETF managed by BlackRock. It is designed to track the performance of the Russell 2000 index, which represents 2000 small US companies.

According to the data, the altcoin market capitalization has closely reflected the movement of US small-cap stocks since 2019. This may be because investors view both asset classes as high-risk, high-return.

According to Bravos Research's latest video analysis, small companies and altcoins have not yet fully recovered. Meanwhile, investors are paying more attention to large companies and Bitcoin.

This trend shows that the economic recovery is not yet strong. The recovery is not strong enough to drive capital into risky assets.

"This is also reflected in the behavior of cryptocurrency investors. At moments of narrow economic recovery and stock market recovery, there is also a narrow recovery in the cryptocurrency market." – Bravos Research report.

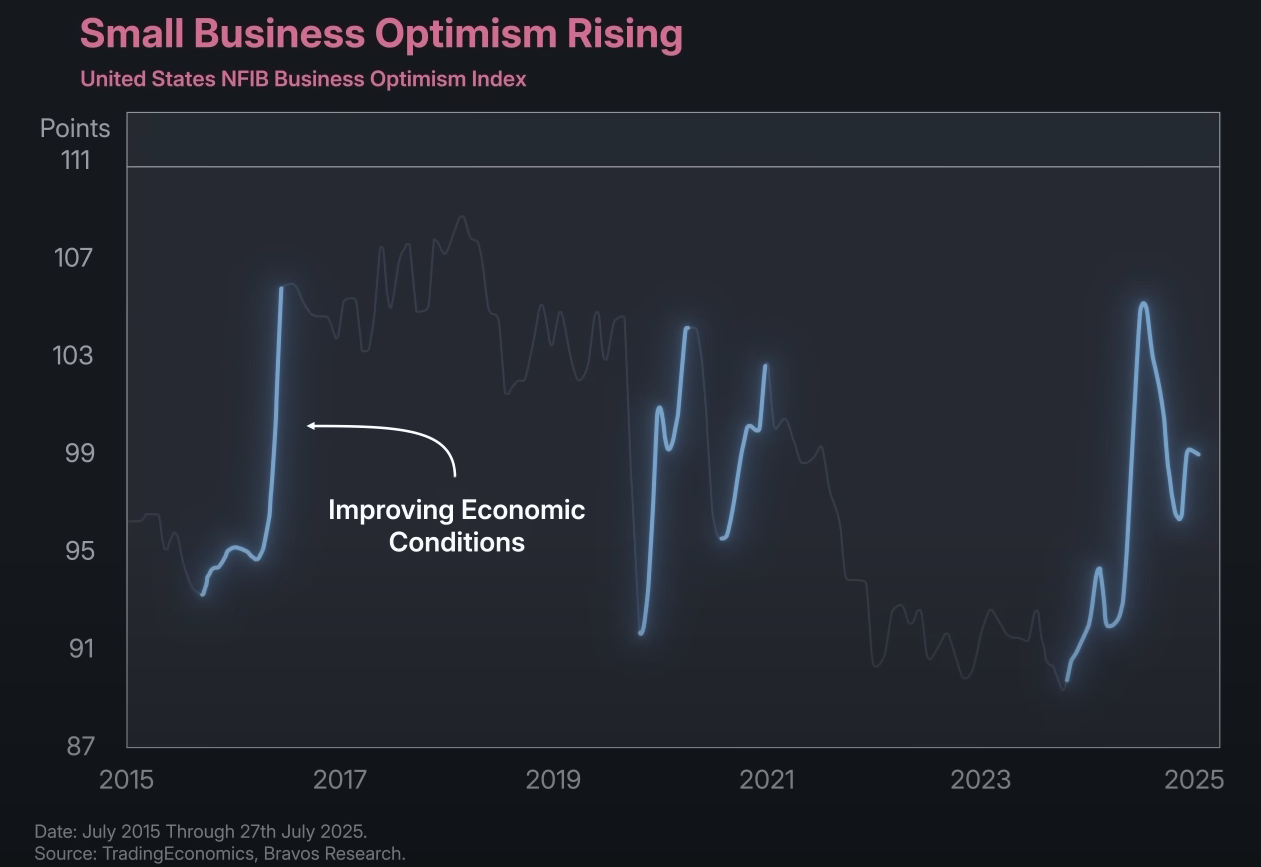

However, the analysis also points out the recent increase in small business optimism. The small business sentiment index is rising, indicating improving economic conditions similar to trends in 2016, 2020, and 2021. If this trend continues, small-cap stocks could surge.

Combined with the correlation with the cryptocurrency market, the positive sentiment of low-priced stocks could indicate that the altcoin season still has room to grow.

Altcoin Market Correction in Early August... Sentiment Remains Strong

The altcoin market turned downward in early August after July's strength. The market capitalization of TOTAL3, excluding Bitcoin and Ethereum, dropped from July's high of $1.09 trillion to about $965 billion. This is nearly a 12% decrease.

However, this decline does not seem to have shaken investor sentiment. The cryptocurrency fear and greed index remains in the "greed" zone.

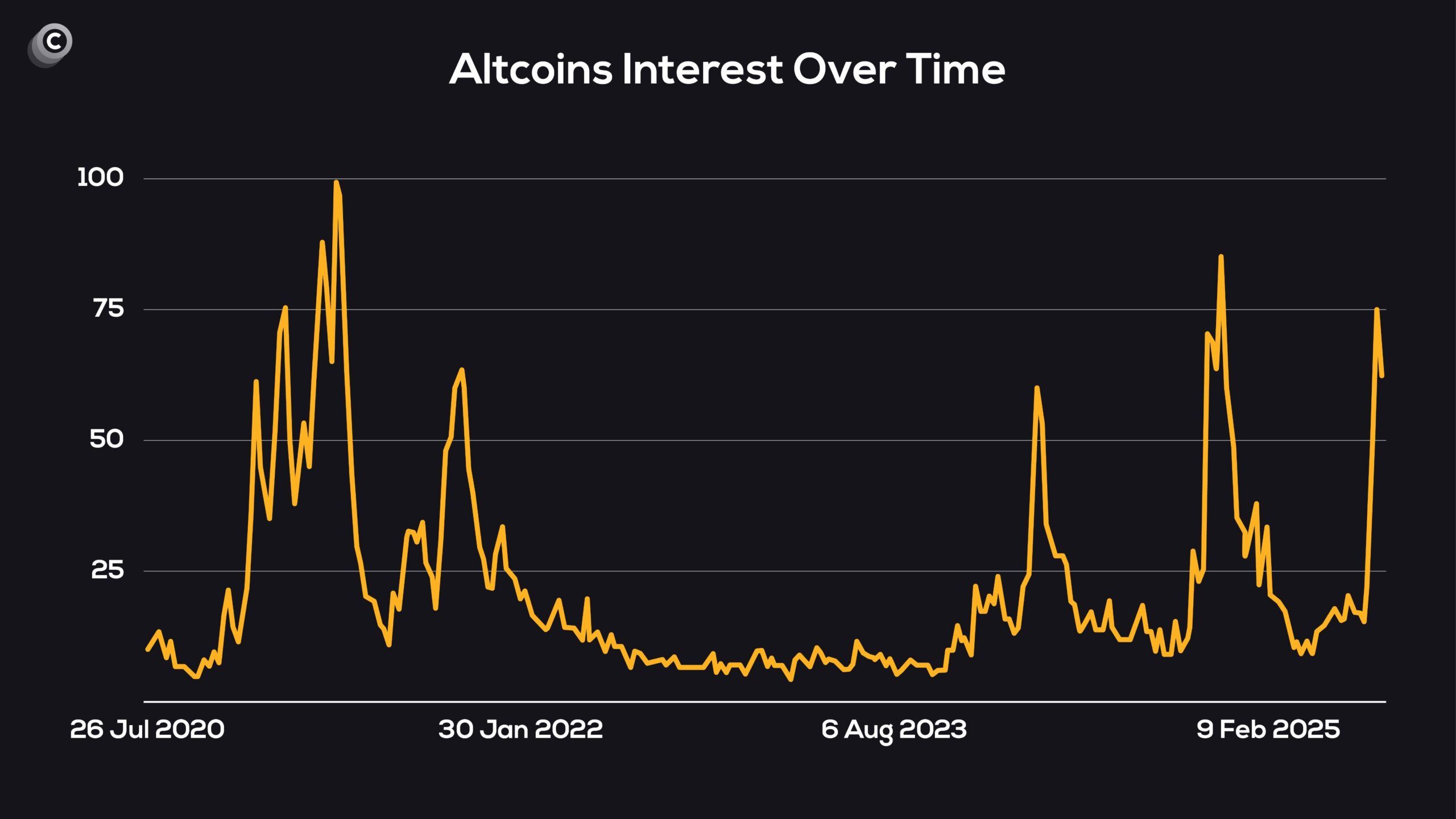

Additionally, Coinvo's altcoin interest indicator has increased sharply since the beginning of the year, reflecting new enthusiasm among retail investors.

"Retail investors have fully returned, and the altcoin season has finally arrived." – Coinvo report.

A recent report by BeInCrypto highlights the decline of Bitcoin dominance and Ethereum's performance against Bitcoin. These are all strong indicators of the ongoing altcoin season.