Bitcoin price has consolidated between $117,000 and $120,000 over the past few days. However, recent market conditions and external factors such as the Federal Open Market Committee (FOMC) meeting on Wednesday have caused a temporary breakdown of this range.

Currently, Bitcoin's price is $118,419, which has recovered after dropping to $115,700. Despite this recovery, factors such as selling pressure make Bitcoin's path still uncertain.

Bitcoin Shows Signs of Decline

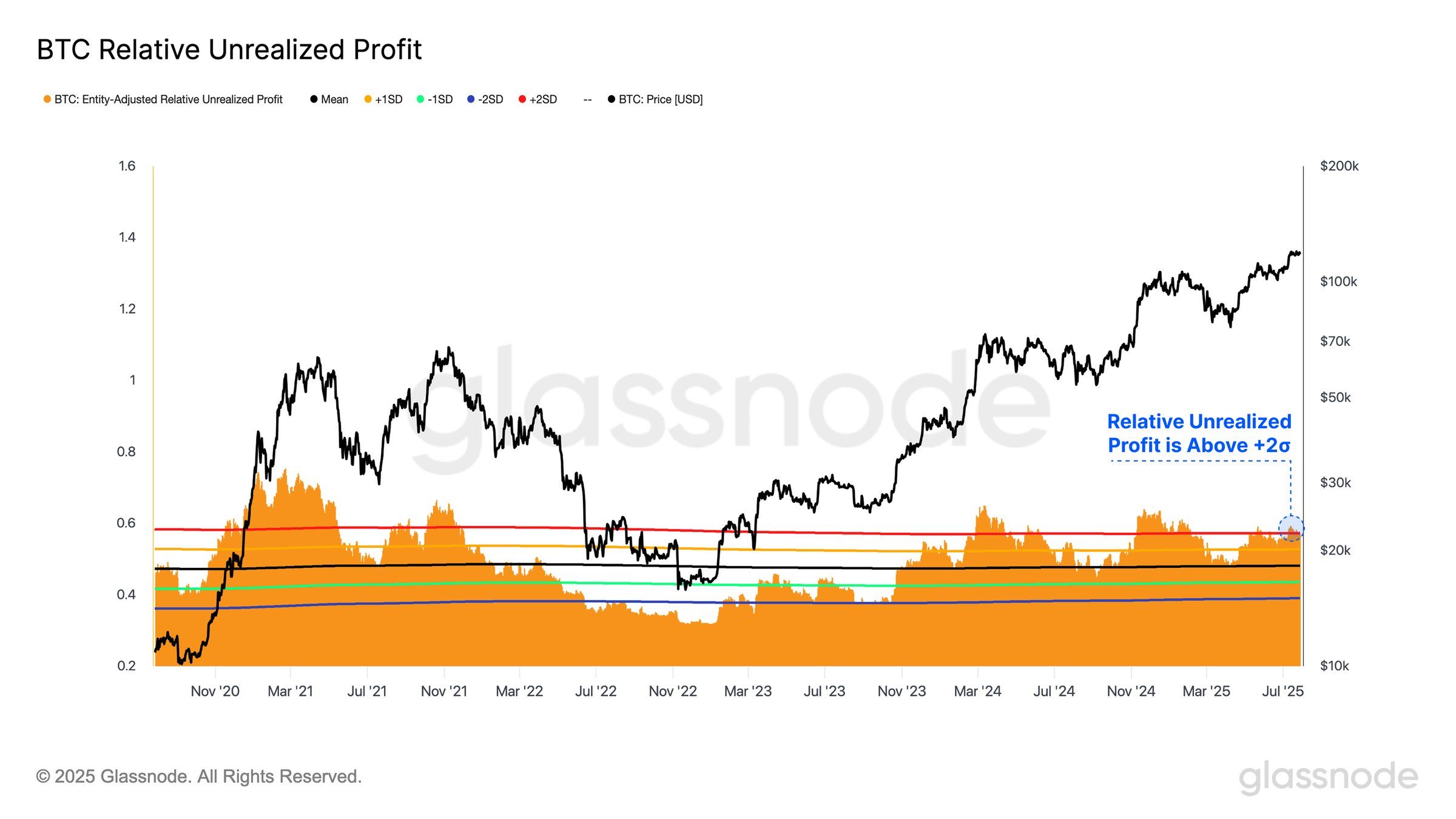

Relative Unrealized Profit (RUP) recently broke through the +2σ band. This is often associated with market overheating stages. Historically, this setting indicates being close to market peaks, suggesting potential selling pressure could drive prices down.

The current RUP status suggests a potential correction within days. This could push Bitcoin out of its consolidation range. Considering past patterns, a shift to selling could lead to additional downward pressure.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

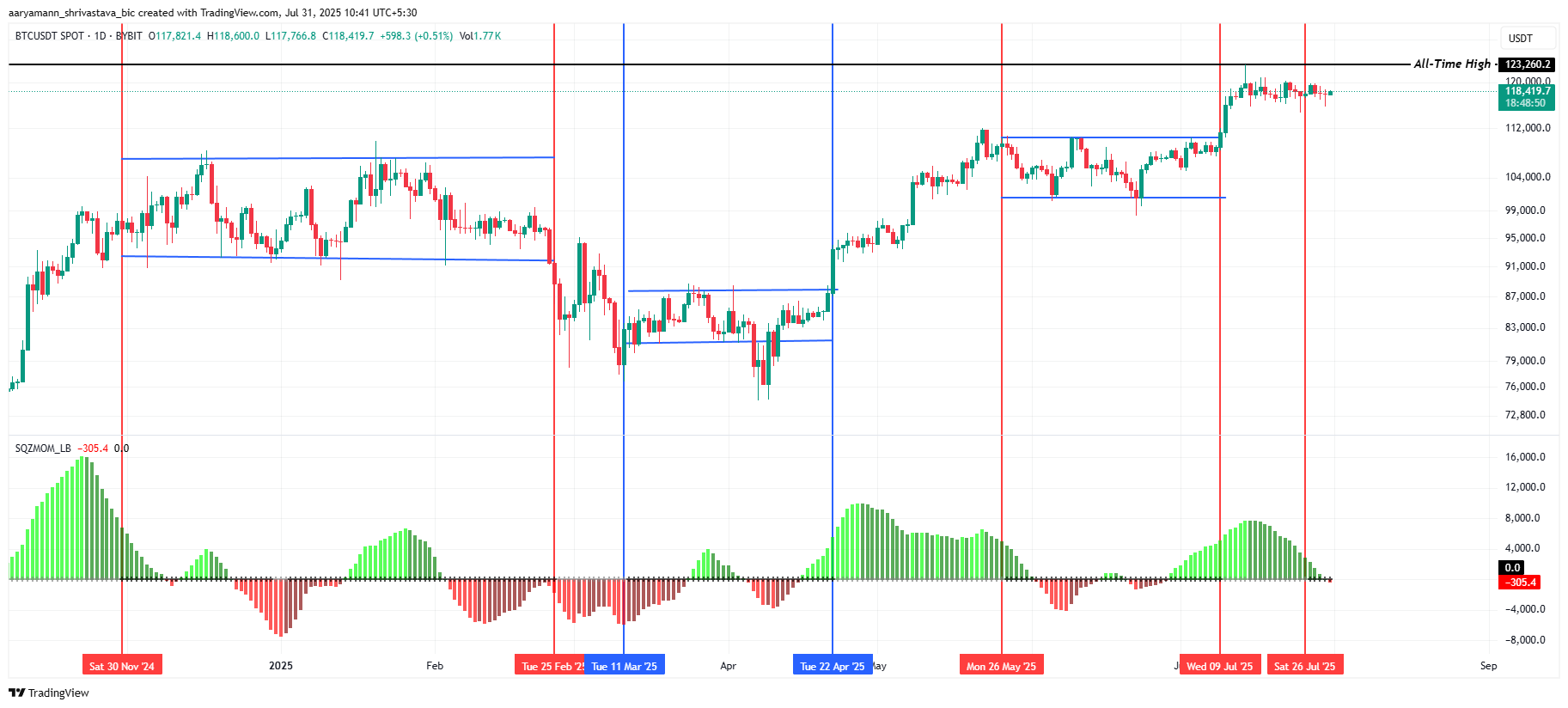

The Squeeze Momentum Indicator (SMI) suggests Bitcoin is entering a consolidation phase. Historically, such consolidation periods have preceded significant price movements when the squeeze is released.

As the squeeze continues to build, Bitcoin's price is prepared for a sharp move in one direction. If the market remains bearish, Bitcoin could experience a sharp decline, especially if the SMI confirms this negative trend.

BTC Price Needs to Rise

Bitcoin is currently trading at $118,410, having dropped to $115,700 with the release of the FOMC report on Wednesday. While BTC recovered in response to the Fed's decision to hold rates steady, fundamental market conditions still pose risks.

Bitcoin's price is vulnerable to further decline as investors begin to realize profits. This could push cryptocurrency below the support level of $117,261. Crossing this support could see Bitcoin's price drop to $115,000 or lower.

To invalidate this bearish outlook, Bitcoin needs to maintain levels above $120,000 and recover $122,000 as a support level. Crossing these levels would generate momentum to push Bitcoin to new highs. Until then, Bitcoin's price remains vulnerable to volatility and market pressure.