After Bitcoin (BTC), Ethereum (ETH) has emerged as the next preferred target for institutions. According to Jeff Kendrick, the digital asset research head at Standard Chartered, corporate treasuries have purchased 1% of all circulating ETH since early June.

This demonstrates the growing desire of companies to increase their ETH exposure. In an interview with BeInCrypto, Kendrick stated that these corporate treasuries could eventually hold 10% of all ETH.

Institutions Massively Accumulating ETH in June

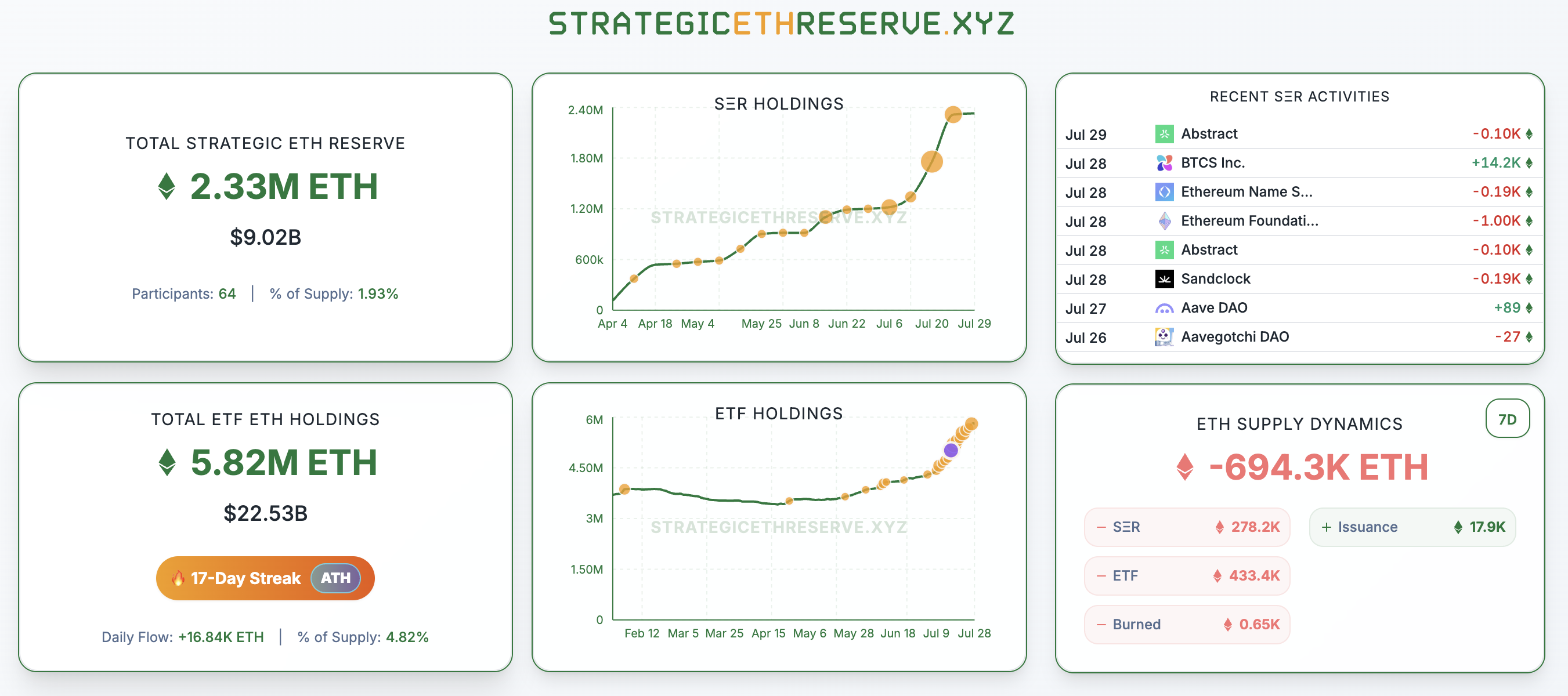

As BeInCrypto previously reported, companies are accelerating their efforts to acquire ETH as part of their financial strategy. According to the latest data, the Strategic ETH Reserve tracking institutions holding Ethereum in their treasuries currently stands at 2.33 million ETH, worth over $9 billion.

This holding is distributed across 64 institutions, representing 1.93% of Ethereum's supply. This marks a significant increase from the 789,705 ETH held in mid-May. In just two months, institutions' ETH holdings have increased by approximately 195%.

Notably, 113,000 ETH (approximately $409 million) is held by companies that first disclosed their positions this quarter.

Meanwhile, some companies are drawing attention with their large holdings. For example, Bitmain Emergence Technologies initially invested $250 million in the ETH reserve and within a month held over $2 billion in ETH.

Furthermore, the company plans to expand this stake to $4.5 billion, with a long-term goal of owning 5% of ETH supply. Similarly, SharpLink Gaming has increased its ETH holdings to $1.7 billion.

SHARPLINK GAMING NOW HAS $1.7 BILLION USD OF ETH

— Arkham (@arkham) July 28, 2025

SharpLink Gaming ETH holdings have risen to $1.67 Billion as of last night, when the team acquired an additional $295M of ETH.

Will SBET become the MSTR of ETH? pic.twitter.com/nb8gshxcfX

Jeff Kendrick from Standard Chartered emphasized that listed companies with digital assets have acquired 1% of ETH circulation in just two months. Notably, this acquisition rate is twice the speed of corporate treasuries' Bitcoin purchases.

"These purchases were as strong as the strongest ETH ETF purchases on record. We expect ETH treasury companies to eventually own 10% of all ETH, which is a 10-fold increase from current levels," Kendrick told BeInCrypto.

He stressed that in terms of flow, ETH treasury companies are becoming more significant than their BTC counterparts.

"ETH treasury companies are more rational than their non-crypto equivalents due to staking yields, DeFi leverage. And from a regulatory arbitrage perspective, they are more rational than BTC equivalents," he said.

Why Are Companies Increasing Ethereum Holdings?

Management explained that companies' Ethereum investments are attractive primarily due to the inefficiencies in the financial system driven by regulatory barriers.

Additionally, ETH treasuries can benefit from staking rewards and leverage opportunities in DeFi, which are currently impossible through the US Ethereum ETF.

Kendrick also mentioned that this momentum has contributed to ETH's recent price increase. According to BeInCrypto market data, the price has risen by 56.9% over the past month, reaching levels close to its peak from a few months ago.

"ETH has significantly outperformed BTC since ETH treasury companies emerged in early June, with the ETH-BTC cross rising from a low of 0.018 in April to 0.032 currently. The purchases by these companies and the record-best ETH ETF period have contributed to this rise. If the flow continues, ETH could break through the major level of $4,000 (current prediction for the end of 2025)," Kendrick told BeInCrypto.

Therefore, the increasing attractiveness of Ethereum among corporate treasuries emphasizes its long-term growth potential. We will now have to wait and see how the asset actually performs.