BitMine Immersion Technologies proposed an implicit value of $60,000 for Ethereum (ETH) in their latest announcement, citing consultations with unnamed research institutions.

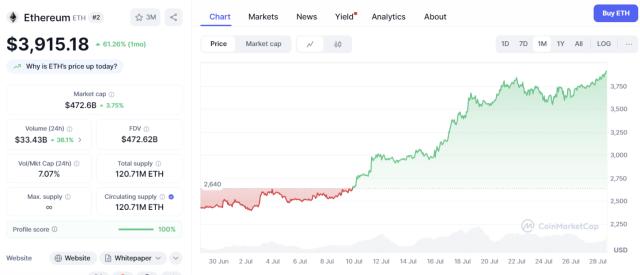

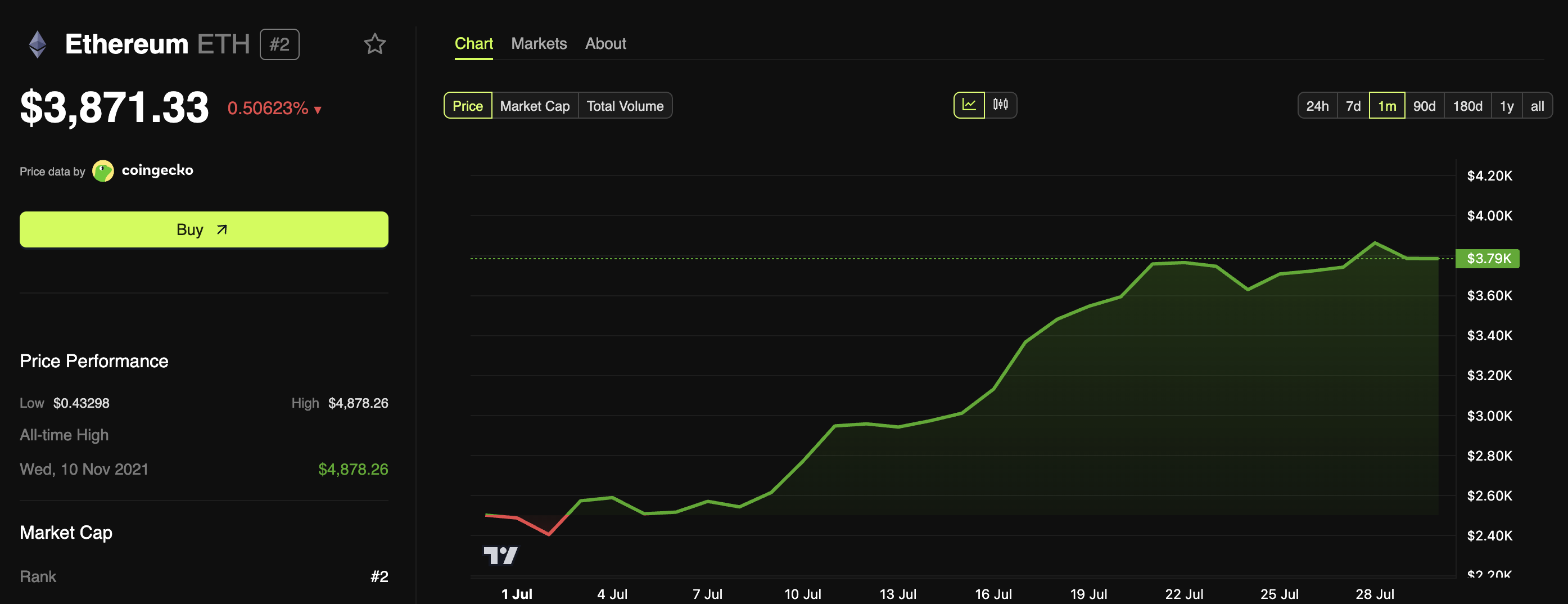

This evaluation came amid a notable bullish rally for ETH. The price surged 57% last month, surpassing Bitcoin's (BTC) 10% monthly increase.

BitMine Evaluates Ethereum's Fair Value at $60,000

On Monday, BitMine, the largest public ETH holder, initiated the 'Chairman's Message'. This monthly video series features the BitMine chairman explaining the company's strategic vision for cryptocurrency investments.

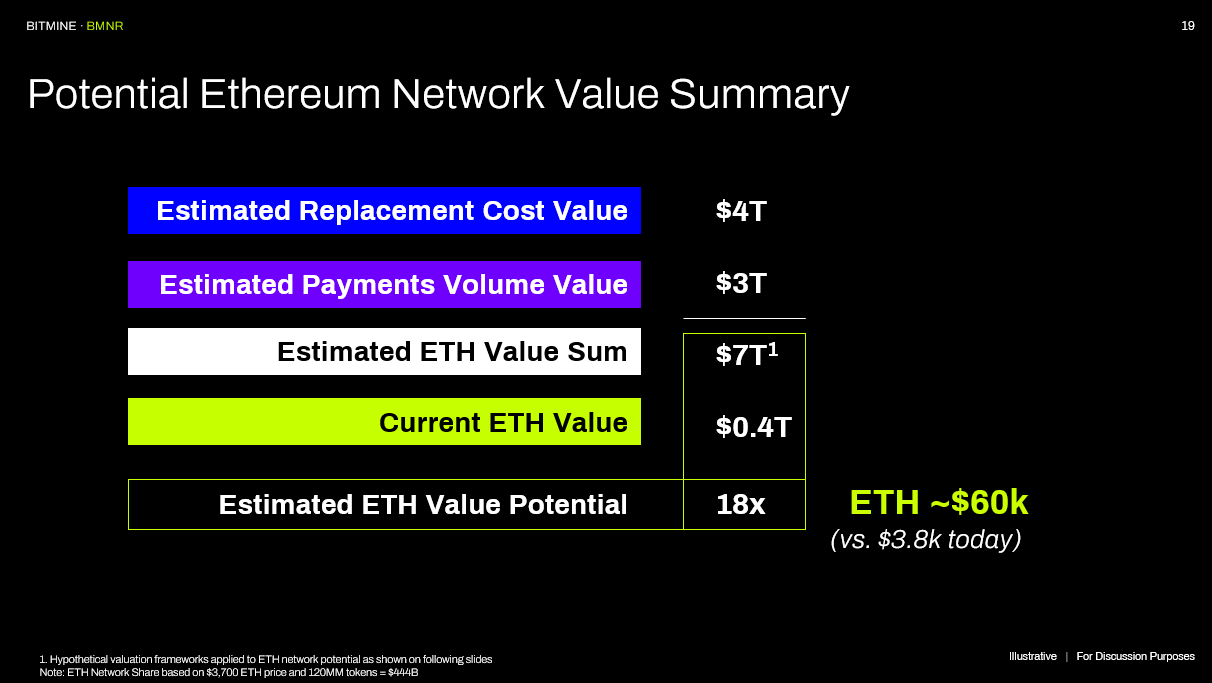

On X (formerly Twitter), alongside the announcement was a slide titled 'Potential Ethereum Network Value Summary', which highlighted Ethereum's potential implicit value.

"We requested several research institutions to assess ETH's 'replacement' value. The implicit value of ETH is $60,000. Currently, ETH is around $3,800," the post read.

The $60,000 valuation suggests an 18-fold increase from ETH's current market value. However, the company's post presented this as an explanatory prediction.

While hypothetical, the prediction still emphasizes ETH's substantial potential. This confidence aligns with the recent impressive rise of the second-largest cryptocurrency.

According to BeInCrypto data, ETH broke through $3,900 yesterday for the first time since December 2024, further fueling its continuous recovery. At the time of reporting, Ethereum was trading at $3,871, down 0.50% in the past 24 hours.

Ethereum Price Prediction... Analyst Expectations

Meanwhile, many market analysts are increasingly predicting higher valuations for Ethereum's price. In a recent X post, Bitcoinsensus suggested that Ethereum is preparing for a significant upward movement similar to what Bitcoin experienced in 2020.

The analyst observed that Ethereum could break through a multi-year trend line, potentially leading to a price increase.

"ETH is showing relative strength for a breakout after years of pressure below this trend line. With sufficient momentum, the breakout could lead to a much higher Ethereum price in the next stage of this cycle," the post read.

Furthermore, Ethereum supporter Ted Pillows mentioned that altcoins are currently undervalued. He argued that Ethereum's value should already be over $8,000 based on M2 money supply growth.

"This shows how undervalued ETH currently is, and perhaps one of the best trades from here," Pillows said.

Meanwhile, analyst Mark emphasized that more investors are accumulating Ethereum, often considered a signal of increasing confidence in the asset's future price potential.

"Ethereum's accumulation rate is rising again. After hitting a low in April 2025, the rate has started to increase, indicating a potential increase in demand for ETH," he mentioned.

This paints a bullish outlook for ETH. Additionally, several factors are working in Ethereum's favor, suggesting these predictions might not be overly exaggerated.

BeInCrypto reported that institutional interest in altcoins continues to grow, with many companies investing millions of dollars in Ethereum as part of their financial strategy.

"Ethereum moves slowly and then all at once. When institutions rotate, it won't be subtle," a market observer noted.

I'm excited about the upcoming weeks.

— Ted (@TedPillows) July 28, 2025

Things are looking very bullish right now.

Bitcoin's dominance is dropping below 60%, which shows money is flowing into other coins.$ETH is going to break $4,000, boosted by strong demand from institutional investors.

Altcoins are in a… pic.twitter.com/ROF8x91jbL

With Bitcoin's dominance decreasing, many experts predict Ethereum could be a major beneficiary. Lastly, Ethereum's upcoming 10th anniversary is generating high interest, drawing investors' attention to the token.