Ethereum (ETH) investment products emerged as the market leader last week, attracting approximately 1.37 trillion won (1.15 billion dollars) in funds. This represents the second-highest weekly inflow for digital asset investment products, accounting for most of the total cryptocurrency market inflow of 1.66 trillion won (about 1.19 billion dollars). Coinciding with Bitcoin (BTC) fund outflows, speculation about an 'altcoin season' is resurfacing.

According to the latest report by CoinShares, Ethereum investment products have seen cumulative inflows of 10.87 trillion won (about 7.79 billion dollars) this year, already exceeding the total inflows for 2023. In contrast, Bitcoin recorded outflows of about 243.2 billion won (175 million dollars) during the same period, suggesting investors' interest is gradually shifting to other assets.

In this context, some major altcoins are showing positive trends. Solana (SOL) attracted about 432.6 billion won (310 million dollars) last week, while XRP drew around 262.7 billion won (189 million dollars). Sui (SUI) brought in 11.1 billion won (8 million dollars), and ADA and Chainlink each received about 1.8 billion won (1.3 million dollars) and 700 million won (500,000 dollars), respectively. However, Litecoin (LTC) and Bitcoin Cash (BCH) experienced outflows of about 1.7 billion won (1.2 million dollars) and 900 million won (660,000 dollars), showing a notable temperature difference.

CoinShares analyzed that these inflows are more a result of supply and demand centered on specific assets due to expectations of spot ETF approval in the US, rather than a broader altcoin rally. The current situation, with investor interest focused on specific assets, is closer to a limited upward trend rather than a traditional 'altcoin season'.

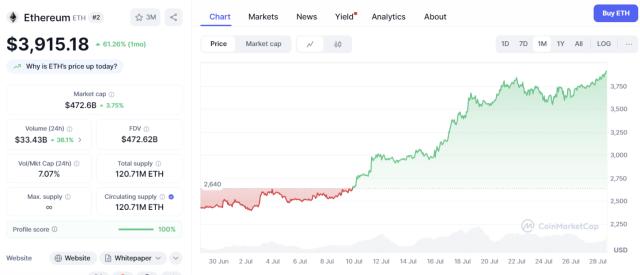

Ethereum is on the verge of breaking through $4,000 (about 5.56 million won), recording spot ETF inflows ahead of Bitcoin for seven consecutive days. QCP Capital explained that since Ethereum's market capitalization is only 20% of Bitcoin's, its price can rebound significantly with smaller amounts. In contrast, they assessed that Bitcoin continues to serve as the market's cornerstone, with its price remaining largely unaffected despite 80,000 units being sold.

Meanwhile, some boundary signals are detected in the derivatives market. QCP Capital noted that perpetual futures open interest reached an annual high, and funding rates at major exchanges exceeded 15%, raising overheating concerns. Some large investors have begun taking profits, with Ethereum and Bitcoin forming psychological resistance levels at $4,000 and $120,000 (about 166.8 million won), respectively. Nevertheless, due to clear buying momentum and a strong narrative structure, the strategy of buying on dips remains valid.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>