Ethereum, XRP, Shiba Inu, Technical Rebound Signals… Expectations of Breaking Through $4,000↑

This article is machine translated

Show original

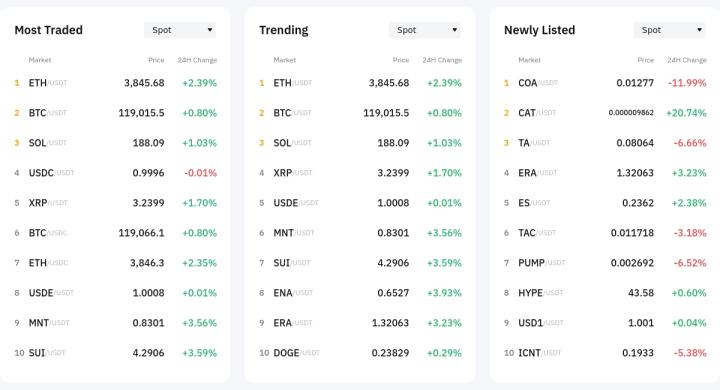

Recently, as signals of a bullish trend have been detected in the cryptocurrency market, the movements of major assets such as XRP, Shiba Inu (SHIB), and Ethereum (ETH) have been drawing attention. From a technical analysis perspective, XRP has solidified its support line by withstanding downward pressure, while SHIB is showing signs of a rebound near its major exit resistance line. Ethereum is forming strong buying momentum at the upper end of a short-term box range, with expectations of breaking through $4,000.

First, XRP found stability in the range of $3.10-$3.20 after experiencing a correction from its recent high of $3.60. The price is currently above the 20-day moving average and is supported above the 50-day and 100-day EMAs. Notably, the Relative Strength Index (RSI) is at 61, indicating room before entering the overbought territory and suggesting potential for further increases. While volume reduction is a common pattern after correction, the lack of noticeable selling pressure in this case increases the likelihood of resuming the upward trend.

Next is Shiba Inu (SHIB). After a recent sharp decline that broke through the resistance near $0.0000145, SHIB successfully rebounded near the 100-day EMA and has now secured a support line between $0.0000134-$0.0000136. The RSI is at 53.63, remaining in a neutral zone with low oversold pressure, and the trading volume has slightly increased, interpreted as a signal of buying sentiment returning. If SHIB breaks through $0.0000145 again, it may potentially challenge the previous high of $0.0000160.

Ethereum's (ETH) bullish trend is particularly notable. After a short-term surge, it has maintained its entire price increase around the $3,800 level, which is contrary to the typical pattern of subsequent correction. Currently, all major moving averages are maintaining an upward trend, with the 200-day EMA playing a particularly strong support role. The RSI is at 79.46, which is relatively high, but no clear reversal signal has been detected. This strong momentum demonstrates continued market confidence and accumulation of ETH. Despite low weekend trading volume, the ability to form highs without correction lends credibility to analyses suggesting an imminent breakthrough of $4,000.

A common trend across these three assets is the formation of a bullish range with support confirmation and stable trading volume after correction. While market-wide caution and potential volatility due to external factors remain, core technical indicators suggest the possibility of a short-term upward trend continuing. Particularly, XRP's solid maintenance of the $3.00 support line creates an unfavorable terrain for bears. SHIB and ETH are also showing meaningful responses at key support and resistance levels, with attempts to break through to the next stage becoming a reality.

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content