Spot Market Trading Volume Analysis: Ethereum and SUI Strong, CAT Rises 20%

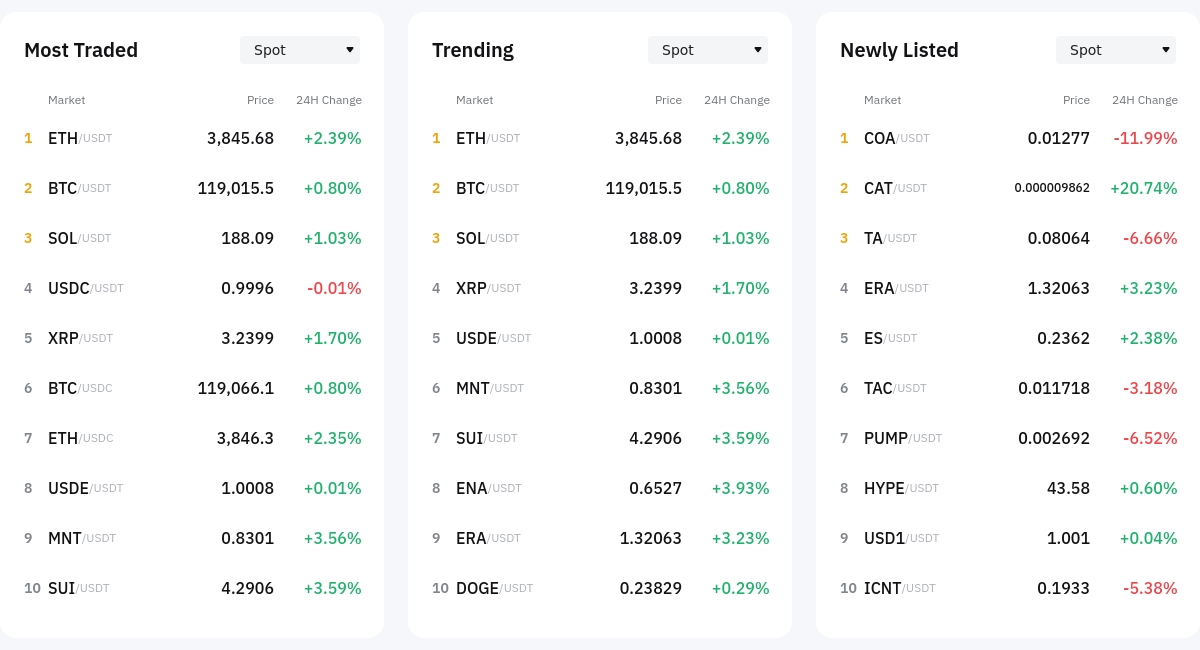

According to Bybit, Ethereum (ETH/USDT) was the most actively traded asset in the spot market. Ethereum rose 2.39% in 24 hours, reaching $3,845.68, showing clear buying momentum. Bitcoin (BTC/USDT) also recovered, rising 0.80% to around $119,000 and demonstrating stable support. Additionally, Solana (SOL/USDT) increased by 1.03% to $188.09, and XRP rose 1.70% to $3.2399, showing relatively strong performance among major altcoins.

Among altcoins, SUI (SUI/USDT) stood out with a 3.59% increase, reaching $4.2906. MNT (MNT/USDT) also rose 3.56% to $0.8301. The newly listed meme coin CAT (CAT/USDT) surged 20.74%, indicating short-term speculative capital inflow. In contrast, another new listing COA (COA/USDT) dropped 11.99%, and TA (TA/USDT) and PUMP (PUMP/USDT) fell over 6%, suggesting some early investors incurred losses.

Overall, major coins showed a stable upward trend, and the market structure featured a mix of themes with short-term capital flows into some altcoins and new listings.

Price Trend Distribution Analysis: 336 out of 529 Assets Rising, Dispersed Upward Energy

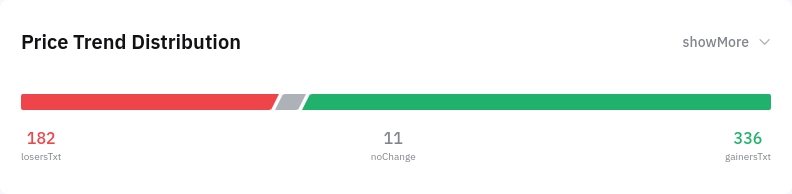

Out of 529 total transactions, 336 assets entered the profit zone, representing approximately 63.5%, indicating a positive investment sentiment in the short term. Declining assets numbered 182, accounting for 34.4%, while 11 assets showed no price movement.

In the profit zone, most assets showed relatively limited gains of 3-5%, suggesting widely dispersed price elasticity. While some assets saw significant increases, the market did not demonstrate strong overall momentum. However, the number of assets falling more than 10% was minimal, indicating limited overall risk.

This distribution suggests that while the market is experiencing short-term rises based on individual asset issues and sector-specific capital inflows, overall buying momentum has not fully recovered. The structure continues to show stable movement centered on major coins, with short-term capital seeking high returns activating certain altcoin segments.

Trending Sector Analysis: Fan Tokens Lead with 6.17% Rise, Exchanges and DeFi Also Strong

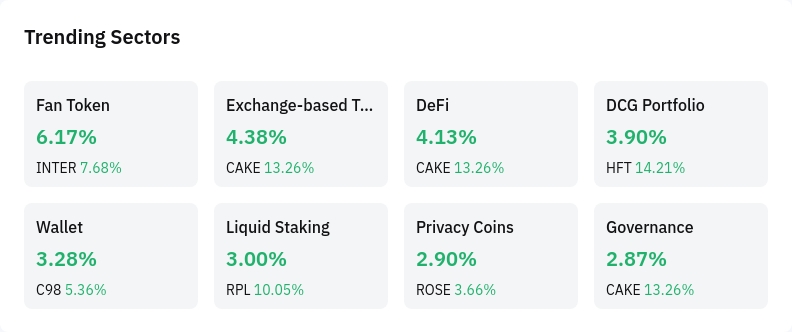

The most prominent sector in the spot market was Fan Tokens, with an average sector rise of 6.17%. The representative Inter Milan Fan Token (INTER) rose 7.68%, reflecting expectations of platform user inflow based on fan engagement. The recent interest in sports-based digital assets seems positively influenced by the European football transfer market post-season.

Exchange-based Tokens followed, rising an average of 4.38%. PancakeSwap (CAKE), representing DeFi and governance sectors, showed a strong 13.26% increase. This is interpreted as a result of recent platform fee revenue increases and DAO restructuring. The DeFi sector also rose an average of 4.13%, with active capital inflow into mid-to-small market cap projects.

The DCG portfolio sector rose 3.90%, with HashFlow Token (HFT) surging 14.21% and attracting investor attention. In the Wallet sector, Coin98 (C98) rose 5.36%, while Liquid Staking, centered on Rocket Pool (RPL), increased 10.05%, attempting a rebound after last week's adjustment. Privacy Coins and Governance sectors also showed favorable average returns around 2.8%, indicating some mitigation of market risk aversion.

Overall, this market highlighted fan-based assets and infrastructure-focused projects, showing a buying trend based on diverse themes rather than concentration in specific sectors. This suggests market participants are gradually diversifying portfolios, capturing signs of structural recovery beyond short-term issues.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction Prohibited>