In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

BTC OG 80k overhang a catalyst to ~110k Put hedging.

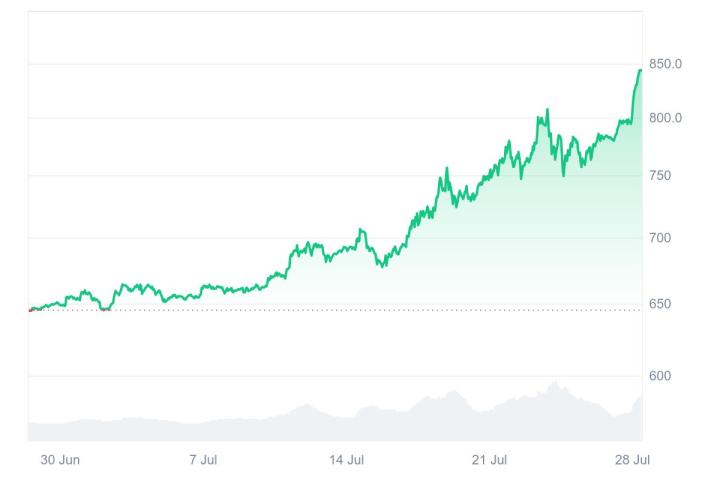

On Glxy execution some fever as 115k breached.

But another entity doubled-up with an extra $25m Dec 140-200k Call spread.

On ETH the large Sep Call fly was TPd for 50% profit.

Aug+Sep Call spreads added.

An outsized 5k purchase of Aug8 110k Puts was a temporary hedge vs a larger strategy.

But others also piled into the surrounding strikes: Aug1 117k Put, Aug1 110 Put, Aug1 110-100 Put spread, Aug29 110-130 RR, all bought to protect/play downside on the OG 80k being sold off.

Put skew naturally firmed on the back of the initial demand, but as the end of the OG sale neared, aside from a little speculative panic, some Puts were Tpd (Aug8 105k), and opportunities presented on the upside.

Skew relaxed, and a small nudge up in IV was also retraced.

One large entity with a mid-term outlook didn’t care, doubling up a position taken in the Dec 140-200k Call spreads on the 18th July with another 3.5k ($25m premium spent, net $49m) on the 21st, with strong upside belief, now supported by the market resilience to absorb 80k.

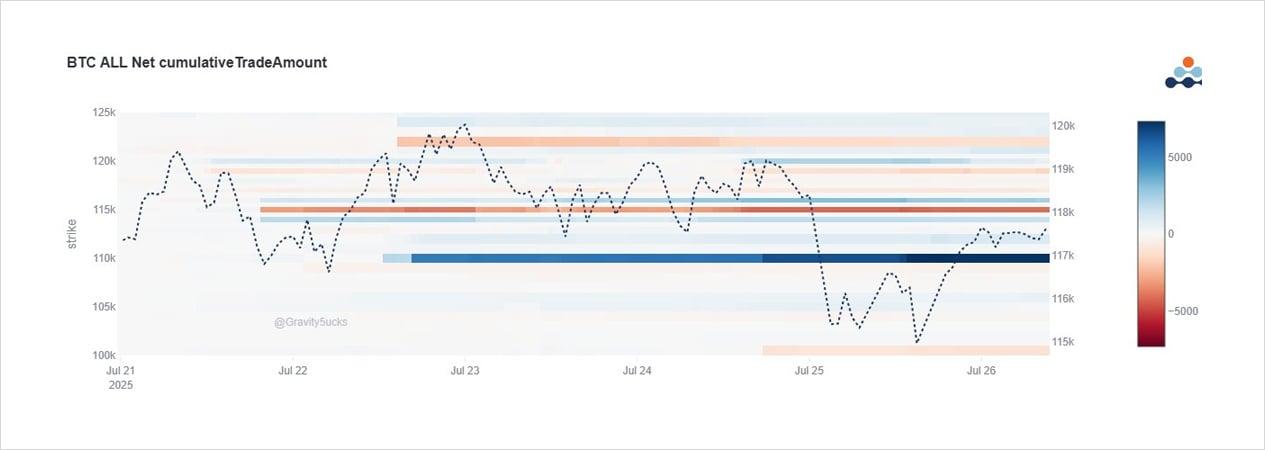

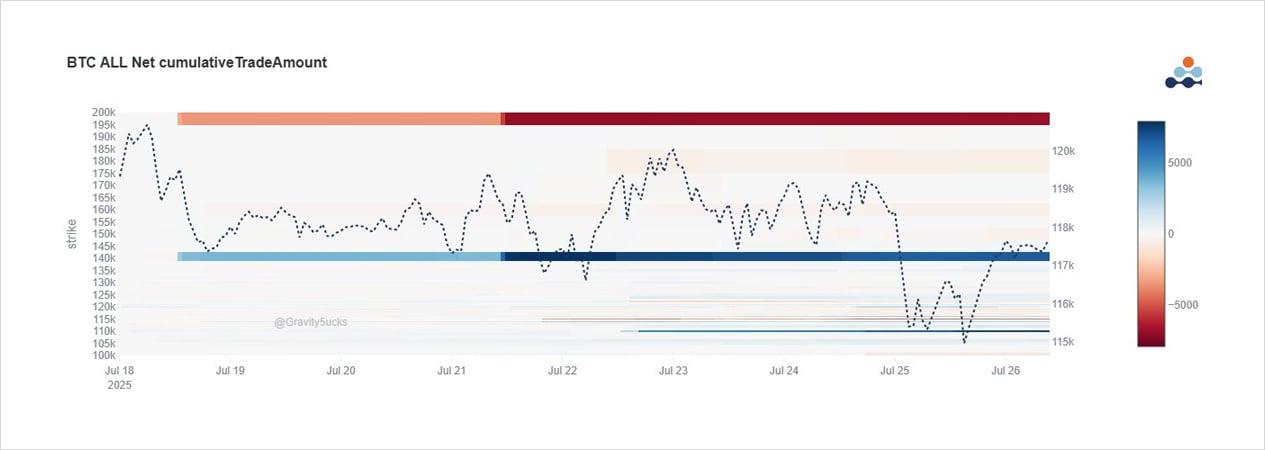

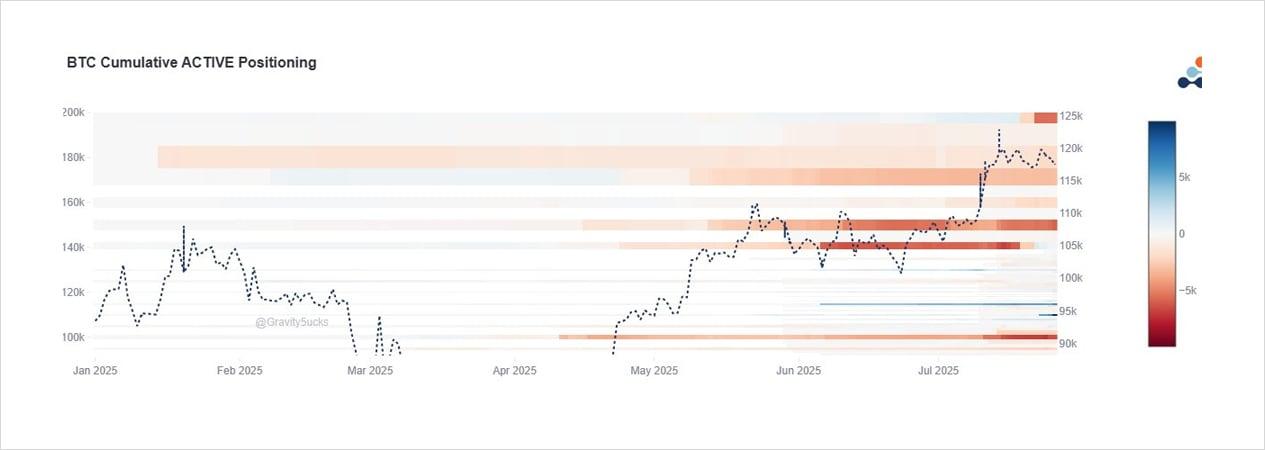

Interestingly, looking at the cumulative net active positioning since the start of the year, there are alot of shorts on the upside from previous heavy over-writing.

The 140k strike has now flipped into positive OI.

Whether the purchase is outright or a short hedge unclear.

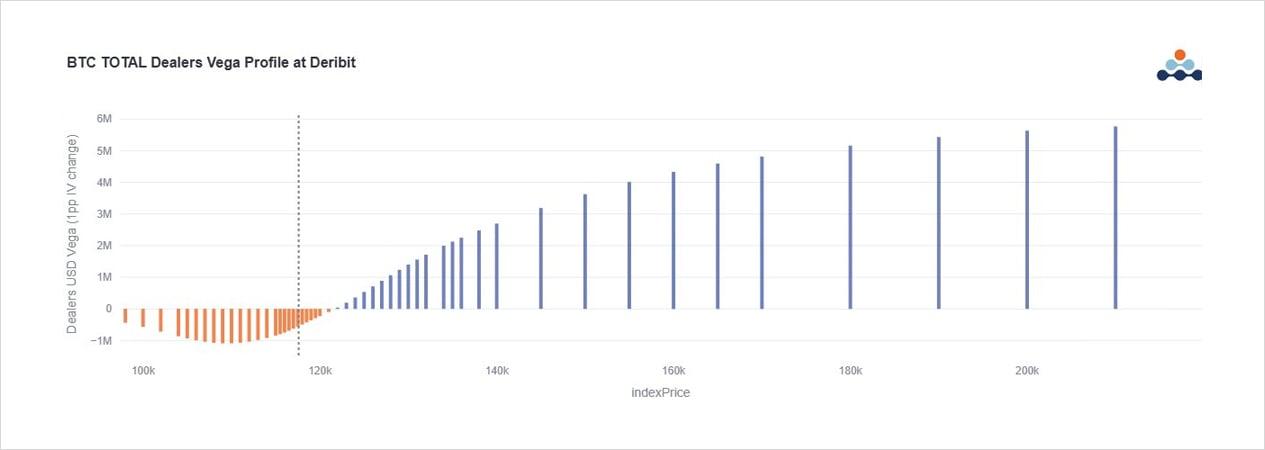

While some of the shorts may be fairly insignificant shorter dated Calls that have an arguably negligible chance of ITM success, it is clear from the below net-dealer positioning chart that a material amount are from Sep+Dec Vega expiries.

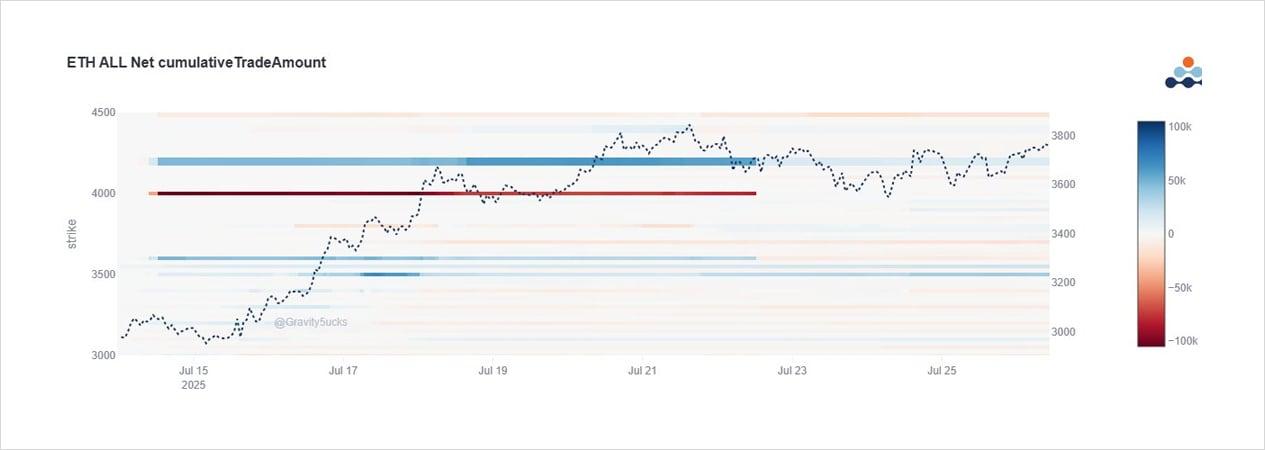

A large ETH 3.6-4-4.2k Call fly purchased two weeks ago for $2.6m, when ETH spot was trading 3050, was TPd v 3700 for a ~50% net profit of $1.4m with 20% of the position still being run for a move higher to 4k.

Focusing in and putting the 3.6-4-4.2 fly to one side, one can pick up $6m being spent on Aug 3.8-4.4 and Sep 3.5-4.5k Call spreads with ETH spot around current levels (3750). The Treasury upside play is still in place, and ETF+Corp flows support this in real time.

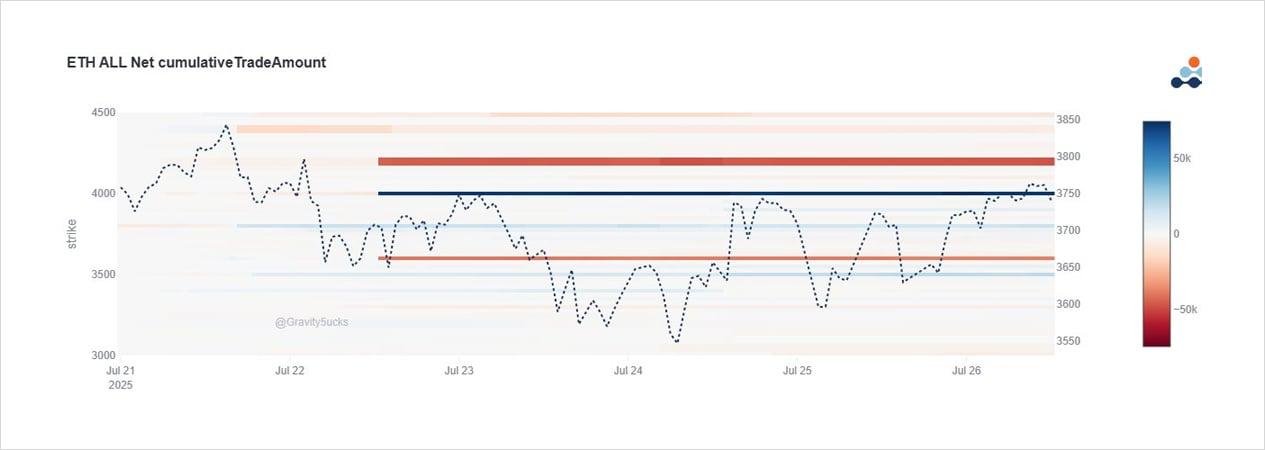

Despite the narrative, initiators took advantage of higher Spot ETH and higher IV to sell Calls, as can be seen from the below chart re Call Skew.

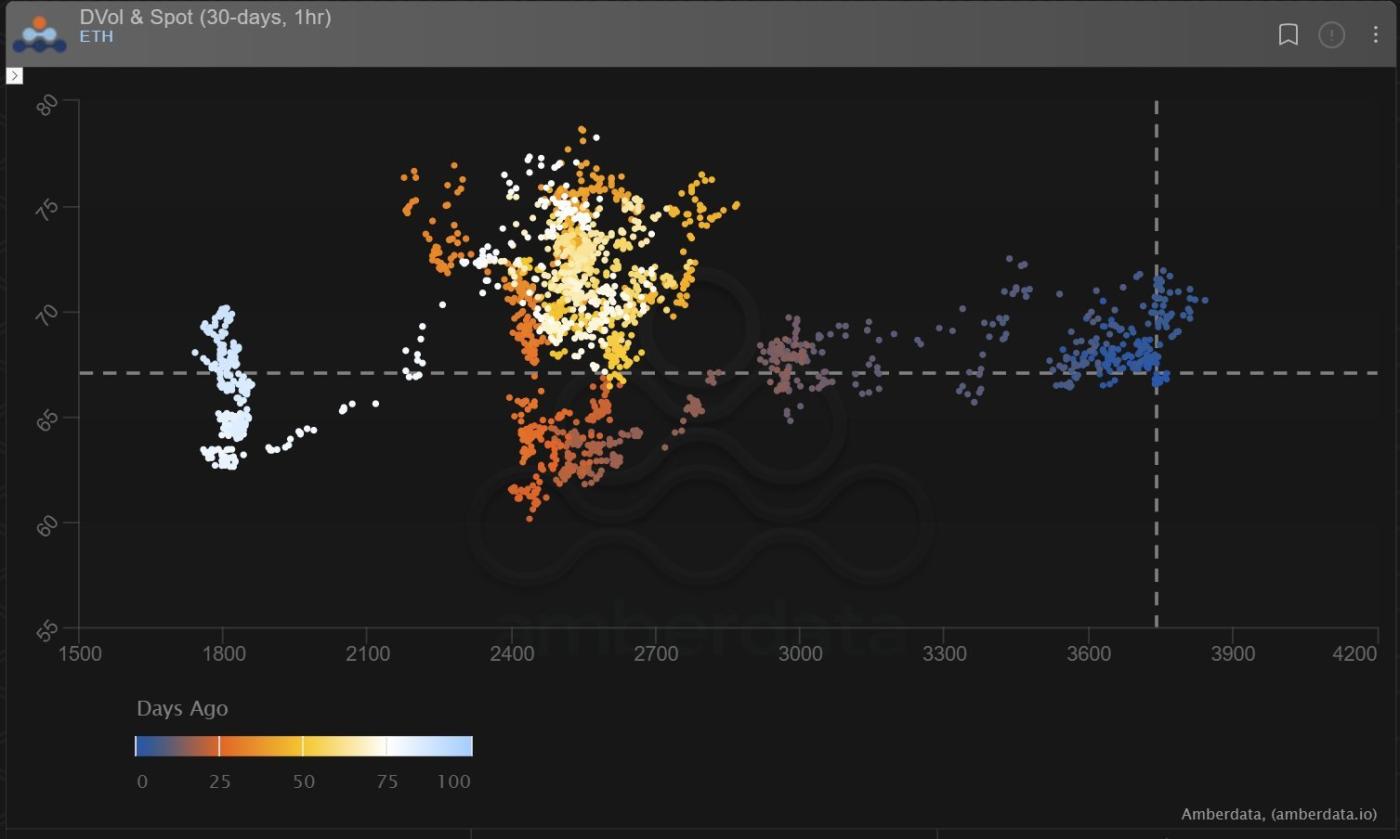

Front IV softened into the weekend, and Dvol is back down to 67%, a 28% premium to BTC.

Upside narrative is well pronounced, and while Call spreads are signalling a continuation, there isn’t quite the aggressive outright purchasing of Calls at these levels for the moment. IV remains firm, but falling short of matching the robust narrative in this summer period.

View X thread.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)

ex-MS Head of Trading desk /BTC Vol. Prop trading /Option Market forensics/ Alter Ego account Digital Asset arena. Tweets are my opinion, not financial advice.

RECENT ARTICLES

Option Flow: Tale of Two Flows

Tony Stewart2025-07-27T11:24:45+00:00July 27, 2025|Option Flows|

Option Flow: Gamma Load Builds

Tony Stewart2025-06-30T07:09:38+00:00June 30, 2025|Option Flows|

Option Flow: $1.2B BTC Roll

Tony Stewart2025-06-07T08:53:18+00:00June 7, 2025|Option Flows|

The post Option Flow: Tale of Two Flows appeared first on Deribit Insights.