Editor's Note: The highly anticipated PUMP token from Pump.fun platform, after listing on July 15th, briefly rose to around $0.007 before entering a one-sided downward trend. The public sale price of $0.004 failed to effectively halt the decline, and PUMP even dropped below $0.003 today, severely damaging investor confidence. Although the PUMP public sale explicitly prohibited US users, it did not prevent US meme players from experiencing losses in meme token trading. The renowned law firm Burwick Law, which has initiated multiple meme coin investment lawsuits, announced yesterday an expansion of the lawsuit against the Pump platform, adding the Solana Foundation, Solana Labs, and Jito to the defendant list. Additionally, the "average age" of the Pump.fun team has become a hot topic in the crypto community. According to a previous New York Times report, Pump.fun is headquartered in London, UK, led by three entrepreneurs in their early 20s: Noah Tweedale, Alon Cohen, and Dylan Kerler. The three have registered a legal entity - Baton Corporation, with Noah Tweedale serving as CEO, and all three are company directors. They met at Oxford University in the UK and have years of experience trading meme coins like Dogecoin. This is from a WIRED article in April this year, which might help readers understand the Pump.fun platform and the people behind it.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]"Developers are aggressively selling the fantasy of high returns," said Nicolai Søndergaard, a research analyst at blockchain analytics company Nansen, "This is precisely the source of FOMO psychology."

The ICO frenzy led many gullible investors to chase profits with almost no due diligence, a phenomenon identical to today's investment in suspicious meme coins. "The meme craze has many similarities to ICOs," Søndergaard pointed out, "It's very easy to sell a story to the masses and then quickly harvest."

EthereumCash's Boom and Collapse

A developer using the alias Dylan Kerler began promoting his most popular token—EthereumCash—in early October 2017.

The developer followed the standard script: minting tokens on Ethereum, building a website, and launching promotions on Bitcointalk, Twitter, and Telegram. To generate hype, they distributed tokens through so-called "airdrops" and promised to release a whitepaper. At the time, a whitepaper was seen as a symbol of legitimacy that could potentially drive price increases.

Søndergaard noted: "The release of a whitepaper can greatly enhance attractiveness. Even just promising to release one is enough to spark market sentiment."

Screenshots of the deleted project website circulating on Telegram revealed how they marketed to potential investors. The page claimed: "We are committed to making the transition from fiat to cryptocurrency as smooth as possible while maintaining an upright and high-end atmosphere." Below the text was an image of an EthereumCash bank card allegedly usable for physical consumption.

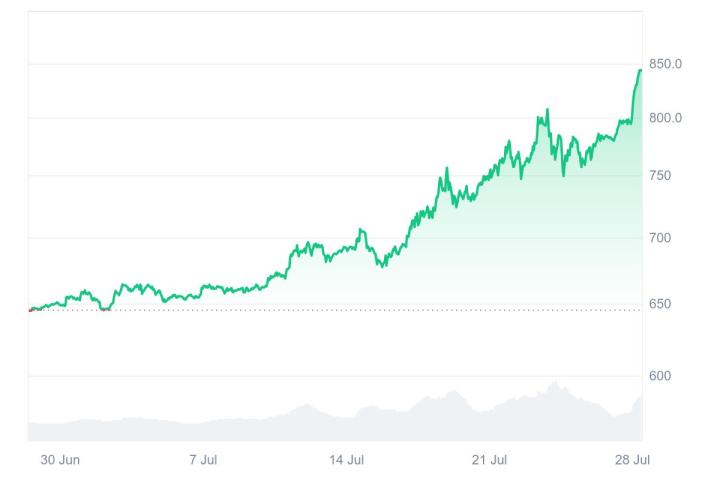

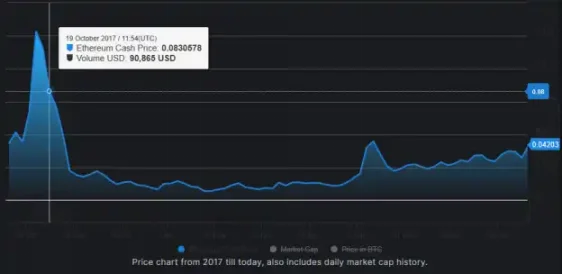

A form obtained by WIRED showed that hundreds of people registered for EthereumCash's airdrop within just a few days. Meanwhile, discussions were heated on the Bitcointalk forum. One user wrote: "Let's spread the word and get more people to notice this excellent token." By October 19, EthereumCash's market value had risen to approximately $1.3 million.

But just as early investors were full of expectations, the developer named Dylan Kerler began secretly selling off tokens.

CertiK's analysis showed that Dylan Kerler distributed millions of EthereumCash to wallets under his control within days of token creation. One wallet starting with 0x7f3E2 was subsequently used to sell tokens in large quantities on the market.

Between October 19 and 21, the 0x7f3E2 wallet sold hundreds of batches of EthereumCash on the peer-to-peer trading platform EtherDelta. These sales coincided with a catastrophic price drop of 87.9%.

Panic began to spread on Telegram and Bitcointalk. One user, perhaps trying to find some humor, started calling the token "ECRASH". Others accused the developer of being fully responsible. Another Telegram user who participated in the EthereumCash airdrop told WIRED: "Everyone was very angry." "I think this is my first experience with a Rug Pull."

The much-anticipated whitepaper never appeared, and ultimately, the developer named Dylan Kerler disappeared from Bitcointalk posts and Telegram groups. Just days earlier, he had written: "I can assure everyone that the project is making significant progress."

In three transactions on October 20 and 21, the developer's wallet withdrew a total of 240 ETH from EtherDelta—worth about $75,000 at the time. After each withdrawal, these ETH were immediately transferred to another wallet address (0xc8ae1), then further dispersed into three wallets: 0x7EAbb, 0x31728, and 0x952F3. Eventually, these ETH were transferred to centralized exchange accounts like Binance, Bity, and the now-closed Cryptopia—platforms typically used to convert cryptocurrency to fiat.

WIRED identified at least 20 wallets used by the self-proclaimed developer Dylan Kerler for issuing, airdropping, or selling eBitcoinCash and EthereumCash, or transferring related proceeds to centralized exchanges.

"The effect of this layered processing is to obscure the flow of funds," Søndergaard said, "If you have nothing to hide, there's actually no need to do this. This itself is very suspicious."

Although some investors still harbored fantasies about its return—on October 24, someone joked "I smell the whitepaper"—all signs had long indicated the final outcome.

In an early October Bitcointalk post, a developer wrote: "This will be like a Pump and Dump, a round of pumping and selling, with early investors able to recoup their costs." "Sorry to be so direct, but that's the fact."

Forgetting is Faster Than Getting Rich

To this day, Pump.fun's surge shows no signs of stopping. According to third-party statistics, the platform's daily revenue reaches $1 million. The founders' wealth has skyrocketed, far surpassing the EBitcoinCash and EthereumCash of years past. While this "wealth machine" continues to operate, Rug Pulls contrary to the original intent continue to play out, with almost no one paying attention.

In November last year, a teenager started a livestream on Pump.fun, creating and selling a token in just a few minutes, netting $30,000. Shouting "Holy fuck! Holy fuck!" while giving a middle finger to the camera—perhaps this moment is the true footnote of this era.