Spot Market Most Traded Tokens Analysis: ENA·PUMP Surge Over 20%... Altcoin Expansion Trend Clearly Visible

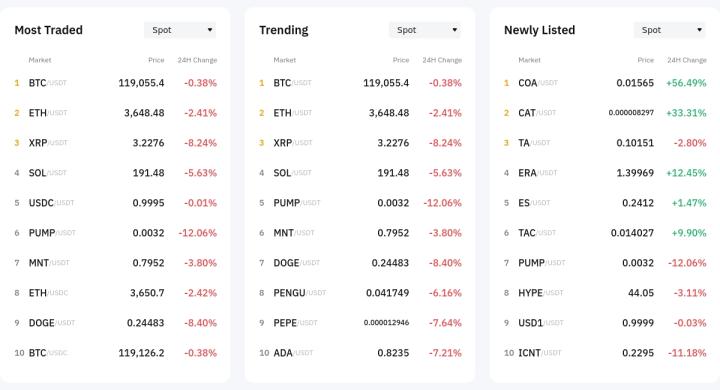

According to Bybit, in the Spot market, ENA/USDT recorded the highest surge, rising 21.39% in 24 hours. ENA showed a rapid short-term surge, forming at $0.5886, with trading volume significantly increasing compared to the previous day. Another token that surged during the same period was PUMP/USDT, rising 10.20% to $0.002752. Both tokens belong to the altcoin group, suggesting that funds are spreading to mid-to-small cap tokens while Bitcoin and Ethereum remain relatively stable.

Among top trading tokens, Ethereum (ETH/USDT) rose 0.64% to $3,705.19, and Solana (SOL/USDT) increased 1.06% to $184.8, with major platform coins maintaining a positive trend. Among major coins, Doge (DOGE/USDT) showed a solid performance, rising 1.69%, while SUI/USDT surged 6.81% to $3.9484, continuing the strength of technology-based utility tokens.

In contrast, XRP/USDT declined 0.95% to $3.1158, recording the largest drop among top tokens. Some newly listed tokens like TA/USDT and ERA/USDT dropped by -14.41% and -15.87% respectively, reflecting potential profit-taking.

Price Trend Distribution Analysis: Over Half of Tokens Showing Gains... Indicating Concentrated Energy in Strong Market

Based on overall transactions, the proportion of rising tokens was significantly dominant. Among the analyzed tokens, 70% were distributed in the positive return range, with many concentrated in the 10% intermediate gain range. Notably, tokens like ENA, PUMP, and SUI showed significant cases of over 20% gains.

Conversely, declining tokens were limited to around 25%, with most experiencing restricted drops of -5% or less. While some newly listed tokens saw adjustments over -10%, the overall decline intensity was not significant. The remaining tokens showed minimal price changes.

This distribution suggests that market energy is concentrating on tokens with rising momentum, indicating a positive shift in trading sentiment. While short-term market structure appears to be forming a strong trend, individual token volatility requires careful attention.

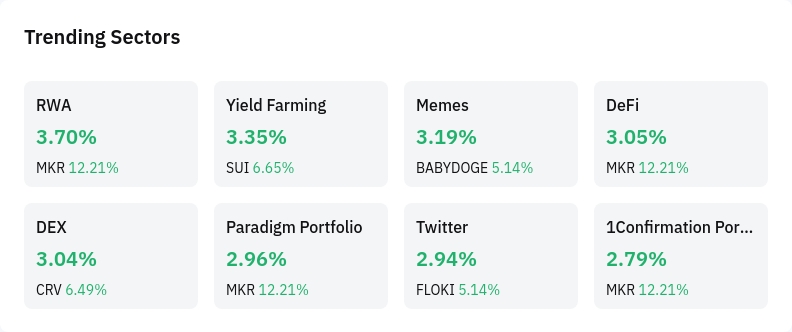

Trending Sector Analysis: RWA·Yield Redistribution Sectors Strong... DeFi and Meme Coins Also Rebounding

The Real World Assets (RWA) sector recorded the highest 24-hour average rise at 3.70%. Its representative token MakerDAO (MKR) notably surged 12.21%, driving strength not only in RWA but simultaneously in DeFi (3.05%) and Paradigm Portfolio (2.96%).

The Yield Farming sector rose 3.35%, with SUI rising 6.65%, reflecting expectations about practical utility and development foundation. The Meme coin sector also rebounded by 3.19%, with tokens like FLOKI and BABYDOGE rising over 5%. FLOKI, classified as a Twitter-linked token, rose 5.14% during the same period.

The Decentralized Exchange (DEX) sector averaged 3.04% growth, with Curve DAO Token (CRV) leading at 6.49%. The 1Confirmation portfolio sector also maintained steady growth at 2.79%, driven by MKR.

Overall, this market was distinctly led by application-centered sectors like real-world assets, yield protocols, and decentralized finance, rather than infrastructure. This signals a market shift towards sectors based on actual liquidity and economic models, suggesting potential structural growth in the medium term.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>