Ethereum's price is approaching the anticipated $4,000, but the upward momentum has temporarily stopped.

Although the market appears saturated, Ethereum's upward trend is not over yet. The recent adjustment is likely a short-term correction ahead of another rise.

Ethereum Shows Rising Signals

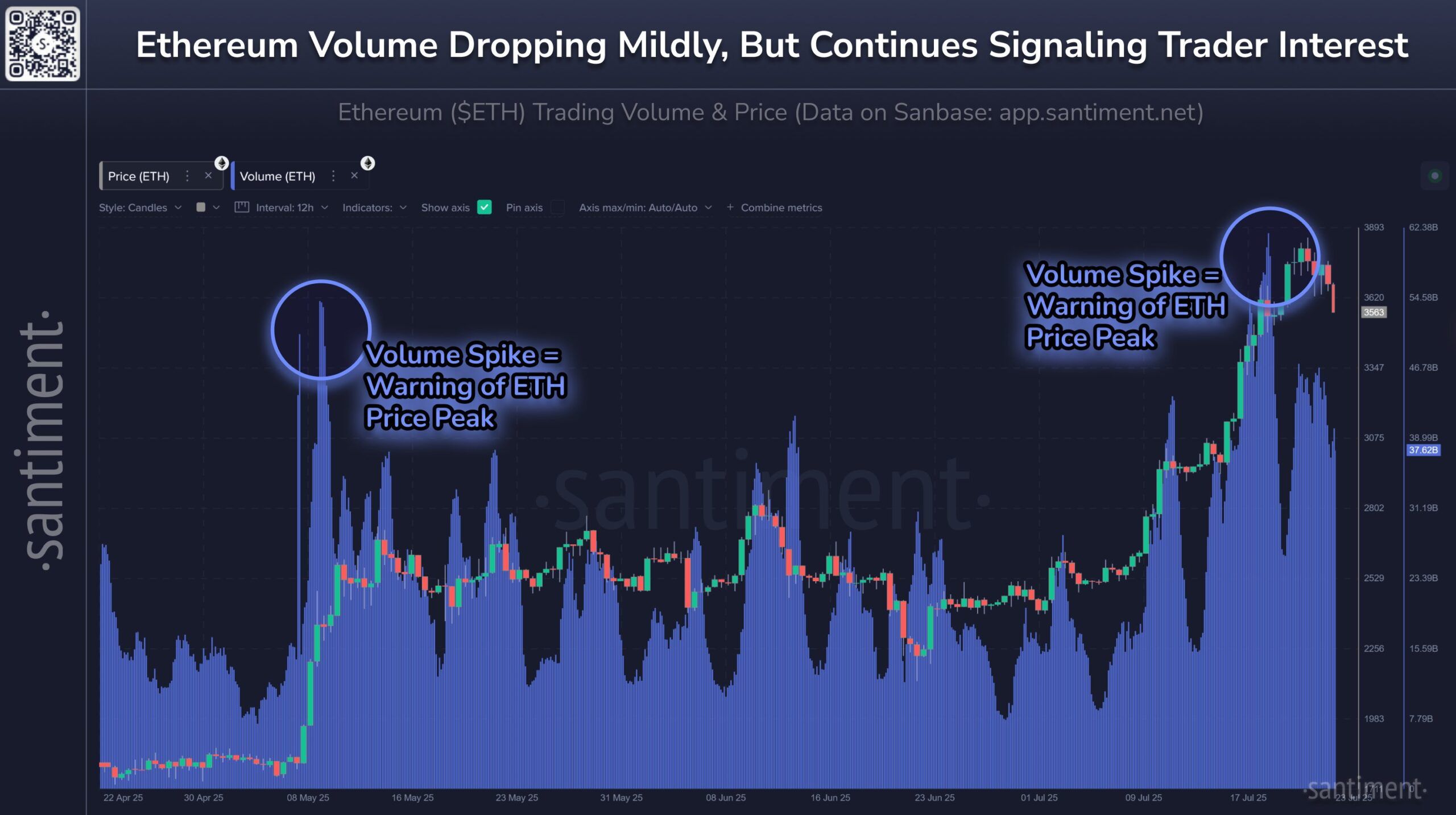

Ethereum's trading volume is rapidly increasing, signaling that individual investors are showing interest again. While Ethereum's price ratio against Bitcoin dropped by about 6% this week, the surge in trading volume is showing a pattern similar to May this year. Such surges often occur before local peaks, but this time might be different.

If trading volume and social media volume decrease during the rest of this week, it could signal that the market is preparing for another rise. The impatience and profit-taking of individual investors may set the stage for the next wave of increase.

Token TA and Market Update: Want more such token insights? Sign up for the daily crypto newsletter here.

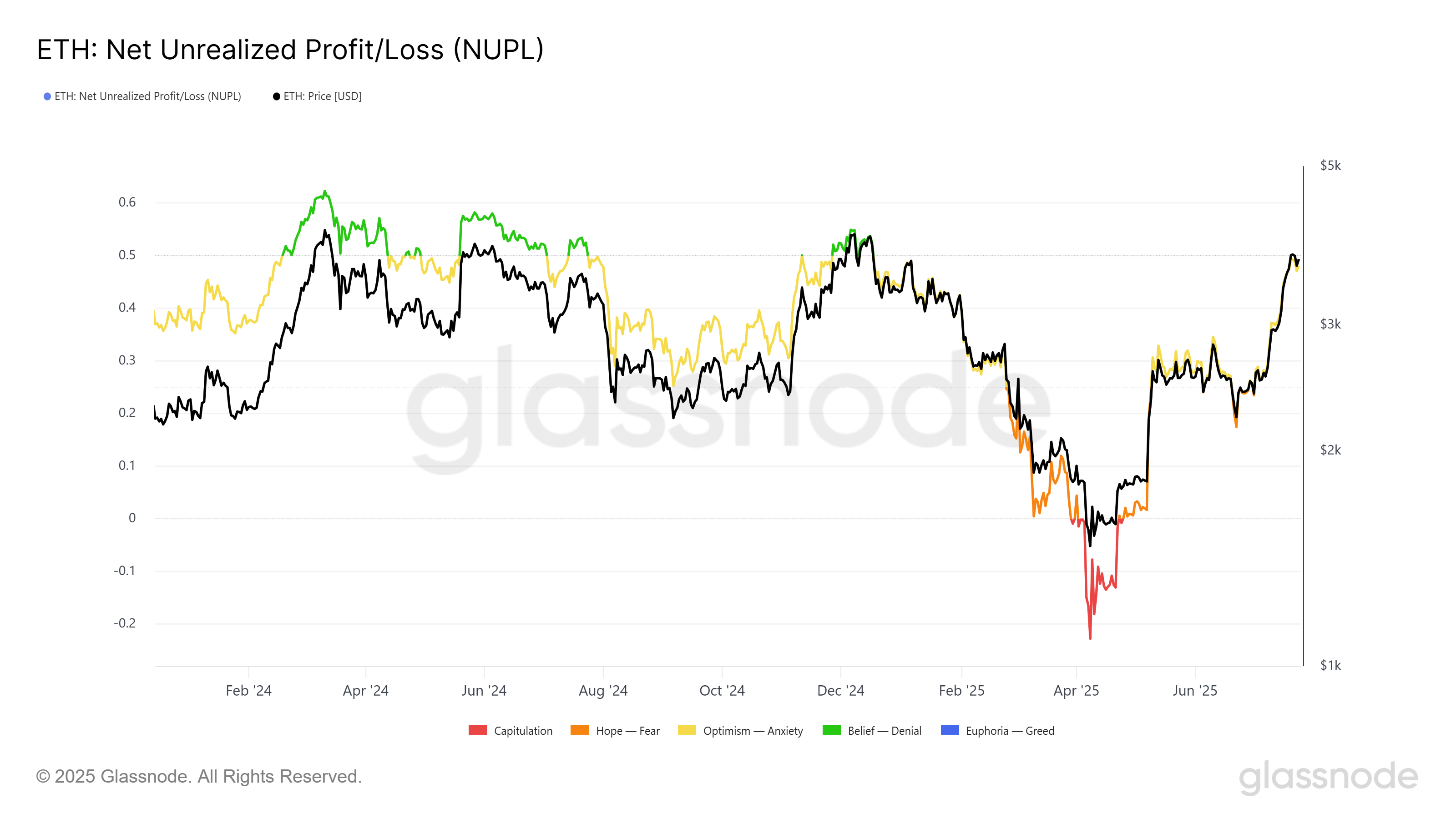

Looking at broader technical indicators, the Net Unrealized Profit/Loss (NUPL) suggests that Ethereum is preparing for a significant rise. Historically, when the NUPL indicator reaches the 0.5 threshold, it has signaled a temporary pause in the upward trend followed by a sharp increase.

Ethereum is currently approaching this threshold, which in the past has indicated the beginning of strong price movements. As the NUPL indicator continues to rise, it provides a powerful historical precedent for Ethereum's next price increase.

ETH Price Enters Adjustment Phase

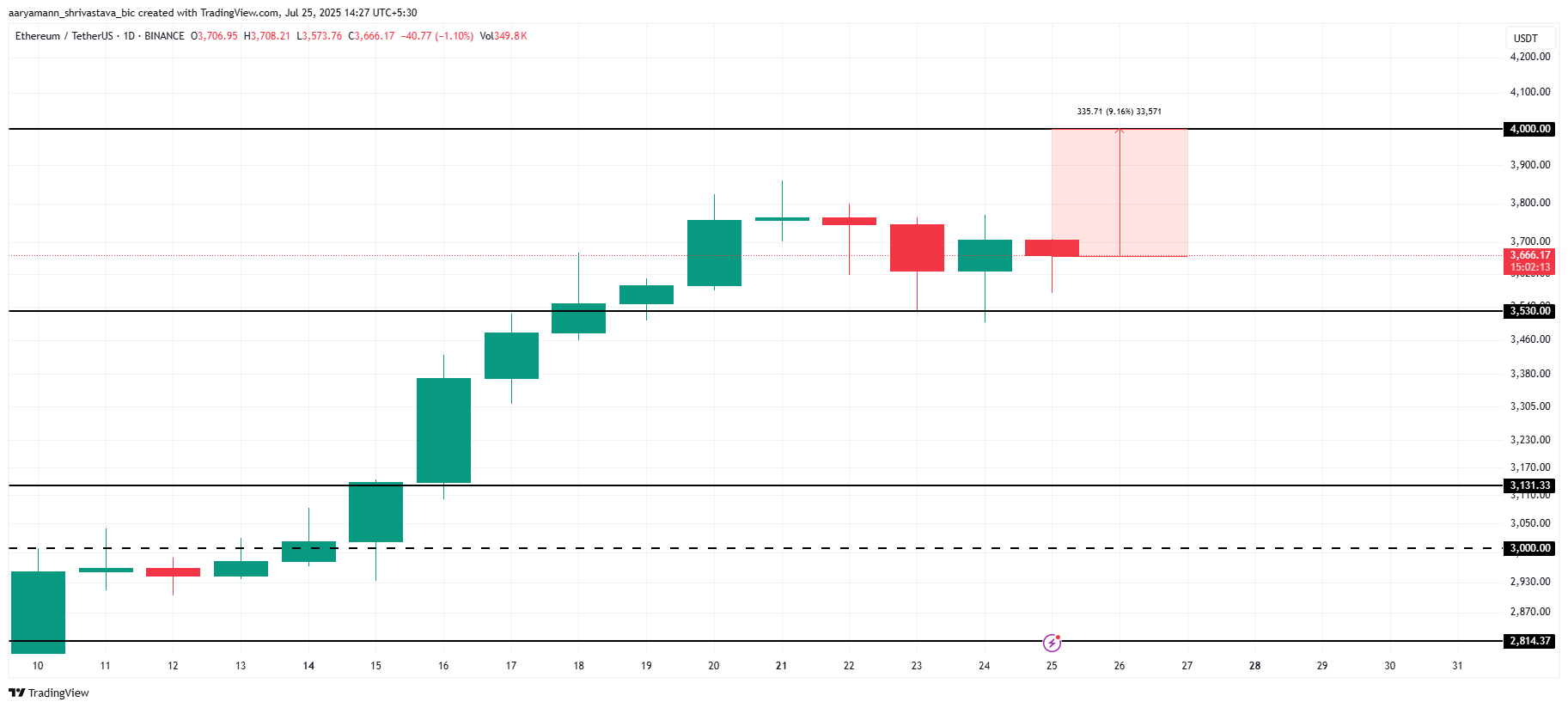

Ethereum is currently trading at $3,666, just 9% away from the crucial $4,000 resistance that many investors have been waiting for over the past seven months. Altcoins are expected to continue their upward trend despite recent adjustments and may soon break through $4,000.

Strong market sentiment and technical indicators support the continuation of the upward trend. As long as Ethereum maintains its key support levels, the price is likely to surge towards $4,000.

If Ethereum can maintain its momentum, breaking $4,000 could serve as a catalyst for further increases.

However, if unexpected selling pressure occurs, Ethereum's price could fall below the $3,530 support level. In such a case, Ethereum might drop to $3,131, potentially invalidating the current bullish outlook.

The key is to maintain support and leverage the rise driven by individual investors.