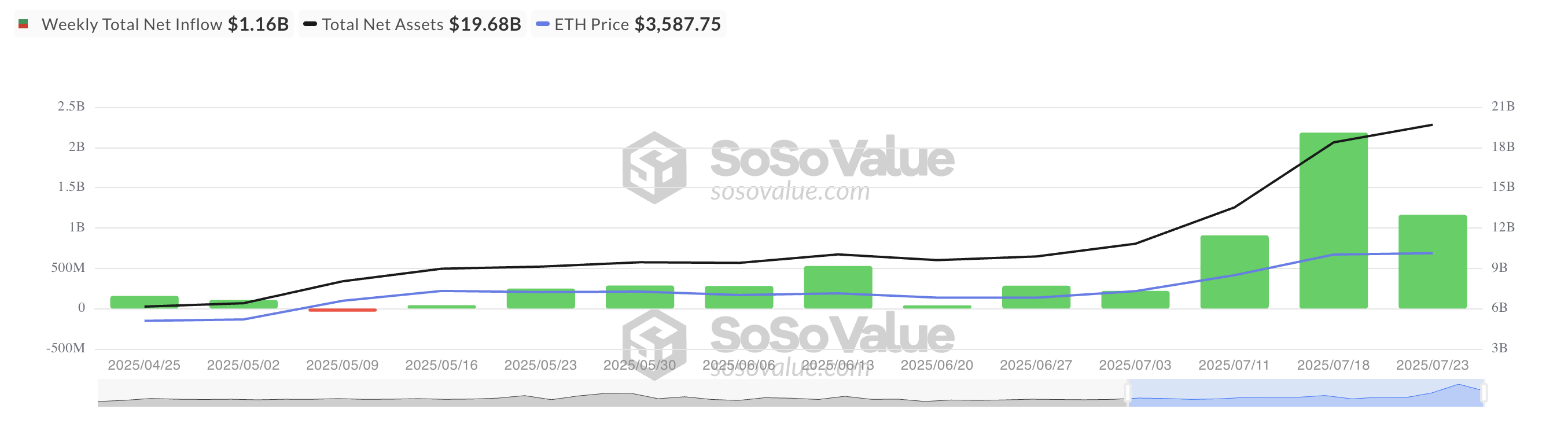

Despite the recent price decline, Ethereum (ETH) continues to attract institutional interest. Over $1 billion has flowed into ETH investment funds this week alone, demonstrating increasing institutional interest in the asset.

However, the coin's price performance does not reflect this strong investment activity. Despite large inflows, ETH is experiencing pressure due to increased profit-taking by long-term holders (LTH).

Ethereum Inflows Continue for 11 Consecutive Weeks... Price Still Below $3,600

According to SosoValue, the second-largest cryptocurrency by market capitalization has been experiencing net inflows into ETH ETFs for 11 consecutive weeks. This is in stark contrast to Bitcoin (BTC), which has seen net outflows amid recent price declines that have shaken investor confidence.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

However, despite strong institutional support for ETH, the inflows have not translated into price momentum. Instead, ETH's price continues to decline due to a surge in profit-taking activities.

At the time of writing, Ethereum is trading at $3,553 per coin, which represents approximately a 5% decline since Monday. What are the factors driving this decline?

Smart Money Quietly Exiting

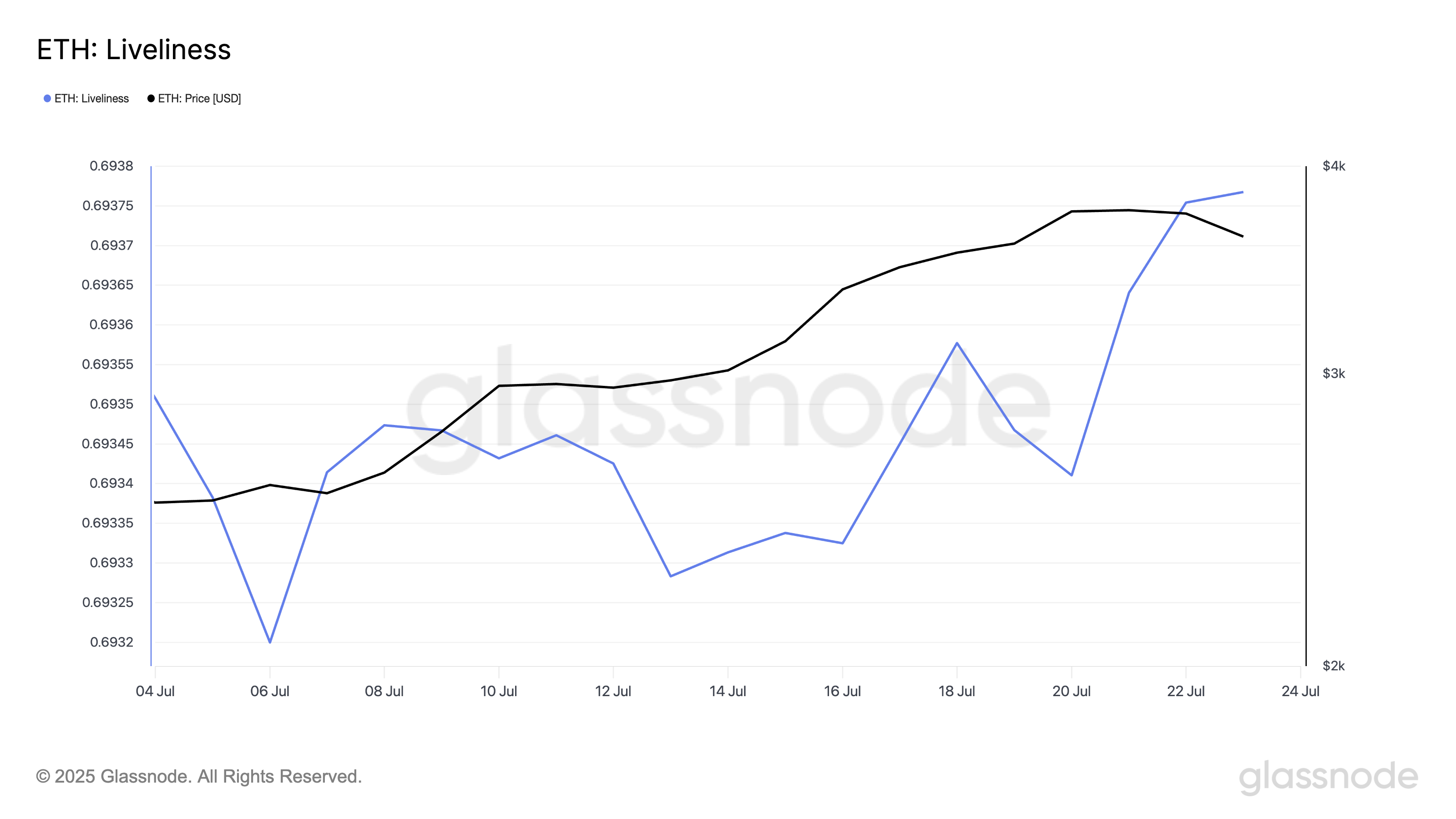

On-chain data shows that ETH's Liveliness is increasing, indicating that long-term holders (LTH), considered the strongest hands in the market, are selling more coins. At the time of reporting, this stands at 0.69.

Liveliness measures the movement of long-term held tokens by dividing the number of coin days destroyed by total coin days. When it declines, LTHs choose to move assets from exchanges and hold.

Conversely, when it rises like now, more dormant tokens are being moved or sold, indicating profit-taking by long-term holders.

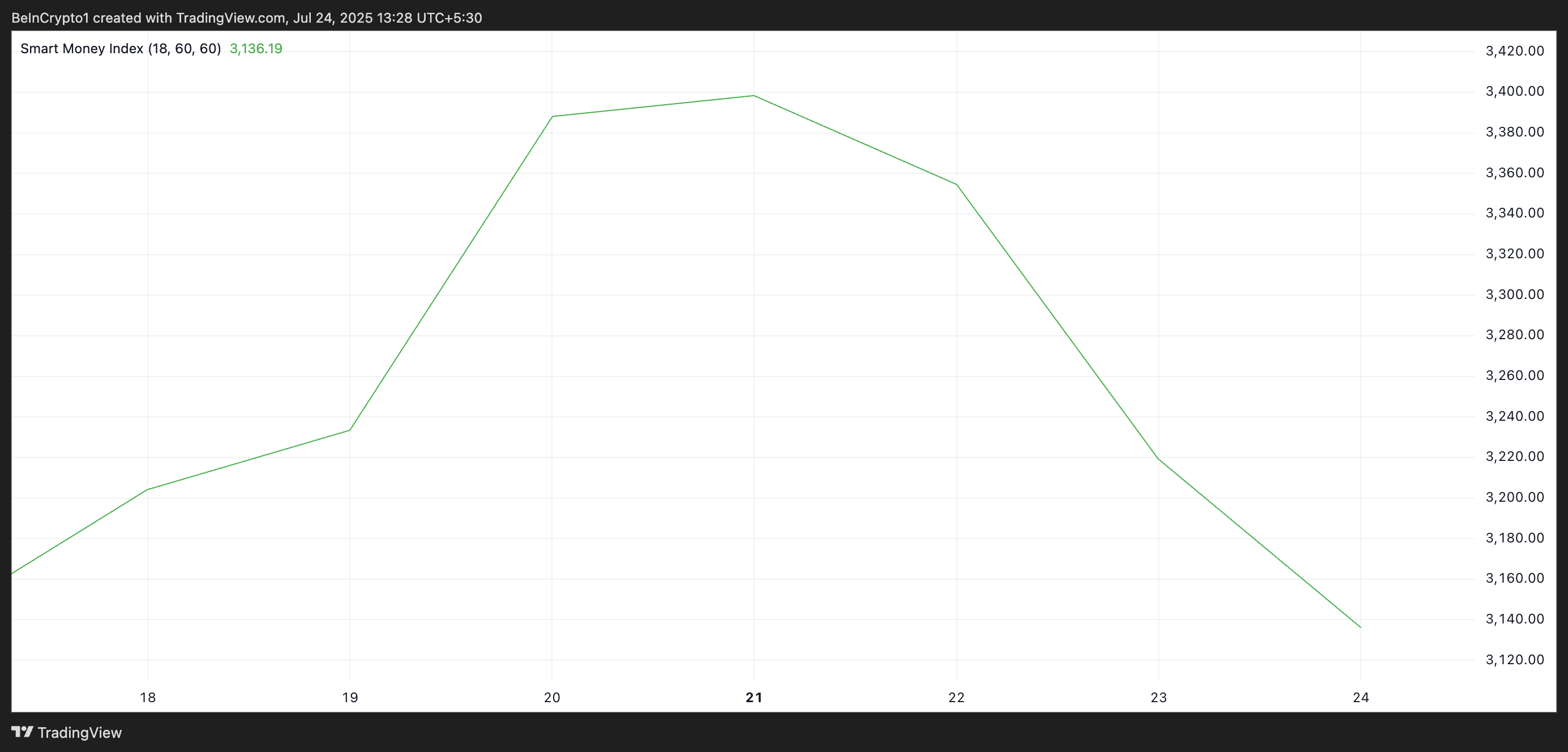

Moreover, the decline in ETH's Smart Money Index (SMI) on the ETH/USD daily chart confirms selling among major coin holders. The indicator's reading has dropped 7% since July 20.

Smart money refers to capital controlled by institutional investors or experienced traders who deeply understand market trends and timing. The SMI tracks these investors' behavior to analyze intraday price movements.

Specifically, it measures selling in the morning (dominated by retail traders) and buying in the afternoon (when institutions are more active).

When an asset's SMI declines like this, smart money is reducing positions, and in ETH's case, this appears to be driven by a desire to lock in profits from the recent rally.

ETH: Tug of War Between Smart Money Sellers and Bottom Buyers

ETH could fall below $3,524 if major holders continue selling. If this level breaks, the altcoin could trade at $3,314. If buying pressure fails to provide support at that point, it could lead to a deeper correction.

However, if buying pressure increases, this bearish outlook will be invalidated. In that case, ETH's price could revisit the recent cycle high of $3,859 and attempt to break through that level.