In the past 24 hours, approximately $523 million (about 764.5 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently aggregated data, short positions overwhelmingly dominate the liquidated positions, reflecting the recent strong market uptrend.

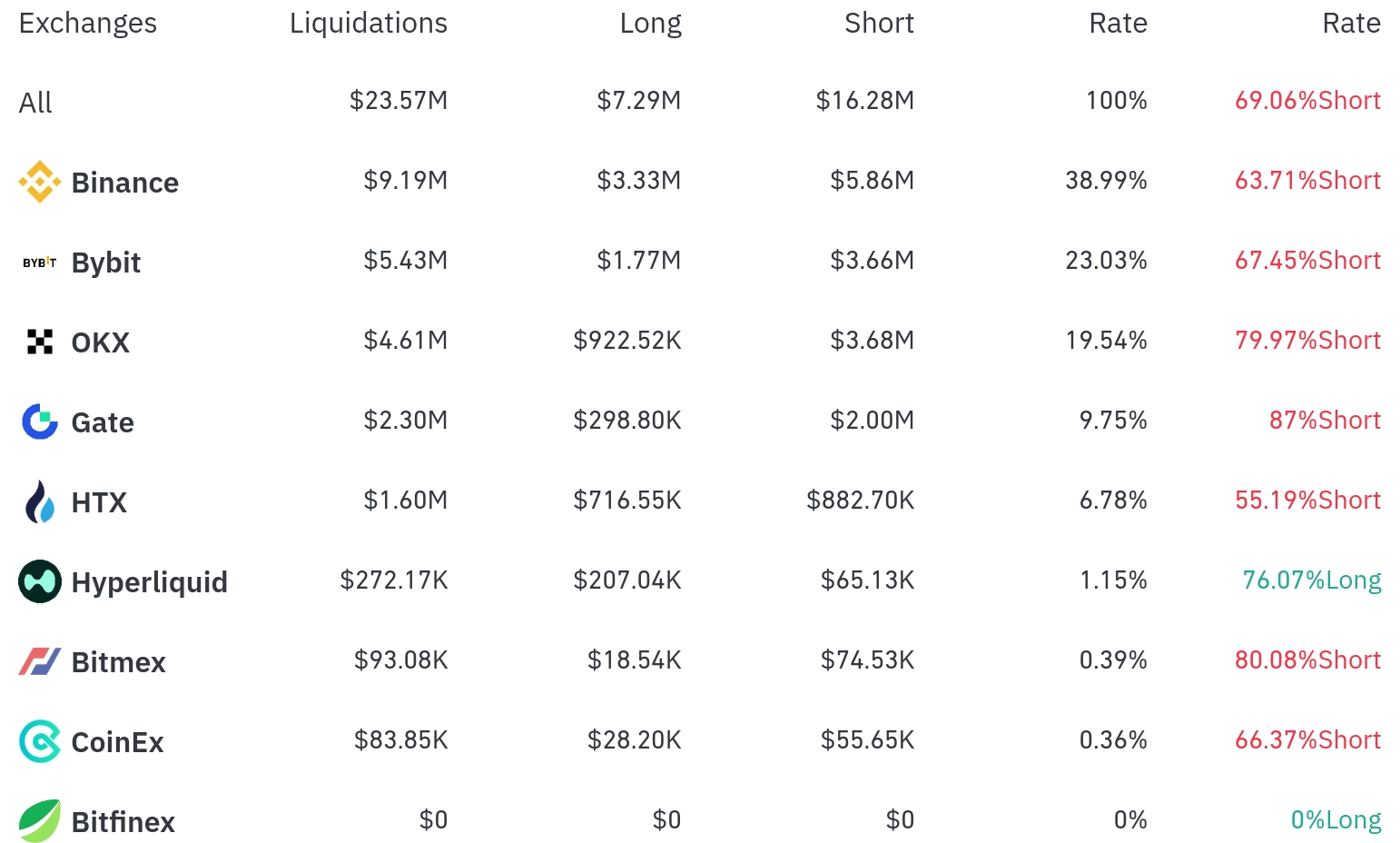

Binance experienced the most position liquidations over the past 4 hours, with a total of $9.19 million (38.99% of the total) liquidated. Among these, short positions accounted for $5.86 million, or 63.71%.

Bybit was the second-highest exchange with liquidations, with $5.43 million (23.03%) of positions liquidated, of which short positions were $3.66 million (67.45%).

OKX saw approximately $4.61 million (19.54%) in liquidations, with a very high short position ratio of 79.97%.

Notably, while most exchanges showed overwhelming short position liquidations, Hyperliquid was the only exchange where long position liquidation ratio was higher at 76.07%.

By coin, Ethereum (ETH) recorded the most liquidations. Approximately $147.39 million in Ethereum positions were liquidated in 24 hours, with $7.91 million in short positions liquidated in 4 hours, showing a sharp increase. Ethereum is currently trading at $3,736, up 4.74%.

Bitcoin (BTC) had about $58.97 million in positions liquidated in 24 hours, with $36.69 million in short positions liquidated in 4 hours. Bitcoin is currently trading at $118,675, up 0.69%.

Solana (SOL) saw approximately $33.24 million liquidated in 24 hours, while among other major altcoins, XRP ($48.80 million) and Doge ($31.17 million) experienced significant liquidations.

Particularly, Sui rose 4.86% and saw $4.46 million in short position liquidations over 4 hours, while the ENA Token surged 7.37% with $3.15 million in short position liquidations.

In contrast, FARTCO (-6.29%) and WIF (-4.68%) showed a downward trend with large long position liquidations.

This massive short position liquidation in the cryptocurrency market reflects the recent strong market uptrend, particularly highlighting the significant rise in Ethereum and altcoin markets, which dealt a heavy blow to traders who held short positions. This suggests that the overall market sentiment is shifting to bullish, coinciding with Bitcoin's movement to break through $120,000.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>