The cryptocurrency market capitalization recorded its first weekly decline after four consecutive weeks of increase. The upward momentum appears to be weakening, and the correction has led to liquidations among short-term traders.

What caused this week's correction, and what implications might it have?

Market Capitalization Drops in the Last Week of July... Nearly $1 Billion Liquidated

According to TradingView data, the total cryptocurrency market capitalization declined by approximately 5% this week, decreasing from nearly $4 trillion to $3.78 trillion. However, the altcoin market capitalization (TOTAL2) fell even more sharply, dropping from $1.57 trillion to $1.4 trillion, a decline of almost 10%.

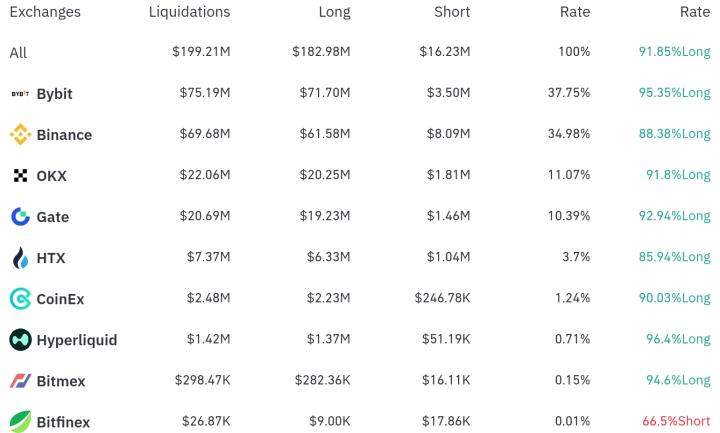

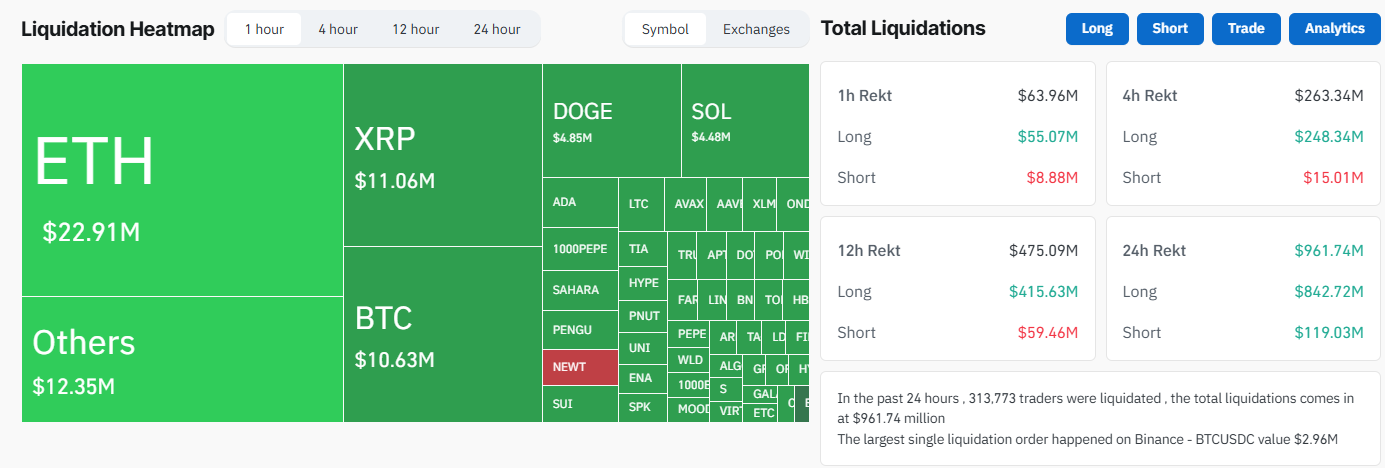

Altcoins were adjusted more drastically than Bitcoin, causing losses for short-term derivatives traders. Coinglass reported nearly $1 billion in liquidations over the past 24 hours.

"314,302 traders were liquidated over the past 24 hours. The total liquidation amount is $966.04 million," Coinglass reported.

Of the nearly $1 billion liquidated, over $840 million occurred in long positions, accounting for approximately 84%. This highlights the failure of many short-term traders who used leverage expecting price increases this week.

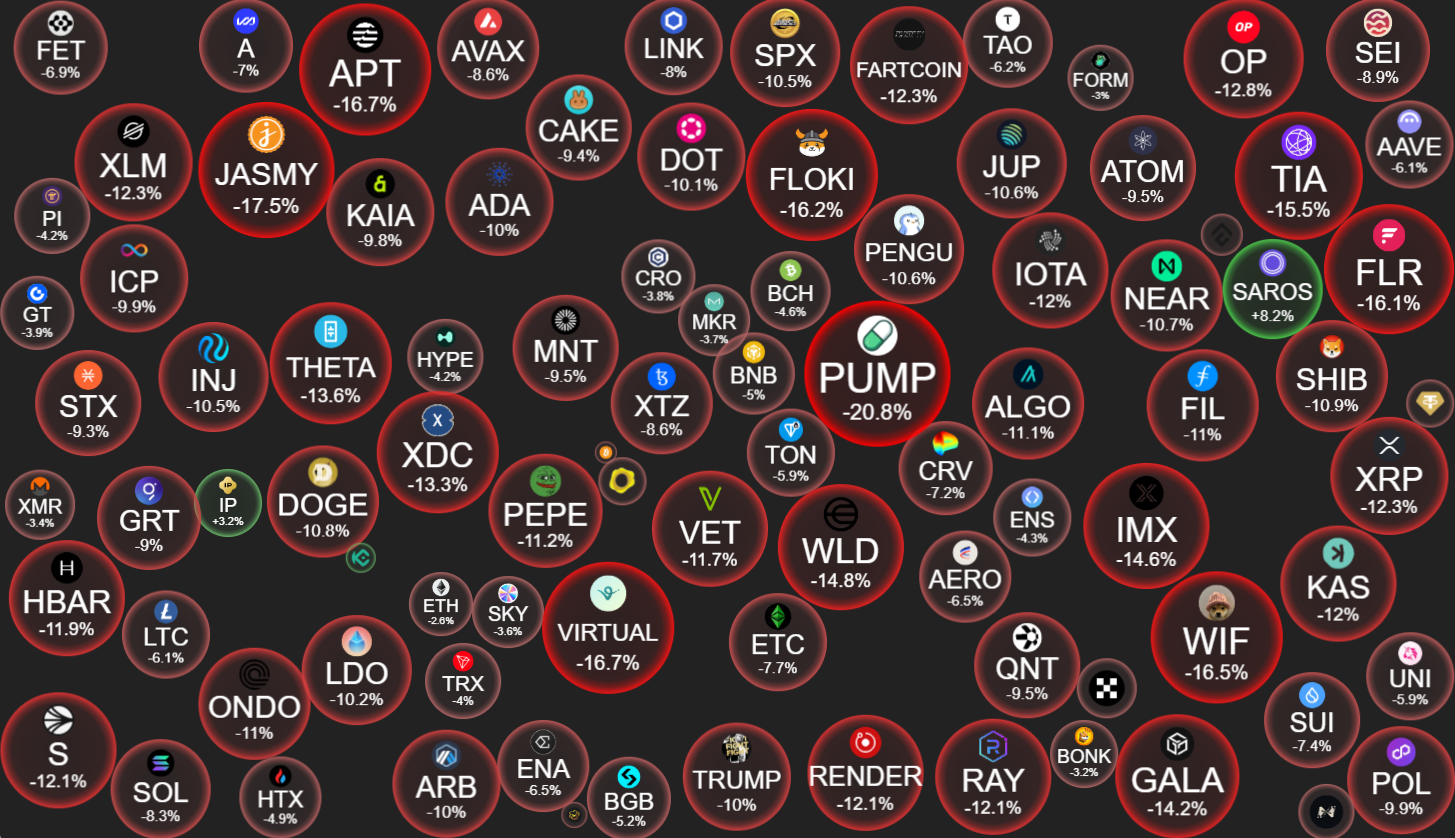

Additionally, according to CryptoBubbles data, almost all altcoins experienced sharp declines today, with losses ranging from 6% to over 20%.

This movement can be seen as the first wave of profit-taking after four consecutive weeks of market capitalization increases.

Who is Realizing Profits?

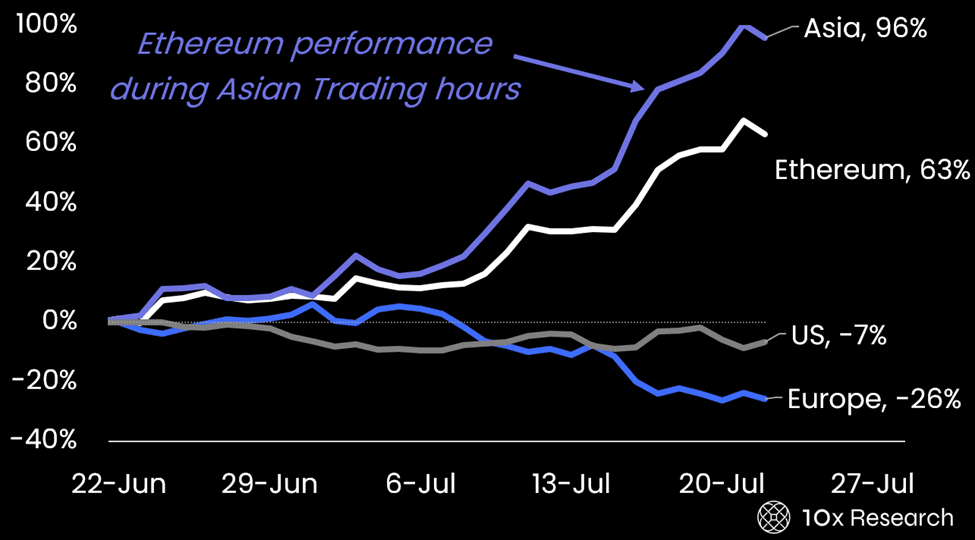

According to a new report from 10x Research, Asian trading hours were the primary driver of the recent rally.

Bitcoin overall rose by 16%, but increased by 25% during Asian trading hours. This indicates that Europe (-6%) and the US (-3%) actually showed net selling, likely due to profit-taking.

A similar pattern emerged with Ethereum. ETH surged by 63% last month, which is an impressive increase. However, almost all of the rise (+96%) occurred during Asian trading hours. In contrast, Europe (-26%) and the US (-7%) sold during price increases.

"Some may be due to financial news after US market hours, but a more likely explanation is the high enthusiasm and aggressive buying by Asian traders," the report explains.

The research suggests that US and European investors may be realizing profits. Ironically, they were also the source of positive news that triggered the strategic cryptocurrency accumulation narrative.

Asian traders became caught up in FOMO based on news from the other half of the world, but were hit by today's headlines.

However, this correction may not be sufficient to indicate a long-term downward trend. Many analysts view it as a natural profit-taking phase and believe the broader trend remains intact.

"I'm not worried about today's altcoin decline. Considering how much everything has risen recently, it was a rational sell-off. The most important thing is that Bitcoin remained strong. Altcoins will soon rebound, and perhaps even more strongly than the previous rise. Patience is rewarded. Look more optimistically," predicted KALEO, an investor and founder of LedgArt.

Binance founder CZ also viewed this correction simply as "going down again".

At the time of writing, market sentiment is in a state of "greed". Despite nearly $1 billion in liquidations, there are still no signs of fear.