Despite the Bitcoin (BTC) downturn, Strategy is issuing preferred shares worth $20 billion (approximately 2.7474 trillion won) for additional purchases.

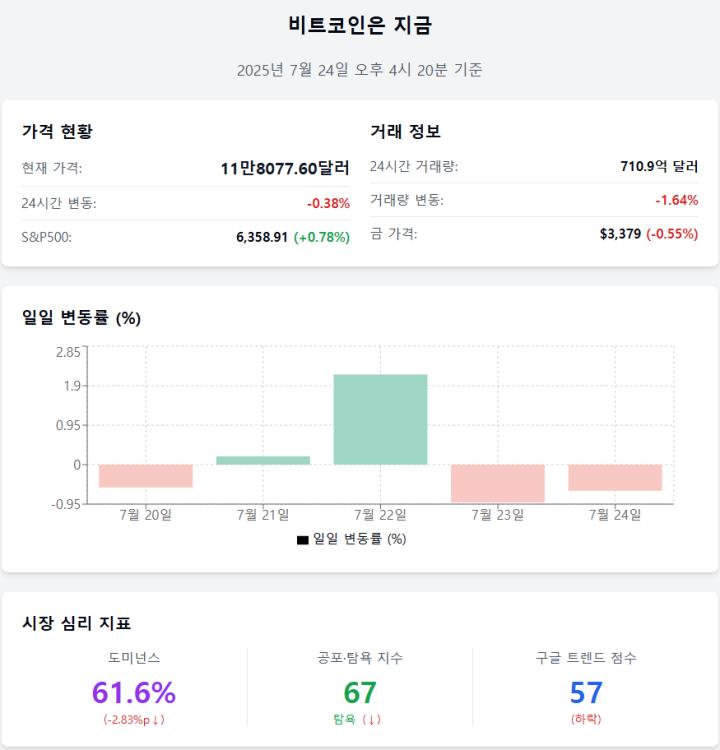

According to CoinMarketCap, a global virtual asset market tracking site, as of 8 AM on the 25th, BTC is trading at $118,673.91, down 1.02% from the previous day. Ethereum (ETH) dropped 2.85% to $3,614.90, XRP fell 9.96% to $3.176, and Solana (SOL) declined 6.42% to $189.13.

Related Articles

- Altcoin Sharp Decline... Warning of "Bubble Concerns Across the Market" [Decenter Market Conditions]

- Bitcoin Temporarily Recovers to $120,000 Line... Rising Again [Decenter Market Conditions]

- Trump Media Bought $2 Billion Worth of Bitcoin [Decenter Market Conditions]

- Strategy Holding 600,000 Bitcoins Says "Will Buy More" [Decenter Market Conditions]

The domestic market shows a similar trend. At the same time, BTC on Bithumb is down 0.47% to 160,807,000 won. ETH dropped 0.30% to 5,058,000 won, XRP fell 2.13% to 4,314 won, and SOL declined 3.07% to 349,700 won.

Bloomberg reported that Strategy has expanded its preferred share issuance from $5 billion to $20 billion to raise funds for additional BTC purchases. The Series A perpetual preferred shares were priced at $90 per share at noon Eastern Time on Thursday. The initial dividend rate is reported to be 9%.

Previously, Bloomberg had forecast the share price would be between $90 and $95. Morgan Stanley, Barclays, TD Securities, and Moellis & Company are participating as joint lead managers. Strategy is the world's largest BTC holding company, with 607,770 Bitcoins.

The Fear and Greed Index from alternative asset data analysis firm Alternative.me is at 71 points, down 1 point from the previous day, indicating a "greed" state. The lower the index is toward 0, the more constrained the investment sentiment, while closer to 100 indicates market overheating.

- Reporter Do Ye-ri

< Copyright ⓒ Decenter, Unauthorized Reproduction and Redistribution Prohibited >