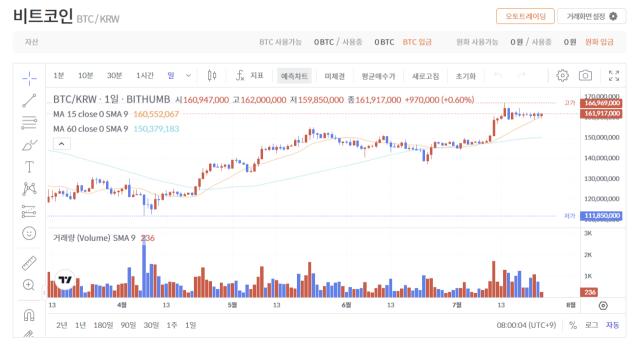

Bitcoin has been experiencing significant sideways movement, struggling to break through important resistance levels recently.

Nevertheless, Bitcoin continues to be actively traded, with short-term and new buyers flooding the market. However, this influx of new capital can bring both opportunities and risks.

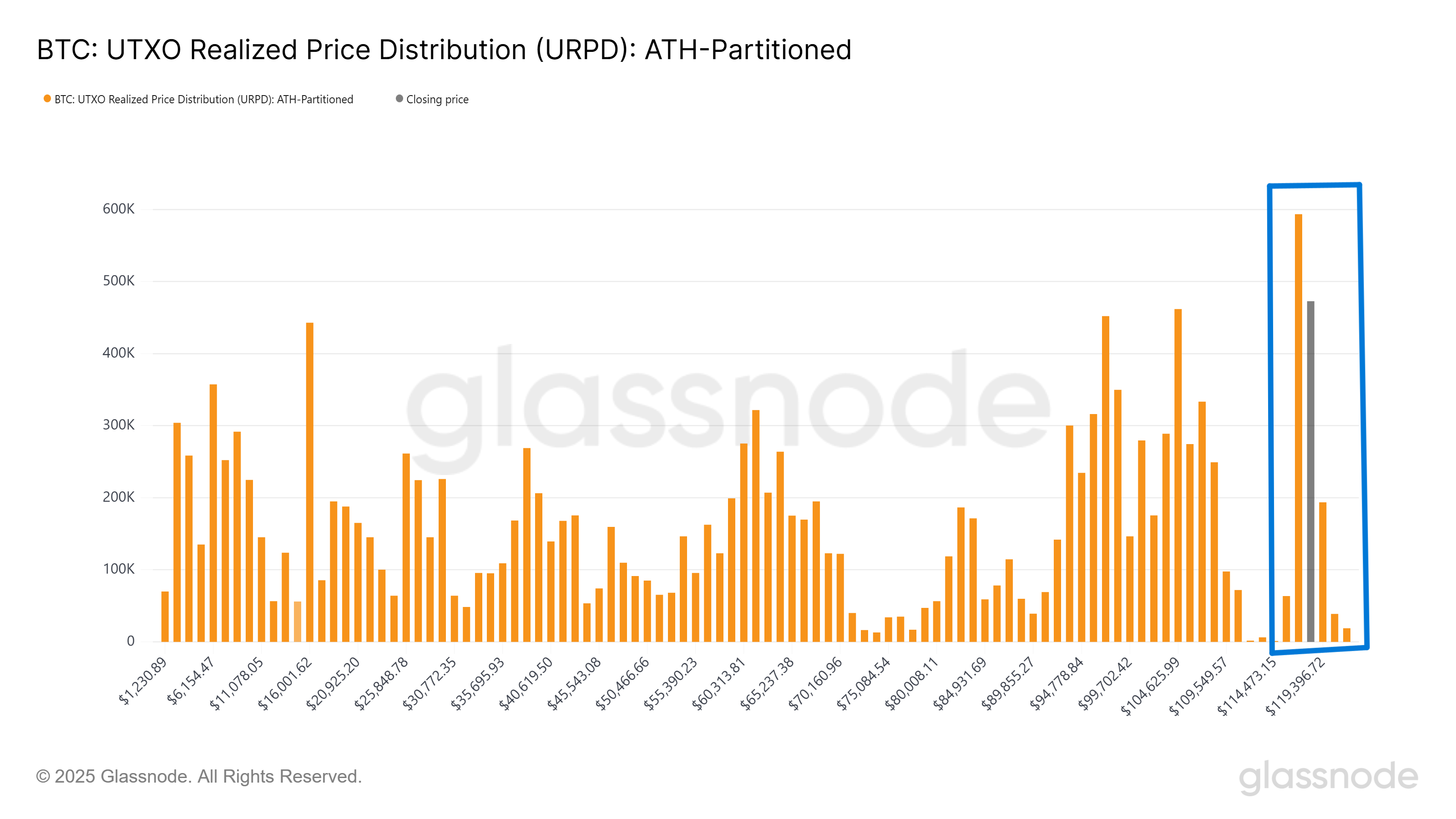

1.38 Million Bitcoin Traded Between $115,000 and $120,000

According to recent data from URPD (UTXO Realized Price Distribution), over 1.38 million BTC have been accumulated between $115,500 and $120,000. This accumulation occurred over the past two weeks, indicating that many purchases were made by short-term holders or new investors.

These buyers are likely to sell to secure profits or avoid losses if the price reverses. This dynamic can create volatility if Bitcoin encounters resistance or experiences a downturn.

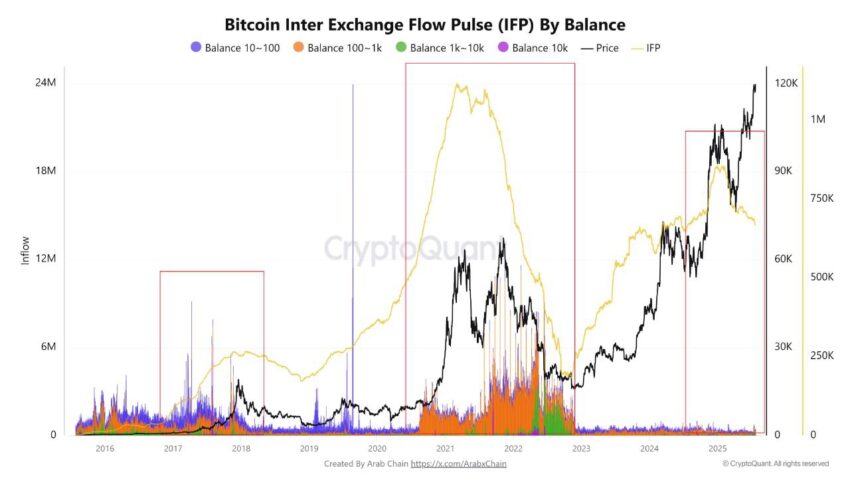

Bitcoin's macro momentum shows mixed signals, with Bitcoin Flow Pulse currently declining. Analyst Kyledoops noted that unlike previous market cycles in 2017 and 2021, where Bitcoin saw a surge in flow before major sell-offs, the Bitcoin Flow Pulse is actually declining after reaching $120,000.

This suggests that large investors are not transferring their holdings to exchanges and may have little incentive to sell from long-term holders (or "diamond hands"). As the Bitcoin Flow Pulse continues to decrease, it may indicate that institutional and major investors are adopting a more cautious approach.

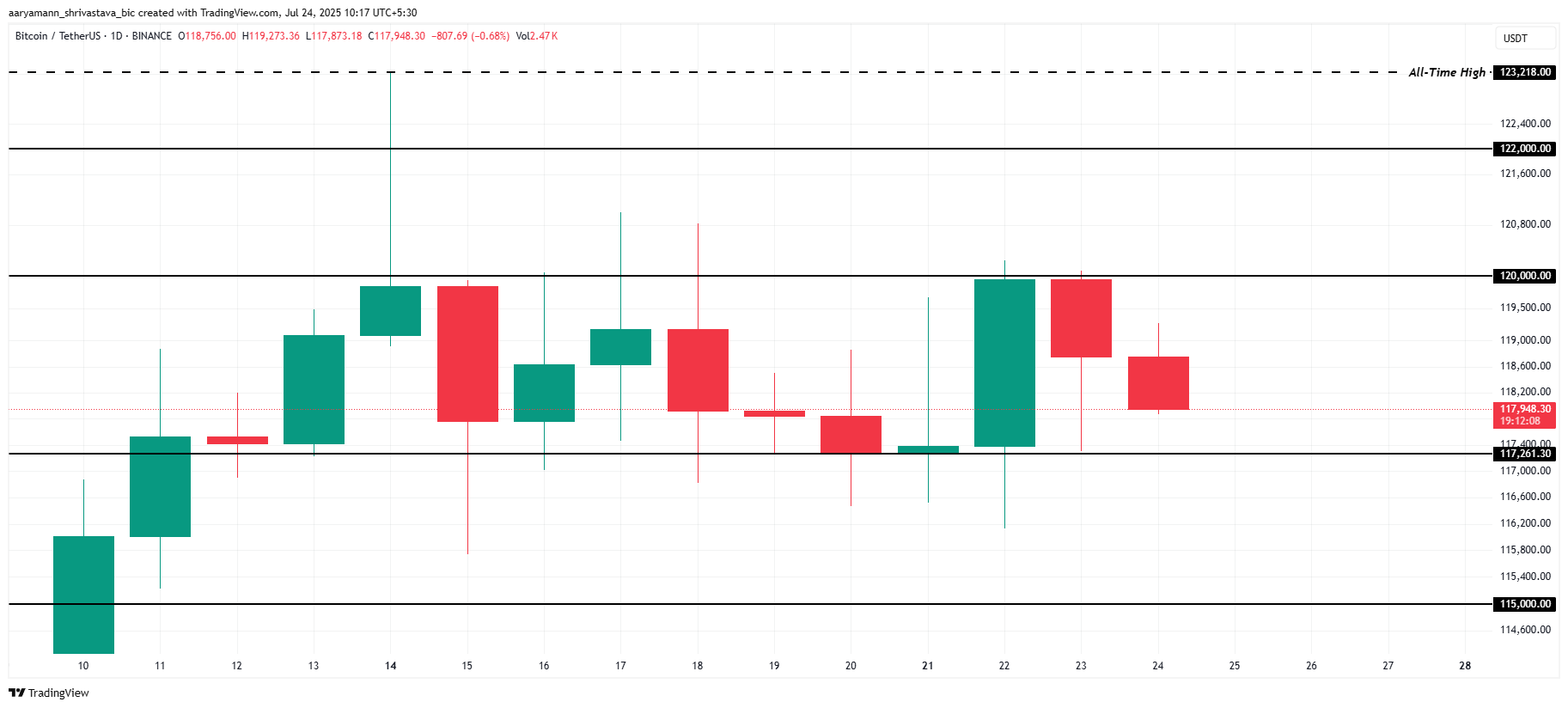

BTC Price Seeking Direction

Bitcoin's price is consolidating within the range of $117,261 and $120,000. Particularly, the $120,000 level is a crucial psychological barrier. Breaking through this could trigger profit-taking from investors currently skeptical of the rally.

Considering the mixed market sentiment and the influx of short-term holders, Bitcoin is likely to continue its sideways movement. The price could potentially drop below $117,261, but Bitcoin is expected to maintain support above $115,000, which will act as a buffer against further decline. This consolidation phase may last for several days while the market digests the recent capital inflow.

However, if FOMO-driven buyers maintain confidence and continue holding positions, Bitcoin could target $122,000 by breaking through the $120,000 barrier. If this occurs, the current downtrend would be invalidated, and Bitcoin would have more potential for further appreciation.