Wall Street is increasingly betting on a U.S. rate cut before the end of 2025. At the same time, Donald Trump's political pressure has intensified, and he is becoming more aggressive in pushing Powell for a rate cut.

As inflation eases and the market adjusts expectations, cryptocurrencies can benefit the most from a relaxed monetary policy.

Trump Wants Fed Rate Cut to 1%

This morning, Trump resumed his attack on Federal Reserve Chair Jerome Powell. He demanded a 3 percentage point rate cut, claiming it would save the U.S. economy $1 trillion annually.

The U.S. President also accused Powell of keeping rates high for "political reasons".

Jerome Powell said that he will not cut interest rates, citing an inflation rate above 2.5% and tariff uncertainty.

— The Constitutionalist 🇺🇸 (@WeWillBeFree24) July 22, 2025

Yet he cut them in December with a higher inflation rate, and pending tariffs.

Watch for an incoming Trump, Truth.

The Fed has maintained rates at 4.25%–4.50% since June. However, positive speculation about rate cuts is increasing. Goldman Sachs now expects the first cut to come in September.

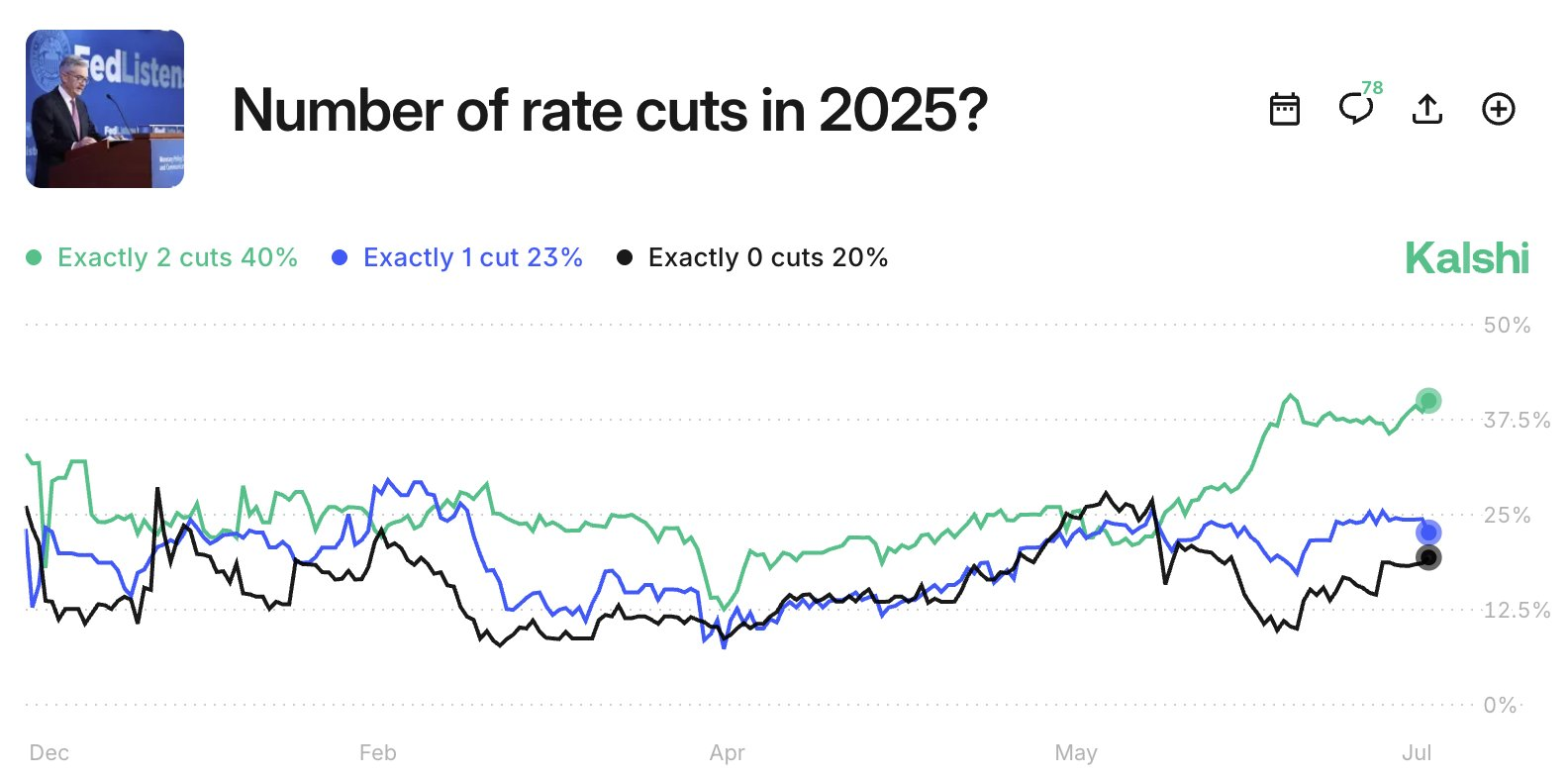

Meanwhile, the prediction market Kalshi sees a 40% chance of two cuts by the end of the year.

This change follows a sharp decline in U.S. inflation expectations. One-year consumer expectations fell to 4.4% in July, the lowest since February. This represents a 2.2 percentage point drop in just two months, one of the largest two-month declines in history.

Long-term inflation expectations are also easing. The 5-year outlook dropped 0.8 percentage points last quarter and is currently at 3.6%.

Overall, these trends suggest the Fed has more room to ease without fear of price increases.

The cryptocurrency market is taking note.

Bitcoin is maintaining above $118,000. Ethereum is near $3,700. Both assets have historically risen after Fed rate cuts, benefiting from increased liquidity and investor risk appetite.

Americans' inflation expectations are changing:

— The Kobeissi Letter (@KobeissiLetter) July 22, 2025

US consumers' 1-year inflation expectations fell to 4.4% in July, the lowest since February 2025.

Over the last 2 months, expectations have declined 2.2 percentage points, marking one of the largest 2-month drops in history.

This… pic.twitter.com/GTbBWDzUN8

Start of a Major Cryptocurrency Bull Market?

Historically, rate cuts have initiated strong cryptocurrency rallies.

After the Fed cut rates in March 2020 during the COVID-19 crisis, Bitcoin surged from below $10,000 to over $60,000 within a year. Ethereum followed, boosted by DeFi and Non-Fungible Token growth.

A new rate cut cycle starting in September could bring similar conditions. Low yields will drive investors towards risk assets, including cryptocurrencies.

Capital may also shift from bonds and cash to Bitcoin, Ethereum, and high-trust altcoins.

Additionally, falling inflation expectations and improved regulatory clarity through bills like GENIUS and CLARITY could strengthen investor confidence.

The convergence of these macro and policy signals could extend the current cycle beyond previous peaks.

However, timing is crucial. Cryptocurrencies are already near record levels, and momentum may depend on the speed and depth of rate cuts. A delayed or shallow Fed response could limit the rise.

Key Dates to Watch

The next Fed policy meeting is scheduled for July 29-30. While the market doesn't expect changes, the Fed's statements will be carefully interpreted for signals about September.

The next important date is September 16-17, when the FOMC will meet again. This is widely seen as the first realistic window for a rate cut if inflation continues to fall.

Other key indicators to monitor:

- July CPI Announcement: Expected in early August, it will shape expectations for the September decision.

- Jackson Hole Symposium (August 22-24): Powell's speech could significantly alter sentiment.

- U.S. Employment Reports (August and September): Labor market weakness could strengthen the case for rate cuts.

For cryptocurrency traders, these dates provide signals of potential market turning points. If the Fed's pivot is confirmed, it could trigger new buying pressure, especially in Bitcoin, Ethereum, and high-liquidity altcoins.