Bitcoin (BTC) has lost its upward momentum and entered a sideways trend after reaching an all-time high of $123,100 (approximately 170.96 million won) last Monday. This stagnation is mainly attributed to the surge of individual investors' selling pressure on Binance.

According to on-chain analysis firm CryptoQuant, the net taker volume of Bitcoin on Binance has recently turned negative again, dropping below $60 million (approximately 8.34 billion won). A negative indicator means that most investors actively executing trades in the market are placing sell orders. In particular, it is interpreted that small-scale investors are disposing of Bitcoin even during a market uptrend.

Additionally, the Bitcoin premium indices in both the United States and South Korea are showing a weak trend, signaling a slowdown in spot demand. This suggests that the current price stagnation is primarily driven by individual investors' risk aversion, rather than buying pressure from major hedge funds or institutions.

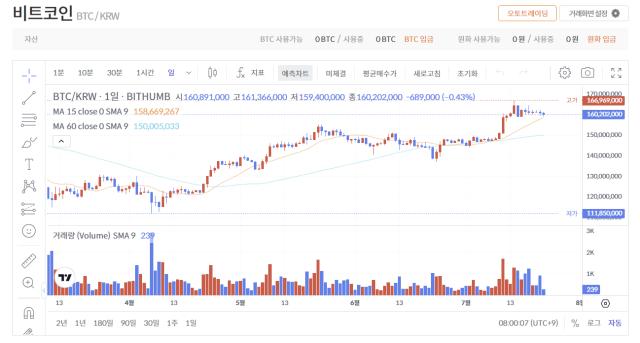

However, Bitcoin continues to maintain strong bottom-buying support around $115,000 (approximately 160.35 million won). At this price level, there is a powerful buying force attempting to absorb selling volumes, which supports the continued market intervention by 'bullish' investors.

Currently, despite some weak signals, Bitcoin remains stable above its core support line. At this critical point that divides investors' trading sentiment, the market is focusing on which direction it will take - a potential large-scale price breakthrough or downward pressure.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>