As capital strongly flows into Ethereum in 2025, pushing the price over $3,600, the amount of ETH waiting to be unstaked unexpectedly surged.

What does this mean for Ethereum's price trend? We introduce insights from experts.

350,000 ETH Waiting to be Unstaked... What Does It Mean?

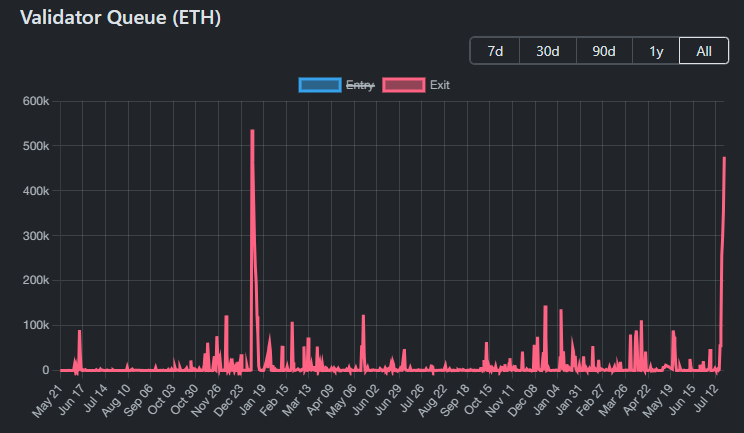

Woody Berthheimer, a prominent crypto community investor, expressed concern after discovering that 350,000 ETH, approximately $1.3 billion, is waiting to be unstaked.

"350,000 ETH is waiting to be unstaked. That's about $1.3 billion. The last time this much ETH was unstaked was in January 2024, when ETH/BTC rose 25% in a week. [The price] has since declined." – Woody Berthheimer, Crypto Investor

Unstaking allows users to withdraw ETH from staking smart contracts and convert it into freely usable assets.

Large-scale unstaking can indicate potential selling pressure, especially when investors are looking to realize profits, given that ETH has risen 160% since its April low.

In early 2024, over 500,000 ETH was unstaked, and ETH surged from $2,100 to over $4,000 before falling back to $2,100.

Where Will the Unstaked ETH Go?

Victor Bunin, Coinbase's OG Protocol Expert, suggested that this ETH could move to internal financial funds, which could be used for financial strategies like long-term investment or portfolio diversification.

This is not a signal of panic selling. Rather, it is likely a form of asset management that could help stabilize the market in the long term.

Meanwhile, according to a LookOnChain report, on-chain data shows that 23 whales or institutions have accumulated 681,103 ETH (worth $2.57 billion) since July 1st.

And the accumulation hasn't stopped. In the fourth week of July, more institutions added ETH worth billions of dollars.

"A new ETH Treasury—Ether Machine—announced this morning ETH worth $1.5 billion. This is the largest so far. But last week, Tom Lee of Fundstrat Capital said he would buy ETH worth $20 billion, and Joseph Rubin said he would add at least $5 billion. I don't know who will be the largest, but what's certain is that ETH is not enough." – Crypto Investor Ryan Sean Adams

ETH Staking?

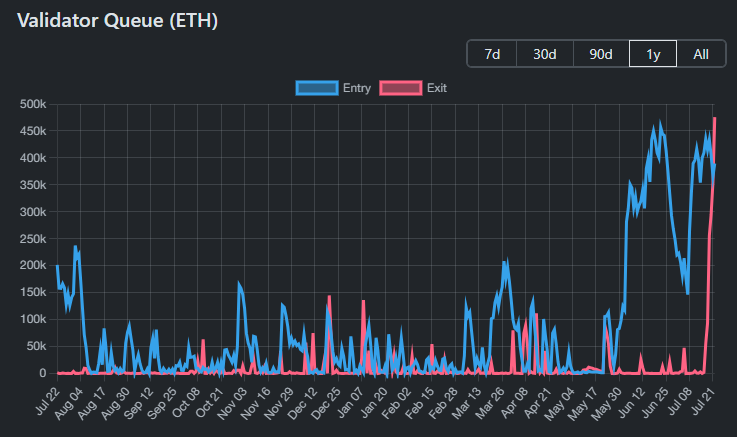

Woody Berthheimer's concerns might sound like a warning when compared to historical patterns. However, he is missing the important perspective of the current amount of ETH waiting to be staked.

According to ValidatorQueue data, the amount of ETH waiting to be staked far exceeds the amount waiting to be unstaked. Since June, this queue has surged, with over 450,000 ETH waiting to be staked on certain days.

This reflects the continued interest of investors in participating in the Ethereum network through staking.

"Also, the current amount of ETH waiting to be staked is at a healthy level." – Woody Berthheimer

According to beaconcha.in data, over 35.7 million ETH is staked across various protocols, representing 29.5% of the circulating supply.

Ultimately, the balance of ETH entering and leaving staking protocols is a crucial factor. This helps determine whether the market is facing real selling pressure or witnessing strategic reallocation by institutional and individual investors.