Ethereum transitioned to Proof-of-Stake (PoS) in September 2022, introducing a staking structure where validators deposit 32 ETH and receive rewards. In April 2023, the Shapella upgrade activated withdrawal functionality. With the emergence of liquidity staking platforms like Lido and Rocket Pool, small-scale participation became possible, and the practicality expanded to asset liquidity and DeFi utilization. The staking trend is a key indicator showing Ethereum's security and value creation structure, which is examined through ▲deposit amount and withdrawal trends ▲number of validators ▲reward rates. [Editor's Note]

According to Dune Analytics (@hildobby), the total staking amount on the Ethereum network as of July 22 is 36,094,907 ETH, accounting for 29.16% of the total Ethereum circulation.

This is an increase of 162,357 ETH (+0.45%) compared to the previous week (35,932,550 ETH).

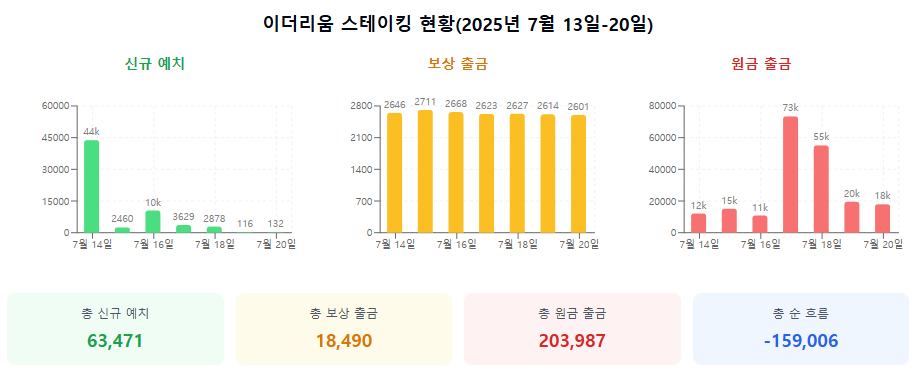

From July 14 to 20, 63,471 ETH was newly deposited. This is a significant decrease of about 77.49% compared to the previous week (282,006 ETH). On July 14, a large-scale new deposit (43,789 ETH) accounted for 69% of the weekly deposit, and after July 15, the new deposit flow sharply declined.

During the same period, reward withdrawals were 18,490 ETH, a slight increase of about 1.42% compared to the previous week (18,232 ETH), while principal withdrawals were 203,987 ETH, a decrease of about 6.55% compared to the previous week (218,291 ETH). Notably, large-scale withdrawals of 73,376 ETH and 55,072 ETH occurred on July 17 and 18, respectively, significantly increasing the total weekly withdrawal amount.

With the sharp decline in new deposits unable to offset the withdrawal scale, the overall net change for one week turned negative at -159,006 ETH.

Since the 'Shanghai Upgrade' that implemented withdrawal functionality, the cumulative net staking inflow is 14,842,417 ETH, and the net inflow excluding reward portions is 17,933,159 ETH.

According to Validator Queue, the recent Ethereum staking annual percentage rate (APR) slightly rebounded from 3.00% on the 16th to 3.03% on this day, continuing an upward trend.

Staker Status

The current number of active validators is 1,093,895. This is an increase of about 0.37% compared to the previous week (1,089,832).

In the Entry Queue for those wanting to start staking, 378,543 ETH is waiting, with an expected waiting time of about 6 days and 14 hours.

In the Exit Queue for those wanting to unstake, 469,852 ETH is waiting, with an expected waiting time of about 8 days and 4 hours. The average Sweep Delay before funds actually move to the withdrawal address after exiting is 9.5 days.

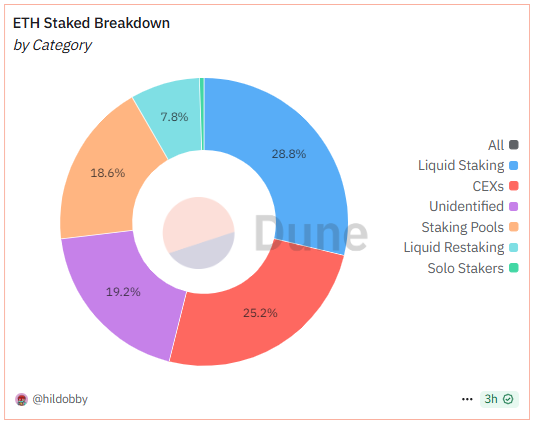

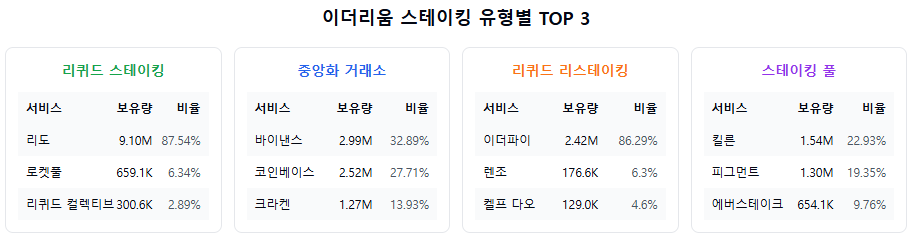

Liquid staking has the largest proportion of Ethereum staking participation at 28.8%. Staking through centralized exchanges (CEX) follows at 25.2%. Unidentified validators account for 19.2%, staking pools 18.6%, liquid restaking 7.8%, and individual validators 0.4%.

In the single staker ranking, ▲Lido (liquidity staking protocol) maintains the highest occupancy rate of 25.1% with about 9,095,517 ETH deposited. Following are ▲Binance with about 2,993,360 ETH (8.3%) and ▲Coinbase with 2,521,795 ETH (7.0%).

▲EigenLayer (liquidity restaking protocol) has 2,419,713 ETH (6.7%), ▲Kiln (staking pool) has 1,536,199 ETH (4.2%), and ▲Figment has 1,295,616 ETH (3.6%).

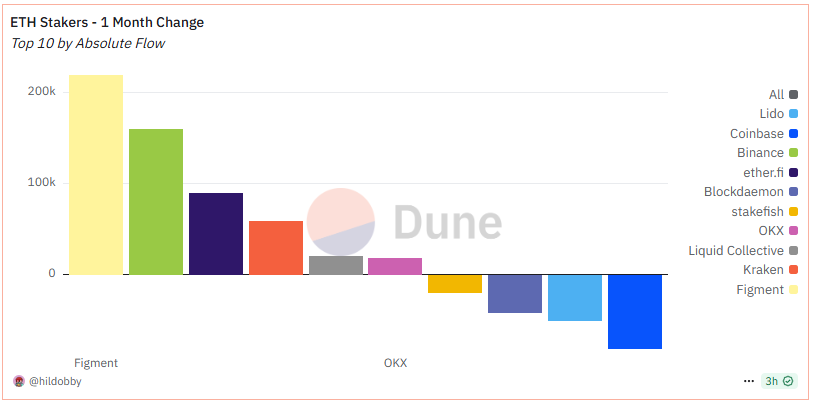

Figment successfully replaced Kraken in the ranking by growing 20% over a month. Binance followed with a 6% increase, and Kraken with a 5% increase.

In the weekly absolute inflow/outflow record, EigenLayer is the only entity recording a weekly inflow of 12,803 ETH. In contrast, ▲Coinbase saw an outflow of 51,104 ETH, ▲Blockdaemon of 46,432 ETH, and ▲Kiln of 22,624 ETH, recording the largest net outflows.

For the 1-month Ethereum staking net inflow ranking, Figment topped by attracting 219,392 ETH. Binance and EigenLayer ranked 2nd and 3rd with net inflows of 160,176 ETH and 89,187 ETH respectively. In contrast, Coinbase, Lido, and Blockdaemon were the major net outflow entities with 81,760 ETH, 50,880 ETH, and 42,272 ETH respectively.

Get news in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>