Corporate Bitcoin adoption is accelerating. Listed companies worldwide are shifting their financial strategies from cash to digital assets.

While investor sentiments vary, the overall market is witnessing an increase in institutions adopting Bitcoin as a reserve and strategic asset.

Corporations Accepting BTC... Bitcoin Adoption Accelerates

MicroStrategy (MSTR) is a notable leader in corporate Bitcoin adoption. The company recently announced plans to issue $5 million Series A STRC preferred shares to raise capital for additional BTC purchases.

This capital clearly aligns with their long-term Bitcoin reserve strategy and operational funding needs.

Beyond MicroStrategy, other companies are actively adopting Bitcoin as an asset. Listed US company Profusa secured a $100 million stock line of credit to build Bitcoin Treasury. Similarly, electric vehicle startup Volcon has acquired over 280 BTC and completed $500 million in private funding to support further accumulation.

In Europe, listed Swedish company H100 Group increased its holdings to over 510 BTC after purchasing an additional 140 BTC.

Perhaps the most iconic move came from Grupo Murano, a major Mexican real estate company. The company declared Bitcoin a "core strategic asset" with an initial $1 billion investment. This demonstrates the growing corporate consensus that Bitcoin is becoming more than just a speculative tool, but part of global financial policy.

Market Signals Supporting Confidence

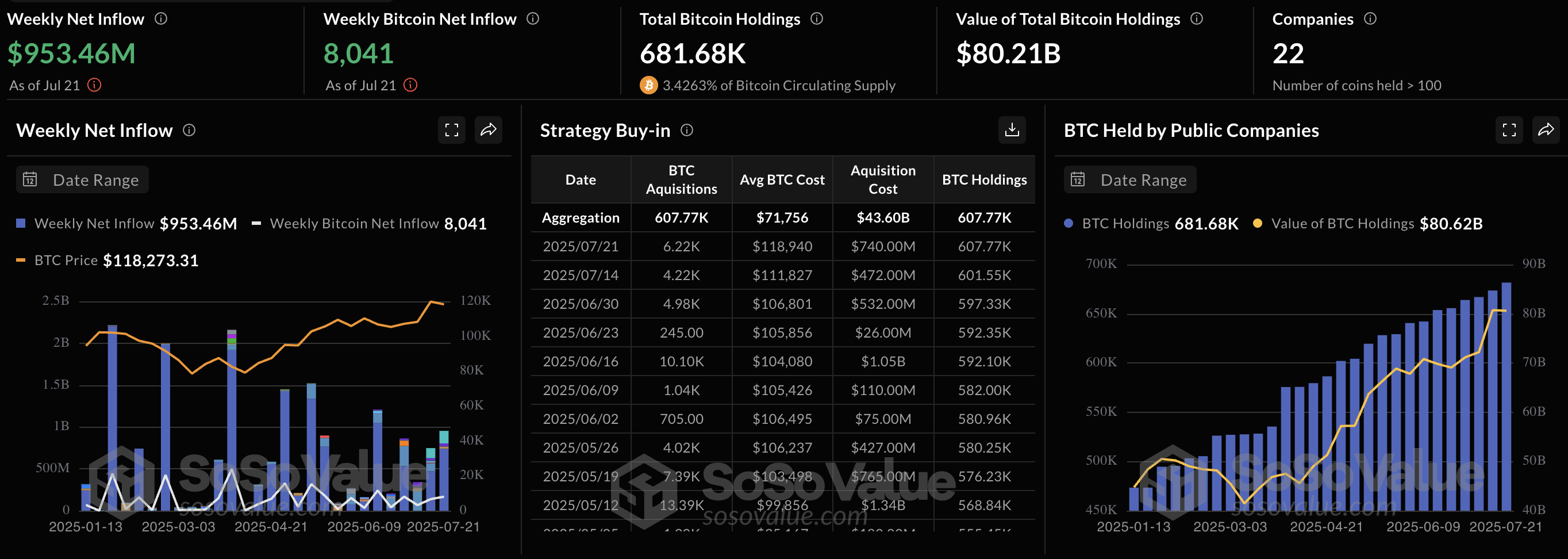

Recent data shows listed companies' Bitcoin net purchases reached $953 million last week alone, with MSTR accounting for over $700 million.

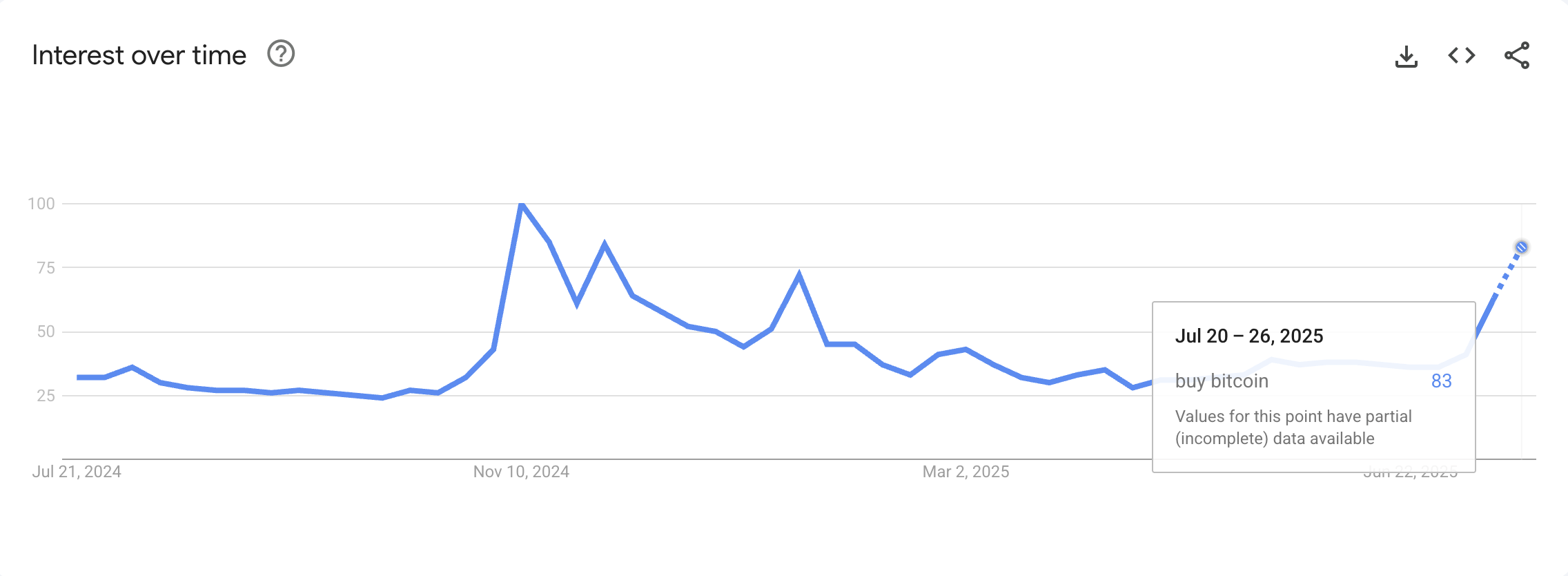

This surge coincides with a sharp increase in Google Trend searches for "buy Bitcoin", suggesting a revival of retail interest alongside institutional momentum.

Overall, corporate Bitcoin adoption reflects a broader financial paradigm shift. Bitcoin is no longer treated as a marginal or experimental asset. From technology to real estate, companies are increasingly integrating Bitcoin into their financial models, establishing it as a symbol of diversification, hedging, and forward-looking strategy.