Michael Saylor-led MicroStrategy ($MSTR) continued its Bitcoin (BTC) buying spree last week when the price broke through $122,000 for the first time in history.

According to a report submitted to the U.S. Securities and Exchange Commission (SEC), MicroStrategy purchased 6,220 BTC for a total of $739.8 million during the week ending July 20. This purchase is interpreted as a strategy to further solidify its position as the largest Bitcoin-holding institutional investor.

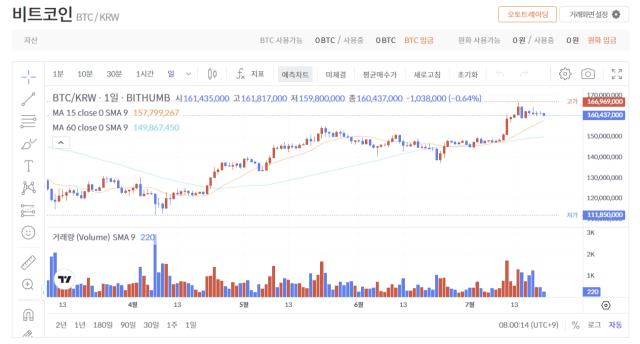

The company purchased Bitcoin at an average price of $118,940 per coin during this period. During this time, Bitcoin's price reached $122,000 before dropping to as low as $116,000 during the week, and subsequently traded around $118,000. The continued purchases amid significant price volatility reveal a strong confidence in digital assets amid U.S. government policy uncertainty and inflation response strategies.

MicroStrategy has consistently maintained its Bitcoin accumulation strategy initiated after the COVID-19 pandemic. Its periodic large-scale purchases reflect a clear intention to keep digital assets at its core, undeterred by external variables such as Trump's presidential campaign statements or Federal Reserve interest rate policies.

Including this purchase, MicroStrategy's cumulative Bitcoin holdings are estimated to exceed 220,000 coins. Market analysts suggest that such aggressive buying movements are partially influencing Bitcoin's price rebound. Particularly, the combination of limited supply and long-term holding strategy could further compress liquidity.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>