On Upbit's entire market, the daily trading volume from July 22nd 0:00 to 6:07 PM was 5.31 trillion won, and the cumulative trading volume for the recent 24 hours was 9.45 trillion won. The 24-hour trading volume decreased by -33.69% compared to the previous day.

Looking at the theme-based trading flow, trading volume was concentrated in the 'DeFi' and 'Infrastructure' areas.

In the DeFi theme, ▲Strike (STRIKE, +125.16%) showed a sharp increase and received the most attention. Following that, ▲Jupiter (JUP, +3.45%) and ▲USDT (+0.18%) also showed a slight upward trend. In contrast, ▲Drift (DRIFT, –7.45%) and ▲Ondo (ONDO, –3.33%) recorded a decline, showing a mixed trend.

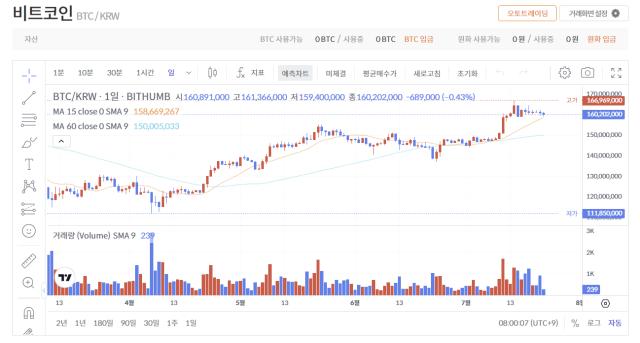

In the infrastructure theme, ▲Stratis (STARX, +13.07%) showed a notable upward trend, and ▲Bitcoin (BTC, +0.82%) maintained a stable flow. In contrast, ▲Ripple (XRP, –2.29%) turned downward, showing a contrasting trend.

In the smart contract platform theme, ▲Solana (SOL, +0.67%) showed a strong and stable trend. Meanwhile, ▲Ethereum (ETH, –2.88%), ▲Cardano (ADA, –2.71%), ▲MOVE (–4.82%), and ▲OM (–7.13%) all recorded weakness.

The meme coin theme mostly showed a downward trend. ▲Dogecoin (DOGE, –1.51%), ▲Pepe (PEPE, –3.01%), ▲Trump (TRUMP, –4.18%), ▲Bonk (BONK, –3.49%), and ▲Shiba Inu (SHIB, –3.36%) all performed poorly. Only ▲Pengu (PENGU, +0.01%) showed a slight increase.

In the culture and entertainment theme, ▲UXLINK (+9.54%) and ▲AQT (+7.67%) drew investor attention.

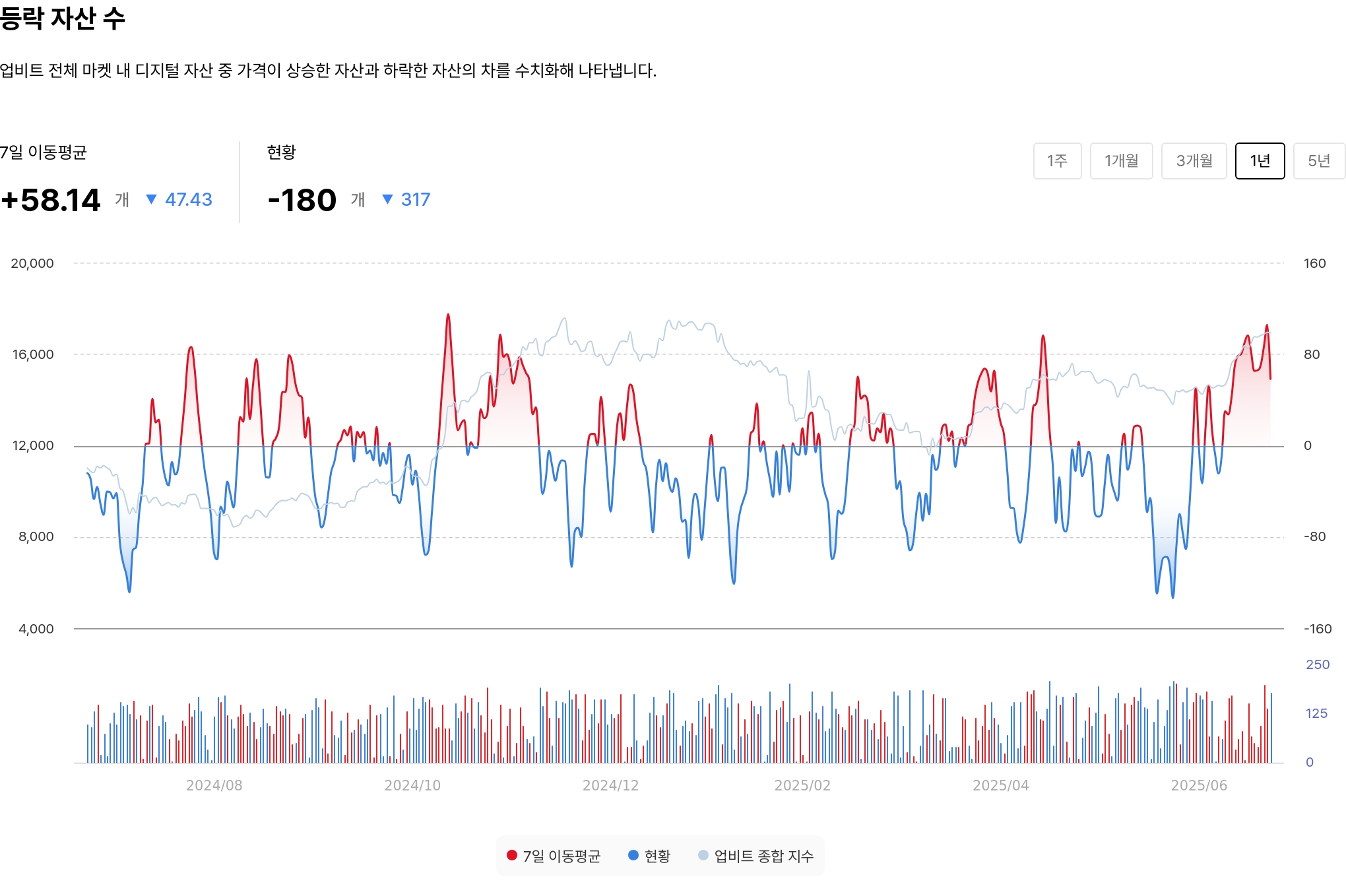

In the Upbit market, the number of declining stocks continues to overwhelm the rising stocks. The number of rising and falling assets is –180, indicating that there were 180 more declining assets than rising assets.

The 7-day moving average is +58.14, but the day-to-day change has sharply decreased to –317, showing that short-term investment sentiment has rapidly contracted.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>