XRP (Ripple) is on the verge of breaking through the major resistance level of 5,000 won. There are expectations that it will set a new all-time high due to the resolution of legal risks and anticipation of spot ETF launch and stablecoin benefits.

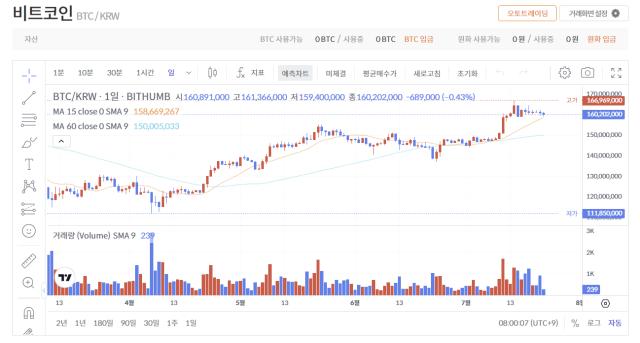

According to Upbit, a domestic cryptocurrency exchange, on the 22nd, Ripple, the 3rd largest cryptocurrency by market capitalization, soared to 4,861 won at one point. This is a 21% surge compared to last week. Compared to last month, it has risen by nearly 70%. In contrast, Bitcoin, the top cryptocurrency by market cap, declined by -2% last week and rose by 15% last month, highlighting Ripple's significant upward trend.

Despite the recent steep rise, expectations for further increases remain high. This is because Bitcoin dominance reached a 4-month low, suggesting a favorable outlook for altcoins. A decline in Bitcoin dominance is typically known as a signal for an altcoin market. Generally, when an altcoin market emerges, major altcoins like Ethereum, Ripple, and Solana tend to surge, outpacing Bitcoin's growth rate.

The industry expects Ripple and other major altcoins to set new all-time highs following Bitcoin. Currently, Ripple's dollar all-time high is $3.84, recorded in January 2018. This is a 7.02% difference from the previous day's price ($3.57).

It is even closer to its won-denominated all-time high. The Bithumb reference price for the all-time high is 4,987 won, recorded in January. This is only a 2.59% difference from the previous day's price (4,861 won). If the current trend continues, breaking the all-time high is expected to be relatively easy, according to industry perspectives.

The primary factor is the green light for spot ETF launch following the settlement of the lawsuit with the U.S. Securities and Exchange Commission (SEC) last month. Some believe Ripple may launch an ETF before Solana in terms of institutional investor demand and liquidity.

Nate Geraci, CEO of ETF Store, stated on X on the 28th of last month that "With Ripple withdrawing its appeal against the SEC lawsuit, the path for a spot ETF has opened" and "If this issue is resolved, BlackRock could also consider a Ripple spot ETF".

The potential benefits from the 'GENIUS' Act, the first U.S. stablecoin regulation law signed by President Donald Trump on the 19th, are also an expectation. As the stablecoin era begins with the GENIUS Act, demand for Ripple could increase.

Ripple was the first altcoin to launch its own stablecoin 'RLUSD' in December last year. Earlier this month, it also became the first cryptocurrency company to submit a banking license application to the U.S. federal regulatory authority, the Office of the Comptroller of the Currency (OCC).

If approved by the OCC, Ripple's potential to lead the stablecoin market in the U.S. increases. Due to the nature of stablecoins as trust-based assets, their influence grows when issued from the position of a financial institution. Essentially, Ripple would be elevated to a mainstream financial institution.

Brad Garlinghouse, CEO of Ripple Labs, emphasized on X on the 2nd that "If approved by the OCC, we will be supervised by both state and federal authorities" and "This represents a new and special standard of credibility in the stablecoin market".