Ethereum is showing strength in on-chain and technical indicators, and the current situation is similar to just before the last all-time high in 2021.

The $ETH price is currently hovering around $3,753. The sharp decline in long-term holder activity and Ethereum's strength against Bitcoin are setting the stage for a potential breakthrough over 40% in the coming weeks.

Dormant ETH Quiet... Institutional Aggressive Buying

Over the past two weeks, Ethereum's Age Consumed indicator has plummeted from 795 million on July 10th to 12.47 million today. This is a decrease of over 98%. This indicator tracks how much $ETH is moving from old wallets that have not been traded for a long time.

When it drops sharply, it means long-term holders are holding onto their coins and not selling during the rally.

Simply put, Ethereum is creating a new local high, and the oldest holders are not wavering. This is a strong signal of confidence in the $ETH price. This is a behavior not typically seen near market peaks.

Age Consumed measures the amount of dormant $ETH that suddenly becomes active, and it is often used to track whether long-term holders are selling or holding strongly.

At the same time, institutional accumulation is heating up. A notable example is SharpLink Gaming adding 19,084 $ETH to its holdings in a single transaction, worth over $67.5 million.

SharpLink Gaming (@SharpLinkGaming) has added 19,084 $ETH, worth $67.52M, to its $ETH strategy reserve.

— Onchain Lens (@OnchainLens) July 18, 2025

They now hold a total of 345,158 $ETH, valued at $1.22 billion.

Address: 0x0b26c05866e6353e46f4a7e2d10cb42d4b583e57 https://t.co/Mdb74Ghimx pic.twitter.com/Epylgr6m7O

Combined with previous purchases, SharpLink now holds 345,158 $ETH, worth over $1.22 billion. Thus, old $ETH remains unmoved, but major buyers are quietly accumulating.

ETH/BTC Ratio Repeating All-Time High Setup

Since June 2025, the $ETH/$BTC ratio has risen from 0.021 to 0.031, indicating a 50% increase in Ethereum's strength against Bitcoin. Ethereum's current price is $3,753, almost identical to October 2021, when the ratio rose 30% in 5 weeks, leading $ETH to its all-time high of $4,878.

At that time, a 30% ratio increase ($ETH/$BTC) coincided with $ETH rising from $3,800 to $4,870, representing an almost 28% price increase. If the ratio follows a similar path at current levels, a comparable 28% rise from $3,753 would position Ethereum near $4,800 to $4,900. This almost exactly matches the previous ATH breakthrough zone.

And if the psychological resistance level (previous all-time high) is broken, there might not be much resistance to the next major price discovery level above $5,000.

The $ETH/$BTC ratio tracks how Ethereum is performing relative to Bitcoin and often signals when $ETH is gaining market share before a major rally. Meanwhile, $ETH/$BTC has already surged over 50% since June and continues to show strong momentum through multiple EMA golden crossovers.

Ethereum Price Structure Expects 40% Rise

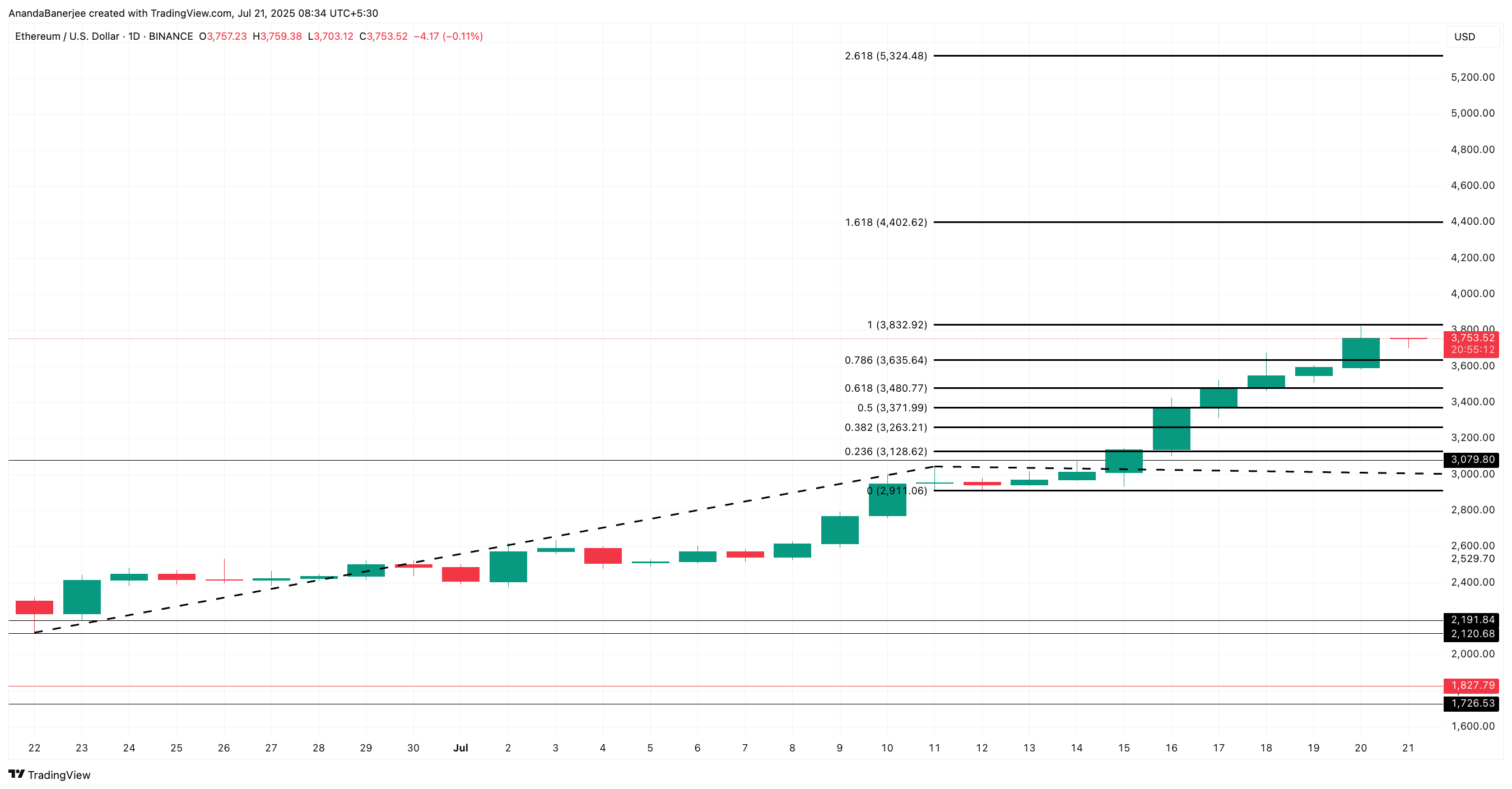

Ethereum's price movement is following a familiar roadmap, moving with current on-chain confidence and relative strength against Bitcoin. After recovering the major resistance near $3,635 (0.786 Fib level), the asset is entering a correction just below the $3,832 zone, where the previous all-time high acts as a psychological barrier.

But first, $ETH price needs to break above $4,402. This is the next major resistance.

In 2021, Ethereum rose almost 28% in this same zone, and the $ETH/$BTC ratio increased 30% in 5 weeks. Based on current levels, a similar move from $3,753 would position Ethereum back near its current all-time high.

However, this time, with long-term holders not active and Ethereum gaining dominance, price discovery may expand beyond that point. A confident breakthrough of the previous high point is expected to extend structurally to $5,324, representing a 41.86% rise from current prices.

But if it drops below $3,128, this structure would be invalidated, suggesting the uptrend has not sustained, making it a key support level to watch.