Title: 'Stablecoin Bill in Hand, Wall Street Bankers Can't Sit Still'

Stablecoins are "coming ashore", and the "ceiling" of US crypto finance has been opened again.

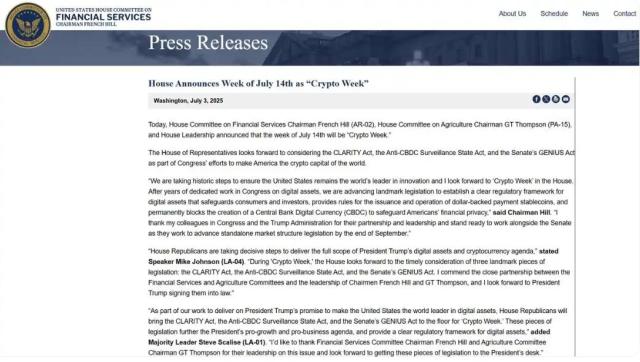

Just last night, the US House of Representatives officially passed the GENIUS Act and CLARITY Act, providing a "pathway to shore" for the stablecoin track and setting a clear regulatory tone for the entire digital asset industry. The White House subsequently announced that Trump will personally sign the GENIUS Act this Friday. From now on, stablecoins will no longer be experimental products in a gray area, but will be written into US law and endorsed by the state as an "official monetary tool".

Almost simultaneously, the Federal Reserve, FDIC, and OCC, three major financial regulators, jointly issued guidance a few days ago, for the first time clearly stating that US banks can provide crypto asset custody services for clients. Wall Street banks and institutions are eager to act.

Traditional Banks Raise the Stablecoin Banner

As the second-largest bank in the US, Bank of America (BoA) officially confirmed that it is actively preparing stablecoin products and considering collaboration with other financial institutions. They stated, "We are prepared, but still waiting for further market and regulatory clarity".

"We have done extensive preparation," said Bank of America CEO Brian Moynihan, indicating they are deeply researching customer needs and will launch stablecoin products at the right time, possibly in cooperation with other financial institutions.

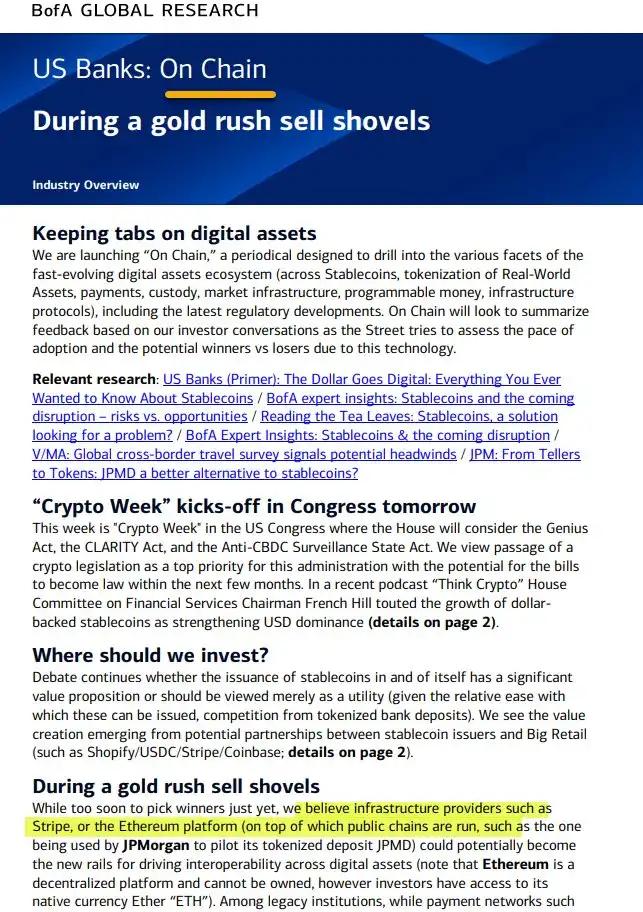

Simultaneously, Bank of America launched an on-chain research weekly report called 'On Chain', focusing on stablecoins, RWA, payment settlement, and infrastructure. The report's release coincides with a critical week in Washington, where legislators are reviewing the GENIUS Act, CLARITY Act, and anti-central bank digital currency monitoring act, which could influence US policy on stablecoins and digital infrastructure.

The research team noted, "We focus on truly transformative financial architecture rather than hype," highlighting Ethereum's potential in promoting digital asset interoperability. They even revealed ongoing stablecoin pilot collaborations with mainstream retail platforms like Shopify, Coinbase, and Stripe, aiming to breakthrough existing models and create new business approaches.

"As long as regulations are clear, banks are ready to accept crypto payments," stated Bank of America CEO Brian Moynihan.

Citibank is equally poised to act when the opportunity arises.

Citibank CEO Jane Fraser clearly stated that the bank is actively advancing stablecoin plans, viewing them as a crucial foundation for future international payments. Citibank's stablecoin bet stems from a reflection on global cross-border payments: high fees and slow transfers. Current cross-border transaction hidden costs often reach 7%, and existing inter-bank networks are far less usable and efficient than on-chain solutions. Citibank's goal is to build an around-the-clock, programmable new payment track using stablecoins, enabling enterprise clients to transfer money globally at low cost and high efficiency.

As a "familiar face" in the crypto world, JPMorgan Chase is moving even faster.

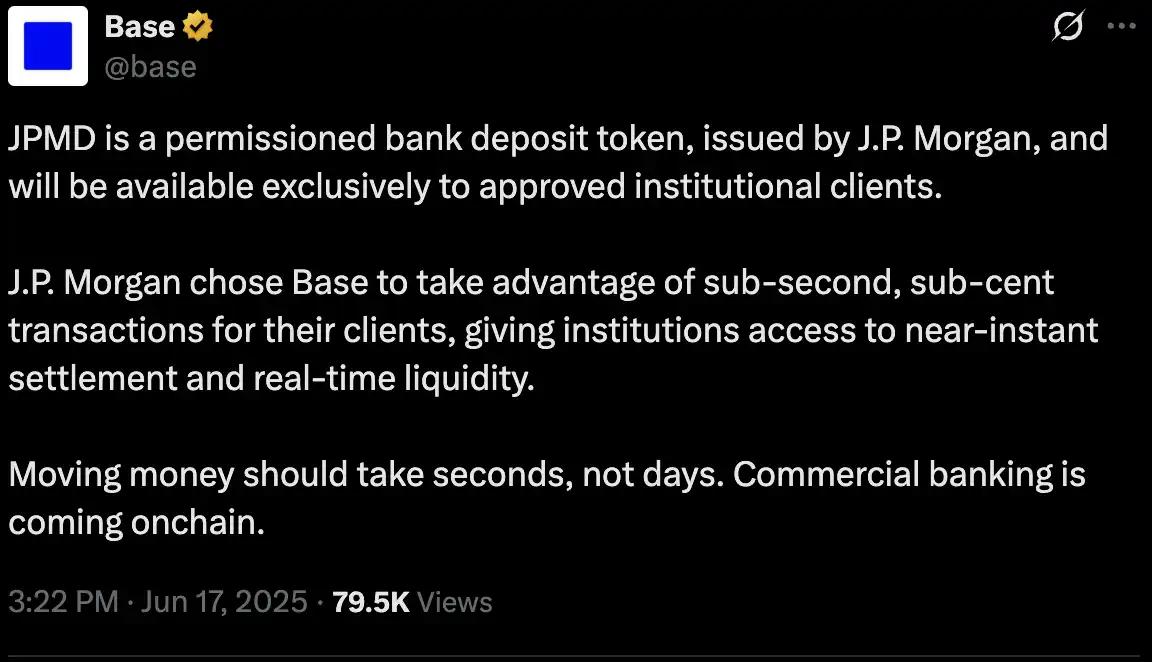

On June 18, JPMorgan Chase announced a pilot launch of a deposit token called JPMD, deployed on the Base blockchain supported by Coinbase. Initially, the token will only be available to JPMorgan Chase's institutional clients, with gradual expansion to broader user groups and more currencies pending US regulatory approval.

This marks the first time a Wall Street giant has directly issued traditional bank deposits on-chain, representing a crucial step in the deep integration of traditional finance and the decentralized world. JPMD is a "permissioned deposit token" that corresponds 1:1 with JPMorgan Chase's US dollar deposits, supports 24-hour real-time transfers, has transaction costs as low as $0.01, and enjoys traditional financial protections like deposit insurance and interest.

Compared to existing stablecoins, JPMD has stronger regulatory compliance and trust endorsement, potentially bringing unprecedented capital volume and institutional liquidity to the Base chain. JPM Blockchain head Naveen Mallela stated: "This is not embracing crypto, but redefining banking."

Looking across the entire US banking industry, this wave of stablecoin entry and blockchain rush far exceeds the most optimistic crypto circle expectations. The true financial transformation wave has arrived.

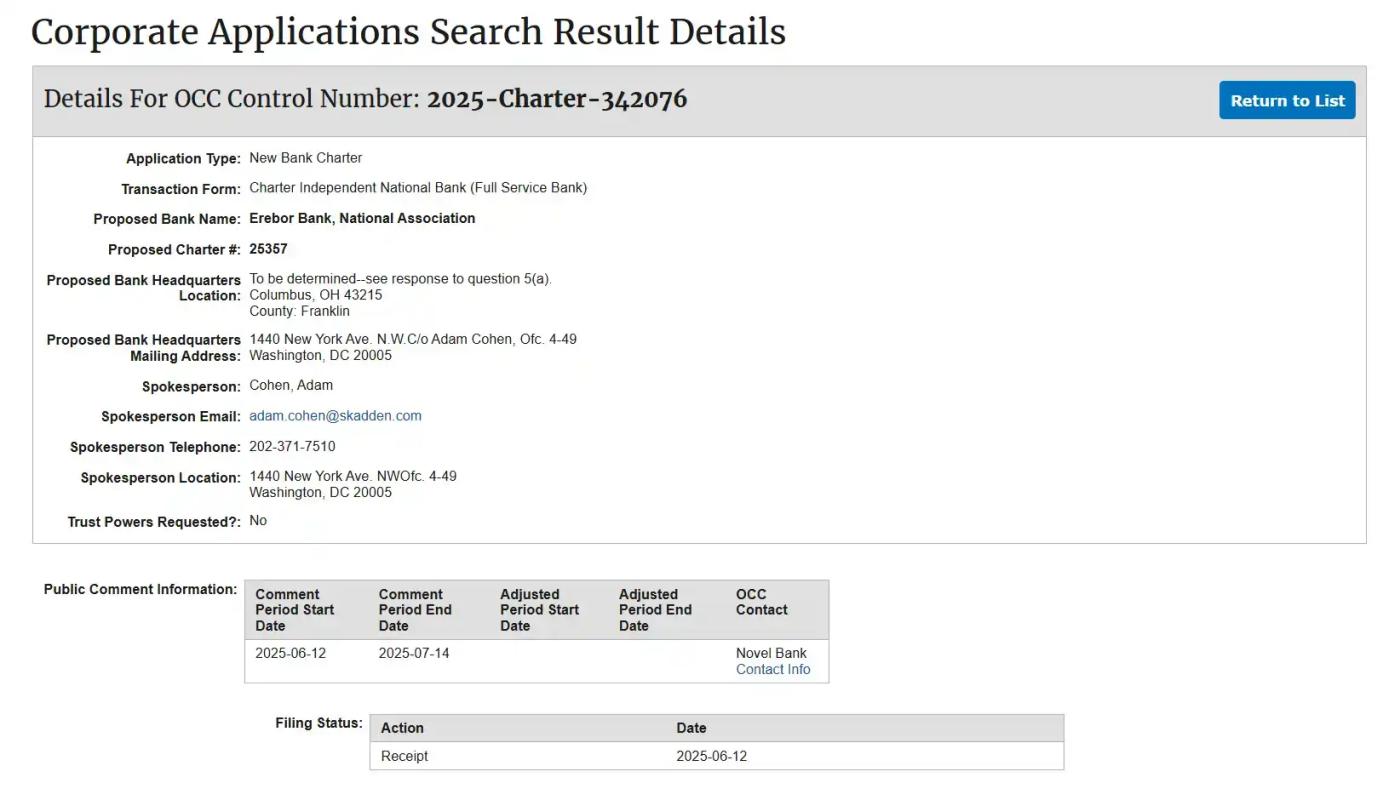

(Translation continues in the same manner for the rest of the text)Multiple mainstream financial media outlets have confirmed: Peter Thiel is jointly initiating a new bank called Erebor with tech entrepreneurs Palmer Luckey and Joe Lonsdale, and has officially applied for a national bank charter with the OCC. The bank's target customers are crypto, AI, defense, and manufacturing startups that "mainstream banks are unwilling to serve", attempting to become an alternative after Silicon Valley Bank's collapse.

The bank's founders also showcase a distinct "Silicon Valley political capital intersection": Peter Thiel (PayPal and Palantir co-founder, Founders Fund leader), Palmer Luckey (Oculus founder, Anduril co-creator), Joe Lonsdale (Palantir co-founder, 8 VC founder). All three are significant political donors for Trump in the 2024 US presidential election and have close connections with the currently proposed GENIUS Act.

According to Erebor's application to the OCC, Founders Fund will be the primary capital support, and the three founders will not participate in daily management, only intervening in governance as board members. The management team includes a former Circle advisor and the CEO of compliance software company Aer Compliance, aiming to clearly delineate politics from operations and emphasize its positioning as an institutionalized financial entity.

Learning from Silicon Valley Bank's lessons, Erebor will implement a 1:1 deposit reserve system and control the loan-to-deposit ratio below 50%, preventing maturity mismatches and credit inflation at the source. Its application documents show that stablecoin services are a core business, planning to support custody, minting, and redemption of compliant stablecoins like USDC, Dai, and RLUSD, creating the "most regulated stablecoin trading institution" and providing legal and compliant fiat entry/exit channels and on-chain asset services for enterprises.

Its customer profile is equally precise: targeting innovative enterprises in virtual currency, artificial intelligence, defense technology, and high-end manufacturing, considered "high-risk" by traditional banks, along with their employees and investors. It will also serve "international clients" - those difficult to enter the US dollar financial system, relying on dollar clearing, or seeking to reduce cross-border transaction costs through stablecoins. Erebor plans to establish "correspondent banking relationships" as a super interface connecting these enterprises to the dollar system.

Its business model also has a strong crypto-native characteristic: offering deposit and loan services with BTC and ETH as collateral assets, avoiding traditional mortgage and auto loans. The bank will hold a small amount of BTC and ETH on its balance sheet for operational needs (such as paying gas fees) without engaging in speculative trading. Notably, Erebor has clearly defined regulatory boundaries: not providing asset custody services requiring a trust license, only offering on-chain fund settlement without directly holding user assets.

In essence, this is an advanced version of Silicon Valley Bank. With various crypto-friendly policies, Erebor is likely to become one of the first "US dollar relay banks" with a compliant status to custody mainstream stablecoins like USDC and RLUSD, providing a federal clearing pathway for stablecoins.

Related reading: 《Peter Thiel Personally "Assembling" Erebor, Aiming to Be Silicon Valley Bank's "Alternative"》

National Bank Charter: The Future of Crypto Banking

(Translation continues in the same manner for the rest of the text)Directly settling, clearing, transferring, and depositing with the Federal Reserve without relying on third-party large banks. For crypto companies, obtaining a master account qualification and placing stablecoin reserves directly with the central bank is equivalent to completely penetrating the U.S. financial infrastructure, no longer being an "outsider" or "second-class citizen", but a truly endorsed "regular army" in the U.S. financial system.

The crypto circle understands that this is the true meaning of "legitimization", transforming from being viewed as an outsider or second-class citizen by the banking system to being recognized as a regular army by the U.S. financial system. Therefore, crypto stars like Circle, Ripple, Anchorage, and Paxos are simultaneously securing federal trust bank licenses and pushing hard for master account approvals.

However, because the Federal Reserve is concerned about potential misuse of "master accounts" by crypto companies, which could pose financial stability risks (such as sudden large-scale liquidation of risk assets affecting system liquidity), and potential regulatory challenges like money laundering, illegal fund flows, and technical security, no pure crypto company has been approved for a Federal Reserve master account so far. Even Anchorage, the first to "break the ice", has obtained a federal trust bank license but still hasn't been granted a master account.

So who else is still pushing for bank licenses?

Circle first submitted materials by the end of June 2025, planning to establish a new bank called First National Digital Currency Bank, N.A., to directly custody USDC reserves and provide institutional custody services.

Immediately following, Ripple officially announced in early July that it has submitted an application to the OCC, simultaneously applying for a federal master account, aiming to place its stablecoin RLUSD reserves directly in the central bank system, with a very aggressive stance.

The veteran custody company BitGo is not falling behind and is waiting for OCC approval. According to public information, BitGo is also one of the designated service providers for "Trump USD1" reserve custody.

Besides these three most representative crypto "regular army" companies, Wise (formerly TransferWise) has also submitted a license application positioned as a non-deposit custody bank. Newcomers like Erebor Bank have boldly announced plans to include AI, crypto, defense, and other new economic industries within their service radius. The first blockchain bank, First Blockchain Bank and Trust, attempted to test waters during the Biden administration but quietly withdrew due to tight regulatory windows. It is rumored that Fidelity Digital Assets also plans to submit materials, but this has not been officially confirmed.

If Circle, Ripple, and BitGo can obtain this license, they can bypass state-level compliance, stake their claim nationwide, and even hope to access the Federal Reserve master account. Once accomplished, stablecoin dollar reserves could be placed in the central bank vault, and their custody and clearing capabilities could directly compete with traditional Wall Street giants.

It appears that regulators have both anticipation and wariness about crypto companies wanting to become banks. On one hand, OCC personnel changes and policy warming have indeed brought a "window of opportunity" for crypto companies; on the other hand, these licenses do not equate to full banking business licenses and still cannot accept current deposits or provide loans.

The new window is open, but the threshold remains high. Who will be the first to knock on the Federal Reserve's door? This will be the most exciting second half of the game between Wall Street bankers and crypto giants, with the winner potentially rewriting the financial landscape of the next decade.

For the crypto industry, stablecoins officially coming ashore and banks formally opening their doors mean that the previously parallel crypto world and Wall Street are finally "converging" under regulatory sunlight. Crypto assets, once repeatedly disputed by regulators, banking, and capital markets, are now walking into the daily accounts of every American and the balance sheets of every global financial institution as "mainstream assets".