Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Bit, is the hidden chess piece of a new round of national competition.

This morning, the U.S. House of Representatives successively passed the GENIUS Act, CLARITY Act, and Anti-CBDC Monitoring National Act, officially opening the curtain of accelerated crypto legislation.

When Bit becomes a national policy, sovereign nations are no longer bystanders, but participants, players, and even table-turners. In today's upgraded global monetary game, understanding the crypto layout of the "national team" may be a key step in comprehending the next global financial trend.

This article will deeply sort out the current Bit holdings and policy trends of major global countries, revealing the true landscape of this "national-level holdings game".

⏰Time-saving Version | Overview of Bit Holdings by Countries

Straight to the point: The following table summarizes the Bit holdings quantity, source channels, and policy attitudes of various countries, providing a quick overview of the crypto asset map of the "national team".

📝Country-by-Country Analysis | Who is Hoarding? Who is Selling?

United States

- Holdings: Approximately 198,012 BTC

- Main Source: Law enforcement seizures, including Silk Road case, Bitfinex hacking incident, etc.

- Strategic Trends:

In March 2025, the Trump administration signed an executive order to officially establish a strategic Bit and digital asset reserve.

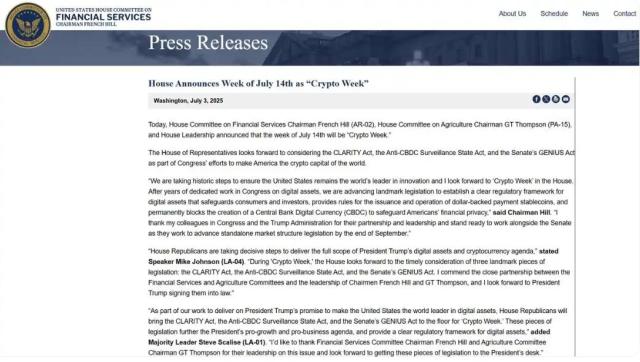

During the current House of Representatives Crypto Week, three crypto bills are being centrally reviewed: GENIUS Act, CLARITY Act, and Anti-CBDC Act, targeting stablecoins, digital asset classification, and central bank digital currency.

The House of Representatives has passed all three bills. The CLARITY Act and Anti-CBDC Act will be submitted to the Senate for review; the GENIUS Act is expected to be officially signed into law by Trump this Friday.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.]- Number of holdings: About 240 BTC

- Main source: Unknown

- Strategic direction:

Venezuela was one of the first countries globally to incorporate crypto assets into its national governance toolkit. In 2018, the government issued the "Constitutional Decree on Crypto Assets and Related Activities", covering mining, trading, custody, platform operations, asset issuance, and established a dedicated regulatory agency SUNACRIP.

In the same year, it launched the national sovereign digital currency Petro (PTR), claiming to be backed by oil and mineral resources, issued based on the DASH blockchain, but always lacking transparency and market trust. In 2023, a $3 billion corruption scandal involving SUNACRIP led to a complete collapse of the regulatory system, and Petro was officially shut down in 2024.

Facing persistent inflation, more and more Venezuelans are turning to stablecoins for hedging. In December 2024, experts stated that stablecoin transactions currently account for almost half of Venezuela's crypto trading volume.

Ukraine

- Number of holdings: About 186 BTC

- Main source: Global donations during the war, law enforcement seizures

- Strategic direction:

Since the Russia-Ukraine war broke out in 2022, Ukraine became the first country to massively adopt Bitcoin driven by war's practical needs rather than ideology. Facing obstacles in traditional financial channels, Ukraine quickly transformed crypto currencies into a cross-border "digital military fund".

In March 2022 alone, Ukraine raised over $100 million in crypto currency donations through online platforms, once holding as many as 46,351 Bitcoins. These funds were rapidly invested in military equipment purchases, humanitarian aid, infrastructure restoration, and wartime logistics.

In May 2025, Ukraine is drafting a legal framework for holding Bitcoin in its national reserves, with a dedicated parliamentary committee led by financial officials finalizing the legislative draft.

Germany

- Number of holdings: About 0 BTC

- Main source: Law enforcement seizures, confiscated 49,857 BTC from illegal movie piracy website Movie2k.to

- Strategic direction:

In January 2024, the German government seized 49,857 Bitcoins (BTC) from the illegal movie piracy website Movie2k.to through law enforcement actions. Just half a year later, the German government chose to sell this entire batch of Bitcoins.

In 2021, Germany passed a new law allowing about 4,000 existing investment funds to invest in crypto asset assets, with fund managers able to allocate 20% of funds to crypto assets. In December 2024, Germany fully adopted the EU's "Crypto Assets Market Regulation", regulating stablecoins, ICOs, and DeFi to ensure market transparency and consumer protection.

Recommended reading:

From Two Pizzas to Major Asset Class: A Review of 27 Key Drivers in Bitcoin's 16-Year Rise

Bitcoin Officially Enters State Government "Treasury", Will a Reserve Trend Emerge?